Home builders feel more confident as the year progresses based on The National Association of Home Builders/Wells Fargo Housing Market Index, which increased by the highest sequential amount years. Homebuilder confidence for newly-built single-family homes in February rose 7 points to 42, according to the NAHB HMI, the highest reading since September and the most significant monthly gain since June 2013. Despite the cautious optimism from home builders, the number of single-family homes started in January dropped to the lowest level since June 2020, following January’s 4.3% m/m decrease.

Compared to January last year, the number of single-family homes decreased by 27%, or the equivalent of 316,000 fewer homes started. That translates to roughly 60,000 fewer flatbed loads of building materials hauled last month and many more dry van loads in coming months for finished goods such as furniture and electrical appliances. Building permits, a leading indicator of flatbed demand, decreased by under 2% m/m and 41% y/y.

According to NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala, “The nation continues to face a sizeable housing shortage that can only be closed by building more affordable, attainable housing. However, the two monthly gains for the HMI at the start of 2023 match the cautious optimism noted by many builders at the recent International Builders’ Show in Las Vegas, who reported a better start to the year than expected last fall.”

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

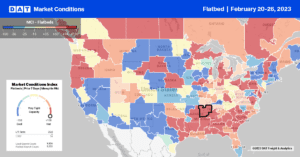

In Minnesota, hard hit by Winter Storm Olive last week, flatbed spot rates increased by $0.11/mile to a state average of $2.04/mile for outbound loads. Most of the state’s gains came from the St. Cloud market, where flatbed rates spiked, increasing by $0.72/mile to $3.68/mile. In the Pacific Northwest, also battered by heavy snow, Portland recorded its second snowiest day ever last Wednesday. Capacity tightened, pushing Portland outbound rates up to $2.48/mile and Oregon state-level flatbed rates to an average of $2.71/mile, up $0.30/mile w/w.

In the Southwest, Dallas/Ft. Worth outbound rates increased by $0.03/mile to $2.06/mile, while Houston linehaul rates increased by the same amount last week to $2.30/mile. The volume of loads moving between Houston and Ft. Worth, DAT’s second busiest flatbed lane, increased by 1% last week. Although volumes have been relatively flat for the prior month, capacity continues to tighten with rates at $2.92/mile, up $0.07/mile since January and $0.13 since December. The number one volume lane between Houston and El Paso reported a 2% w/w increase in loads moved, although capacity loosened with spot rates dropping to $2.59/mile, $0.08/mile lower than January’s average. At the average state level, Texas outbound spot rates continue to climb and, at $2.20/mile, are the second highest in seven years but still $0.30/mile lower than the previous year.

Outbound Florida spot rates continued to improve, increasing by $0.06/mile w/w to $1.69/mile last week. Solid gains were reported in the state’s largest flatbed market in Lakeland, where spot rates at $1.61/mile were up by $0.10/mile last week. Much of this volume moves within the state, with loads to Miami steady at $539/load, while north to Jacksonville at $441/load were the highest since October.

Load-to-Truck Ratio (LTR)

After increasing for most of January and plateauing in the last two weeks, flatbed load posts dropped by 10% last week. Volumes are still 80% lower than a year ago, the lowest recorded in seven years for week eight. Although carrier equipment posts were flat last week, they remained at their highest level in seven years and were 37% higher than last year. As a result, last week’s flatbed load-to-truck (LTR) ratio decreased slightly from 13.93 to 12.62.

Spot Rates

Flatbed spot rates continue to climb following last week’s penny-per-mile gain. National average flatbed linehaul rates ended the week at just over $2.13/mile, representing an increase of $0.05/mile m/m and $0.02/mile since the start of the year. The similarities with the 2018 flatbed market are hard to ignore, with last week’s national average $0.01/mile higher. Flatbed rates are still $0.57/mile lower than the previous year but remain promising as spot rates in dry van and reefer retreat.