According to the USDA, net farm income is expected to drop by 25.5 % from 2023’s forecast of $155 billion to $116 billion in 2024 – nearly $40 billion. Decreasing farm revenues due to moderate crop prices and increased borrowing expenses are prompting a reassessment of significant purchases by farmers, creating an uncertain demand landscape for heavy machinery manufacturers. In June, AEM reported U.S. new farm equipment sales were around 30% below the five-year average, creating headwinds for specialized truckload carriers.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

In April, UK-based farm and construction manufacturer Case New Holland Industrial (CNHI) laid off over 200 workers at its Racine, Wisconsin, location and shifted that work to Mexico. It announced further plans to reduce its workforce, leaving as few as 150 to 170 workers by 2026. In May, CNHI announced that global consolidated revenue had declined 10% in the first quarter compared to last year due to lower industry demand. In North America, industry volume was down 15% year-over-year in the first quarter for tractors under 140 HP and 2% for tractors over 140 HP; combines were down 17%.

The company is the descendent of J.I. Case, founded in Racine in 1842. Its successor company, Case IH, merged with New Holland, another farm equipment manufacturer, in 1999, becoming CNH, also known as Case-New Holland. In 2013, the company merged with Fiat Industrial.

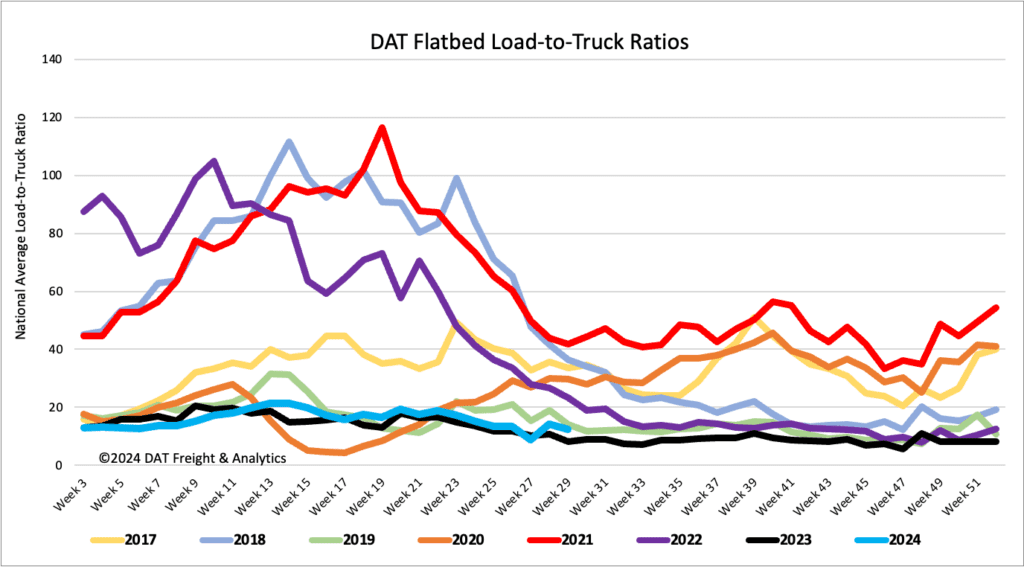

Load-to-Truck Ratio

Even though flatbed load post volumes dropped by 8% last week, they remain 17% higher than last year and 38% lower than the Week 28 eight-year average, excluding years impacted by the pandemic. Carrier equipment posts were down 4% w/w, resulting in last week’s flatbed load-to-truck ratio decreasing by 12% to 12.47.

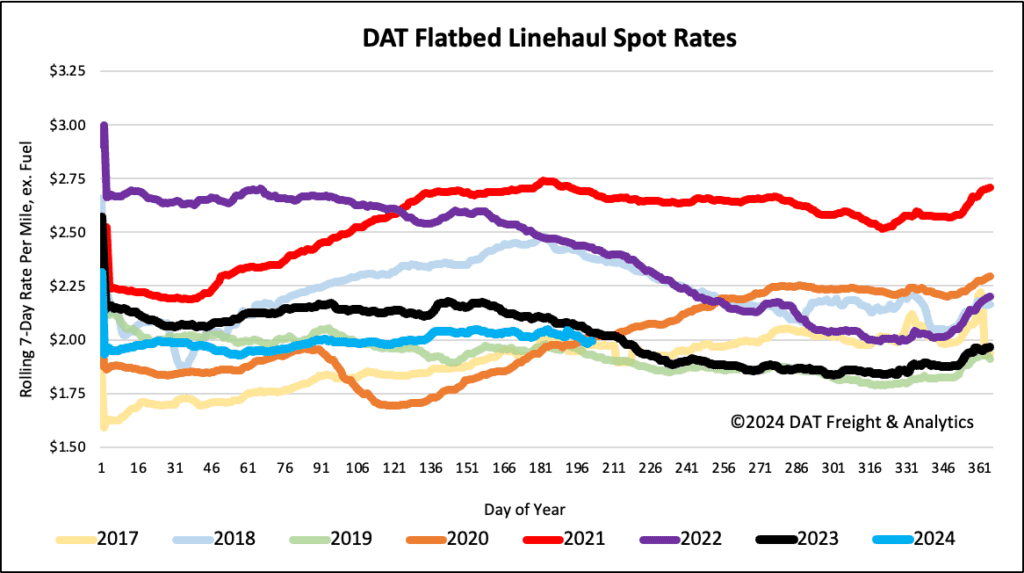

Spot rates

Directionally, flatbed linehaul rates are following solid seasonal trends, decreasing by $0.02/mile to a national average of $2.02/mile. Flatbed linehaul rates are $0.04/mile lower than last year but higher by $0.06/mile compared to 2019. Last year, flatbed spot rates decreased by $0.19/mile from this point to mid-November.