Builder confidence in the market for newly-built single-family homes in July posted a one-point gain to 56, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. Low inventory levels of existing homes have kept demand solid for new homes even as the industry grapples with rising mortgage rates, elevated construction costs, and limited lot availability. Existing homeowners have been reluctant to sell because they can’t afford to give up their current low mortgage rates.

Following May’s surge in single-family home construction, the number of new homes started in June dropped 7% m/m and 8% y/y, according to the latest release from the U.S. Census Bureau. For permits to build, viewed as a leading indicator for future construction, the seasonally adjusted annual rate of new permits last month was just over 2% higher than in May last year. In the Southeast Region, which accounted for 61% of single-family homes started last month, volumes decreased by 7% m/m. The West was the only region posting a gain in June, where volumes increased by 5% m/m. Compared to prior years, last month’s result is 8.3% above 2018 and 9% above 2019 but down 19% from the peak in 2021.

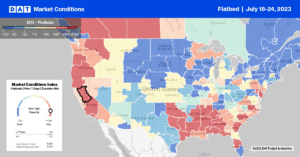

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Since this year’s high of $2.36/mile, the state average in Texas outbound spot rates has dropped $0.17/mile to $2.19/mile. The Dallas market reported an increase of $0.02/mile to $2.17/mile after falling for the previous three weeks, while in Houston, the most prominent spot market in the state, rates decreased $0.02/mile to $2.23/mile. The volume of loads moving on the number two flatbed lane between Houston and Ft. Worth was flat last week, with available capacity easing as rates hit a 12-month low of $2.61/mile. Despite the load volume increasing by 2% w/w on the number one lane (Houston to El Paso), capacity loosened as rates dropped to $2.56/mile – also the lowest in 12 months.

In the Pacific Northwest’s Medford, Oregon, spot rates jumped $0.12/mile to $2.88/mile for outbound loads, just $0.06/mile lower than the record high for this time of the year set in 2021 at $2.94/mile. Medford to Salt Lake City loads paid carriers $2.28/mile last week, which was $0.43/mile lower than the previous year. El Paso loads were paying $1.95/mile, the highest since last August, while regional loads south to Stockton at $3.33/mile were just over $0.30/mile lower than the previous month.

Load-to-Truck Ratio (LTR)

Underpinning the softness in the flatbed market was the lowest volume of load posts in seven years for Week 29 following last week’s 21% decrease. To put into context just how slow things are in flatbed, volumes are half what they were in 2019 when the freight market was also oversupplied. Carrier equipment posts were flat last week, resulting in last week’s flatbed LTR ratio decreasing from 7.4 to 6.32, the lowest since 2016.

Spot Rates

After peaking in mid-May at $2.20/mile, flatbed linehaul rates have dropped $0.16/mile in the past ten weeks to a national average of $2.04/mile following last week’s $0.05/mile decrease. The national average flatbed spot rate is $0.39/mile lower than in 2022, identical to this time in 2020 (as the market was recovering from the onset of the pandemic) and around $0.11/mile higher than in 2019.