Canadian agricultural tractor sales saw a 3.4% increase year-to-date through April, with 4-wheel-drive tractors surging by 46.3%. In contrast, U.S. sales in all agricultural equipment categories declined in April 2025. Total agricultural tractor sales in the U.S. were down 13.3%, and combine sales fell 48.3% year-to-date.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Curtis Blades from the Association of Equipment Manufacturers attributes the U.S. sales downturn to a softer agricultural economy influenced by higher input prices, elevated interest rates, and global trade uncertainties, causing farmers to be more cautious with capital investments. Despite this, there is optimism that the ag economy will improve as planting season progresses, potentially strengthening the ag equipment market.

However, the optimism from six months prior has waned, replaced by renewed concerns about inflation, a possible recession, and general economic uncertainty. Within the agriculture and construction sectors, anxieties regarding the potential effects of tariffs are escalating, leading to downward revisions of forecasts.

Al Melhim, AEM’s Senior Director of Business Intelligence, identifies tariffs as a significant uncertainty for the remainder of 2025. He notes that nearly 60% of imported agricultural equipment consists of intermediate products crucial for manufacturing and final assembly. Increased tariffs on these imports could raise equipment costs for farmers and consumers, likely reducing demand. Furthermore, additional equity market shocks could hinder consumers’ ability to finance equipment, further dampening demand.

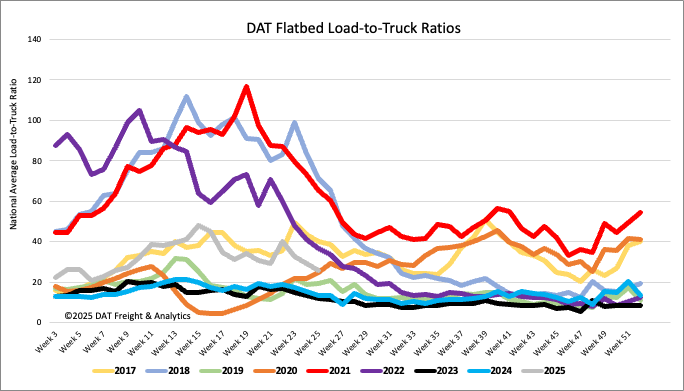

Load-to-Truck Ratio

Flatbed load post volume surged 15% last week following the shorter Memorial Day holiday week, while carrier equipment posts saw an even more substantial 30% increase. This resulted in the flatbed load-to-truck ratio dropping 11% week-over-week, landing at 25.91.

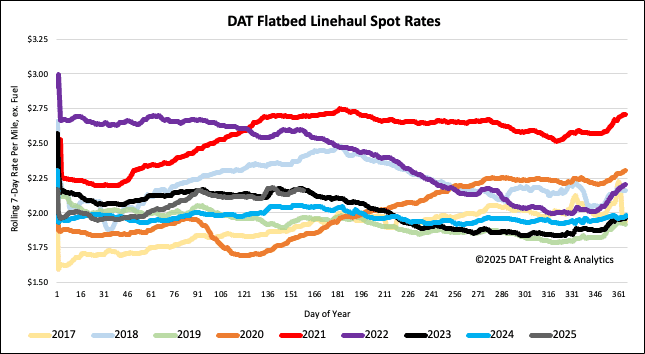

Spot rates

The average flatbed spot rate last week, not including fuel, slightly declined by $0.01 to $2.18 per mile. Compared to the same week in previous years, it is up $0.12 per mile from 2024, but matches the rate observed in 2023.