For temperature-controlled carriers looking to get a good read on future demand, the Technomic TIndex is an excellent data point for consumer point-of-sale transactions in the foodservice industry.

The TIndex was baselined to 100 at the start of 2019. Right before the pandemic hit in March of last year, the index was at 105, but it rapidly crashed to around 50 in March 2020 as the global pandemic took full effect on consumer demand and manufacturing.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

As the economy began to reopen, the index passed through the 80 mark in July 2020. Over a year later, it’s almost back to pre-pandemic levels, increasing by 20% to 98.9 as of September. The foodservice sector is still around 2% behind on a two-year basis despite the 1% sequential gain in September, boosted by return to school and college foodservice demand and the fall wedding season.

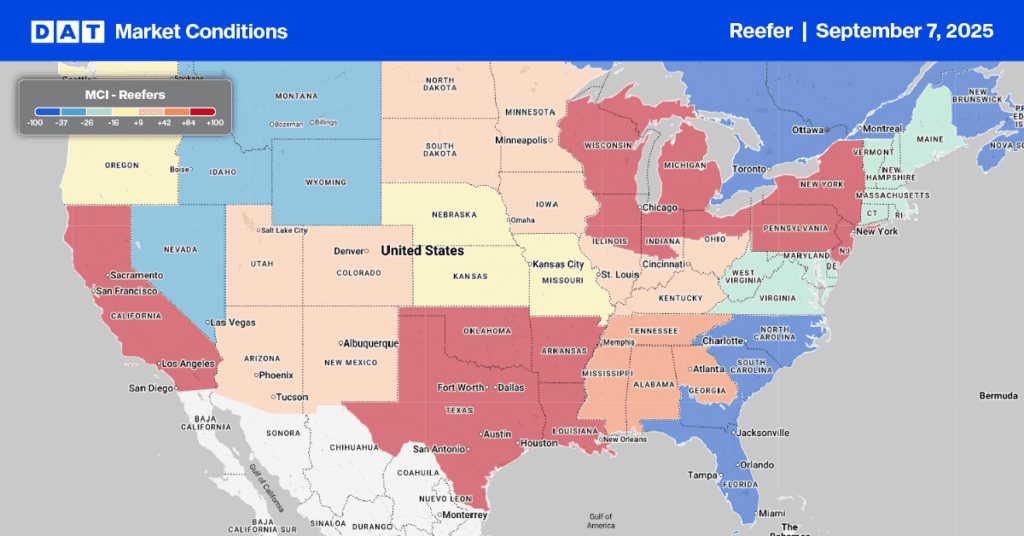

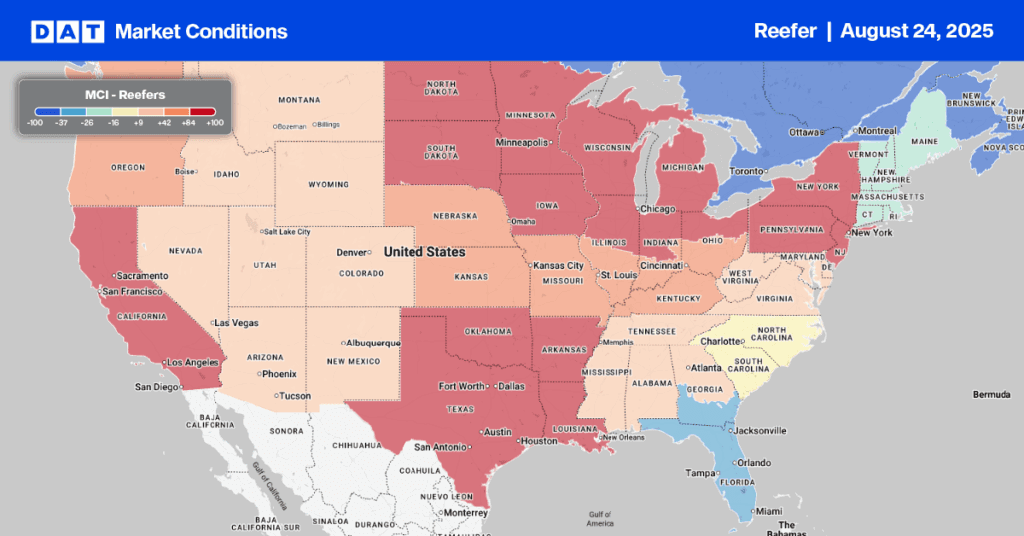

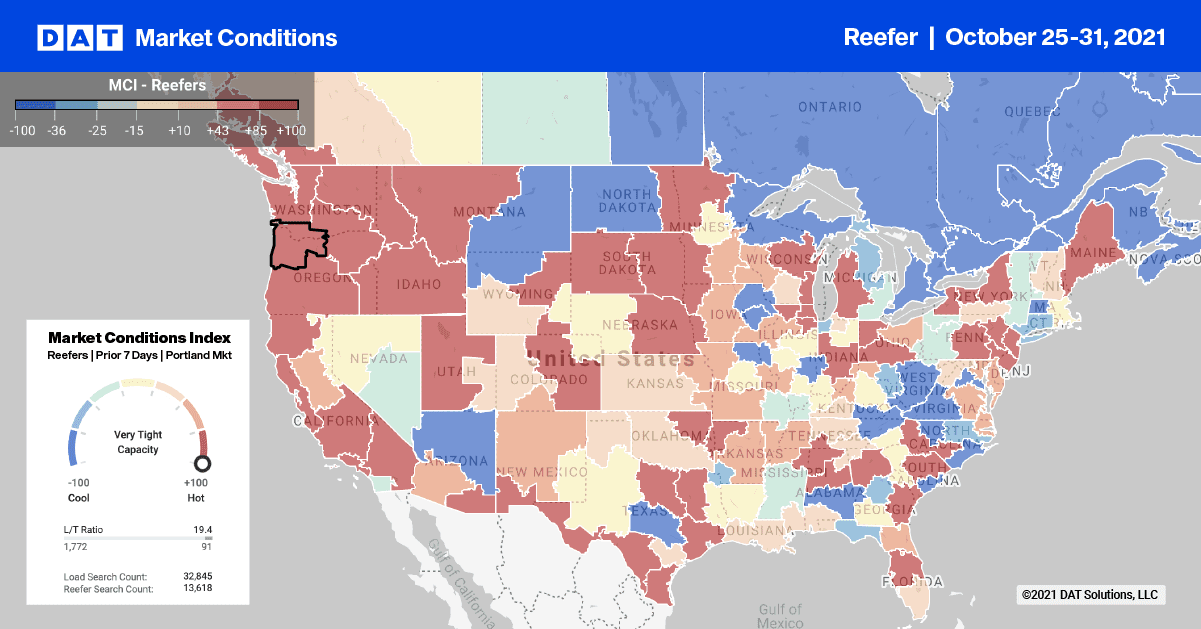

Truckload capacity continues to tighten in the Seattle and Oregon markets following a 23% increase in load post volumes last week. Outbound reefer spot rates jumped $0.18/mile to an average of $2.62/mile.

Loads on the Seattle to Stockton 800-mile lane hit a 12-month high of $2.10/mile, up $0.09/mile in the last week. Capacity on the 1,100-mile run to Los Angeles was even tighter. Loads from Seattle to Los Angeles averaged $2.24/mile last week, which is $0.63/mile higher than this time last year.

Spot rates are still at record-high levels on the Los Angeles to Las Vegas lane averaging $6.05/mile last week, up $0.95/mile compared to the same time last year.

On the East Coast last week, capacity was also tight deep in Florida where average outbound spot rates jumped $0.06/mile to an average of $1.50/mile following a 40% increase in load post volumes in the Lakeland market.

On the southern border, capacity was tight following a 30% jump in reefer load posts volumes in the McAllen market. Outbound spot rates were up $0.15/mile to an average of $2.55/mile. Loads west to Phoenix were paying an average of $2.12/mile while loads east to Atlanta were averaging $2.88/mile, up $0.02/mile last week. McAllen to Hunts Points in NYC were also up $0.05/mile to an average of $2.74/mile last week.

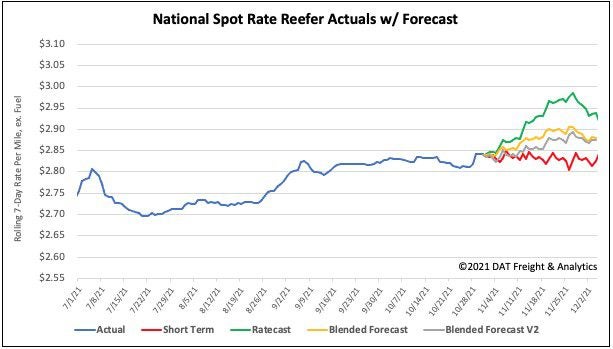

Spot rates

The national average reefer spot rate ended the week unchanged despite Fall produce and Thanksgiving shipping volumes ramping up. Reefer rates are still averaging $2.84/mile excl. FSC nationally, which is still 16% or $0.46/mile higher than this time last year.

Of our Top 70 lanes (for loads moved), spot rates:

- Increased on 21 lanes (compared to 22 the week prior)

- Remained neutral on 35 lanes (compared to 35)

- Decreased on 16 lanes (compared to 14)

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models

> Learn more about rate forecasts from DAT iQ