According to the American Iron and Steel Institute (AISI), domestic raw steel production was 1,716,000 net tons, while the capability utilization rate was 77.3% for the week ending April 20. Compared to last year’s period, when production was 1,769,000 net tons at 78.6% utilization, raw steel production is 3% lower year-over-year (y/y). Production for the week ending April 20, 2024, is down 0.6% from the previous week.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Adjusted year-to-date production through April 20, 2024, was 26,939,000 net tons at a capability utilization rate of 76%. That is down 2.5% from the 27,622,000 net tons during the same period last year when the capability utilization rate was 77.9%.

The raw steel production tonnage provided in this report is estimated by the AISI and compiled from weekly production tonnage provided by approximately 50% of the domestic production capacity combined with the most recent monthly production data for the remainder.

Market watch

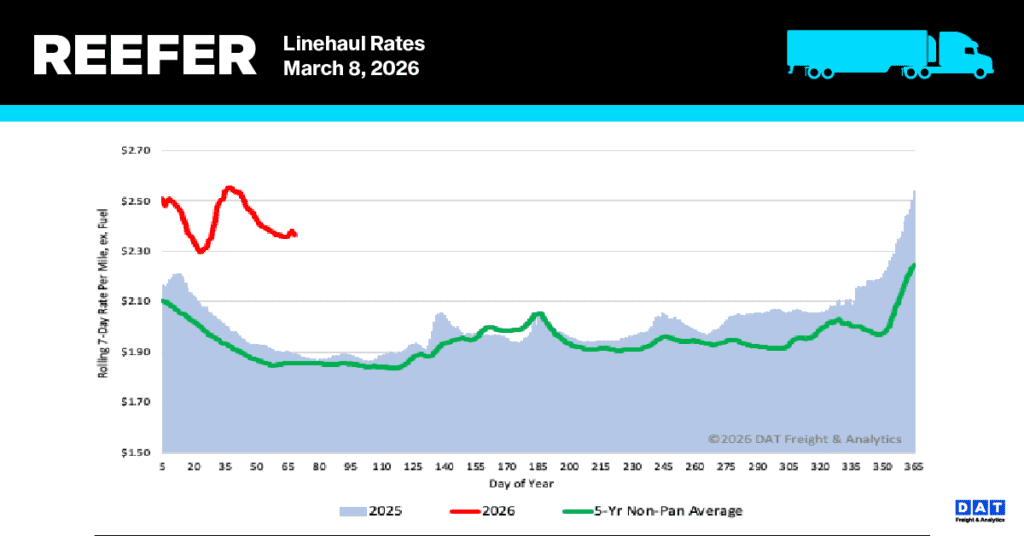

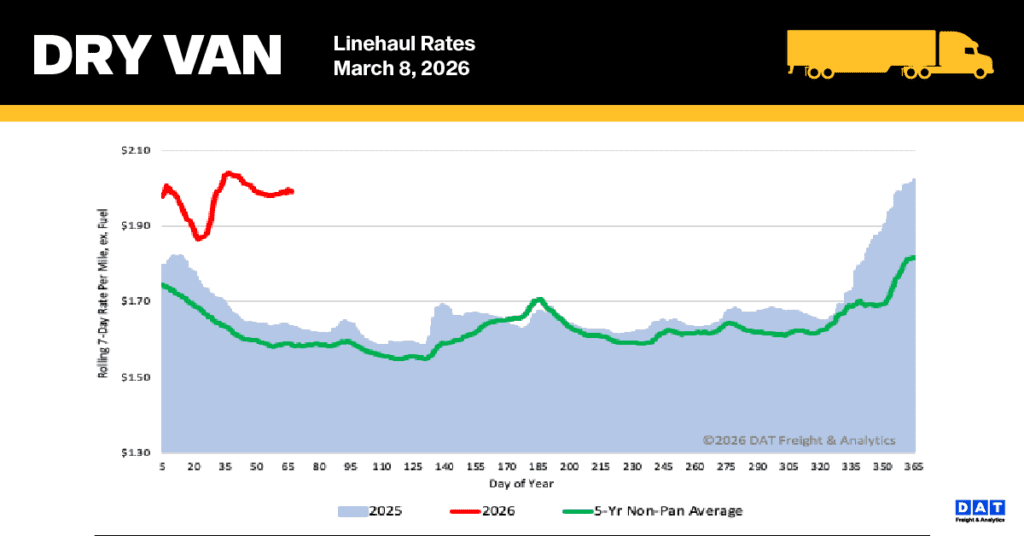

All rates cited below exclude fuel surcharges unless otherwise noted.

Despite loads moved in Texas increasing by 5% last week, outbound available capacity eased in Texas, with linehaul dropping by $0.02/mile to $2.10/mile, just over $0.08/mile higher than 2019 and $0.24/mile lower than last year. In the largest spot market in Houston, loads moved were flat, with spot rates down $0.03/mile to $2.30/mile.

In the combined Gary/South Bend, IN, markets, capacity also eased following a 13% w/w increase in loads moved. Linehaul rates dropped by $0.04/mile to $2.37/mile and are just over $0.20/mile lower than last year. In Cleveland, OH, linehaul rates dropped a penny per mile to $2.57/mile on a 2^% lower volume of loads moved. On the high-volume regional lane from Cleveland to Harrisburg, a 40% higher load volume pushed up spot rates by almost $0.01/mile to #.44/mile last week.

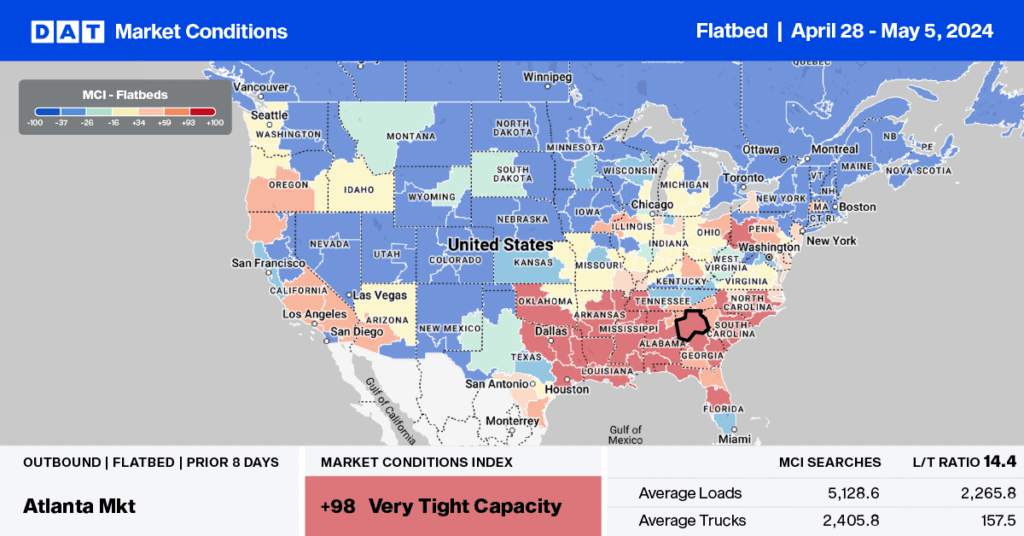

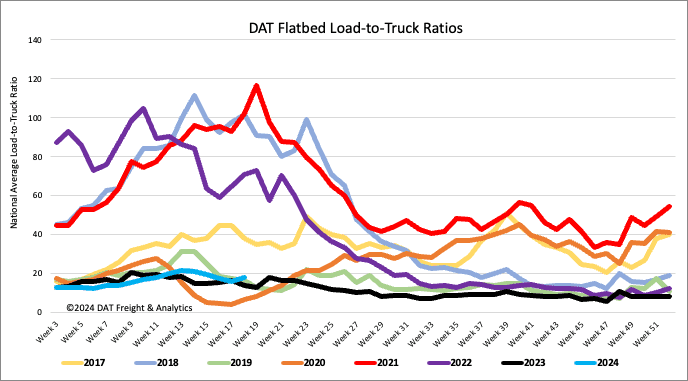

Load-to-Truck Ratio

After dropping for the last five weeks, Flatbed load post volumes reversed course following last week’s 5% w/w increase. Volumes are 5% lower than last year and 6% higher than in 2019. Flatbed equipment posts dropped last week as available capacity tightened, increasing the load-to-truck ratio by 15% w/w to 18.12.

Spot rates

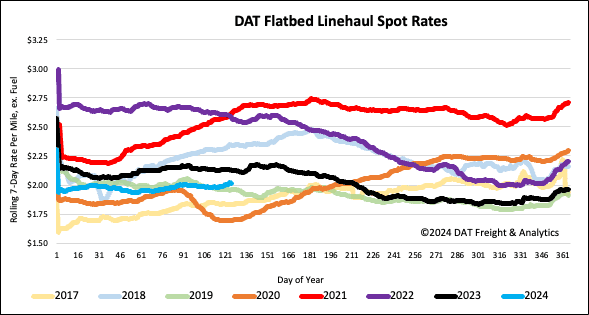

Flatbed linehaul rates increased slightly through last week’s end-of-month shipping period, averaging $2.03/mile. The national average is $0.11/mile lower on a 20% higher volume of loads moved than last year.