In April 2025, the seasonally adjusted Trucking Ton-Mile Index (TTMI), authored by Professor Jason Miller and Yemisi Bolumole at Michigan State University saw a 1.6% year-over-year increase. This marks an acceleration from the 0.7% gain observed in March 2025. The growth was largely fueled by heightened activity in several key sectors, including:

- Chemicals (excluding pharmaceuticals), where output reached its highest point since Q3 2018.

- Wood products manufacturing.

- Nonmetallic mineral product manufacturing.

- Machinery manufacturing and wholesaling.

- Professional equipment wholesaling.

- Electrical and electronic goods wholesaling.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

It’s worth noting that some of the demand, particularly for machinery, professional equipment, and electrical & electronic goods, might be due to a pull-forward effect. Conversely, sectors such as beverage, paper, and motor vehicles and parts experienced softer demand.

Load-to-Truck Ratio

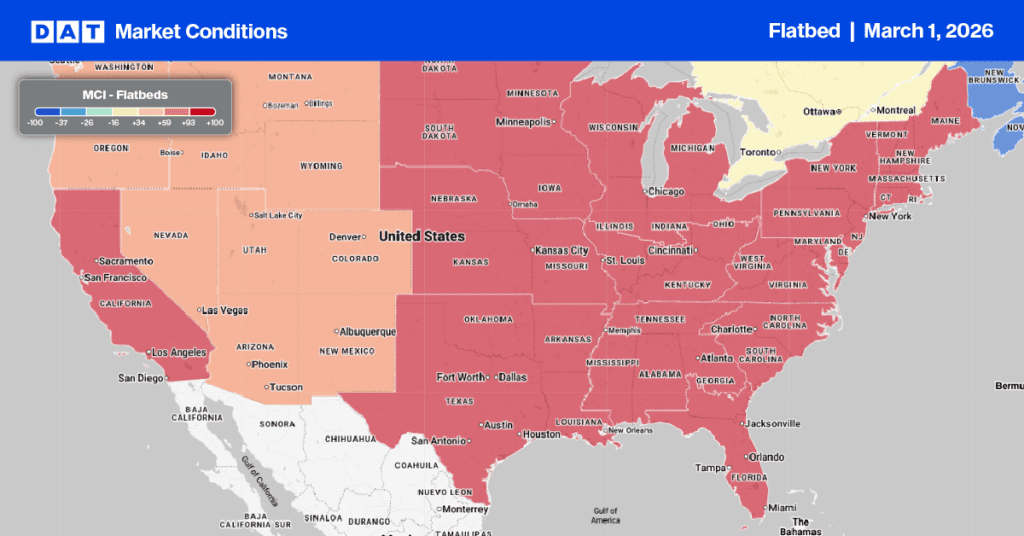

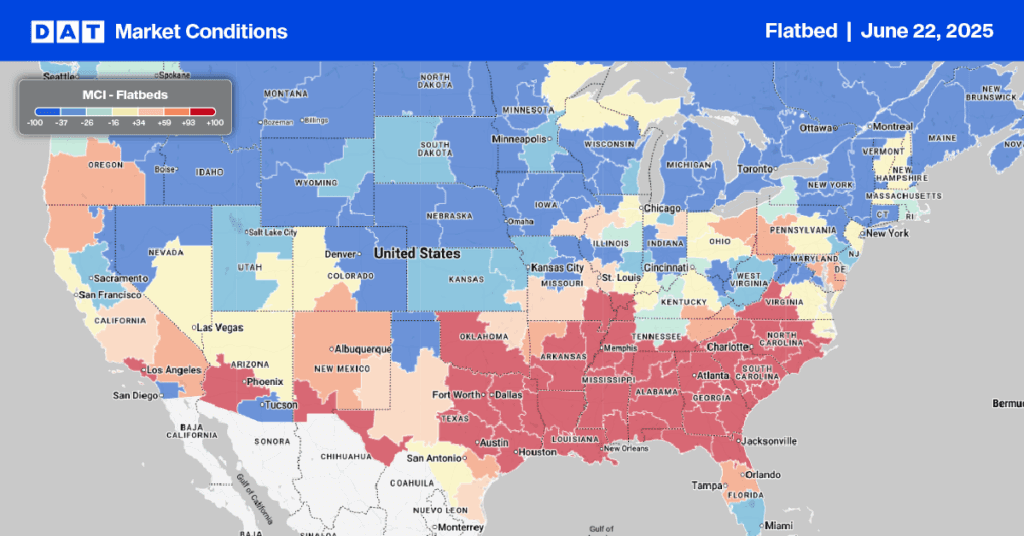

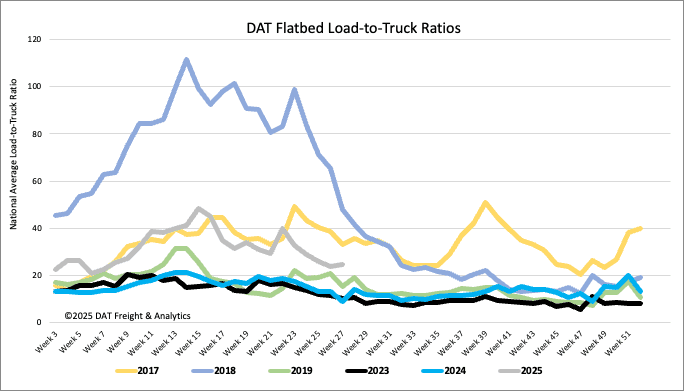

Flatbed load post volume decreased by 4% last week, a typical seasonal adjustment. However, this volume remains 15% higher year-over-year. Concurrently, carrier equipment posts fell by 7%. These factors contributed to a 3% increase in the flatbed load-to-truck ratio, which reached 24.44.

Spot rates

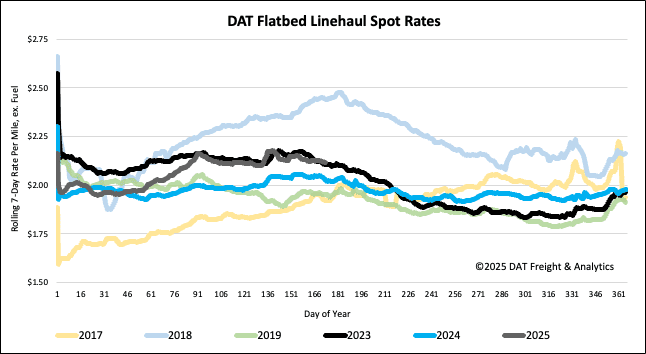

The national average flatbed spot rate, excluding fuel, saw a $0.04 per mile decrease last week, settling at $2.13/mile. This rate is still $0.09 per mile higher than the same week in 2024. However, flatbed spot rates are expected to experience a seasonal decline from now until the end of August.