Grilling season in the United States typically stretches from Memorial Day to Labor Day, covering late May through early September. This period is the prime time for outdoor cooking and barbecues, driving peak sales for grill-related foods, with the Fourth of July as the most popular grilling holiday. Retailers and meat producers experience their highest demand for beef, chicken, and hot dogs during these months.Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Even with the impact of inflation on food prices, grilling continues to be a favored outdoor activity. A study by Talk Research shows that two-thirds of Americans (66%) consider summer grilling season their favorite time of year, and over a quarter (27%) eagerly anticipate the next summer barbecue season, regardless of the current season.

The research also revealed that Americans plan to attend an average of five barbecues and host four each summer. Gen Z expressed the strongest sentiment, stating that summer is incomplete without at least one barbecue. On average, an ideal cookout includes 11 guests, and most respondents (64%) believe it’s essential to bring something to share, considering it a communal effort.

In terms of food, Talk Research found that hamburgers are the top choice for summer barbecues, preferred by 77% of Americans. Hot dogs (65%), chicken (55%), and steak (54%) follow, but hamburgers clearly lead across most states and demographic groups.

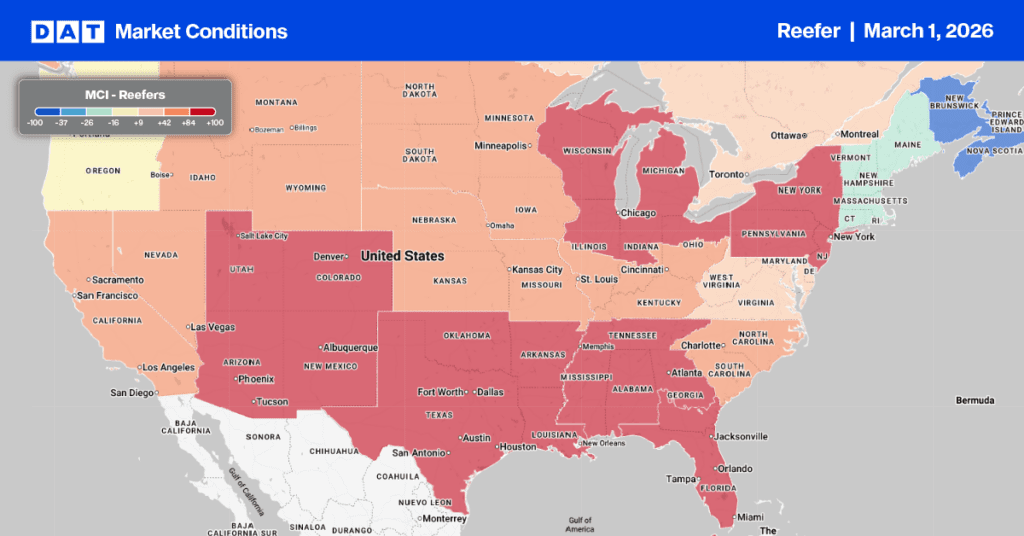

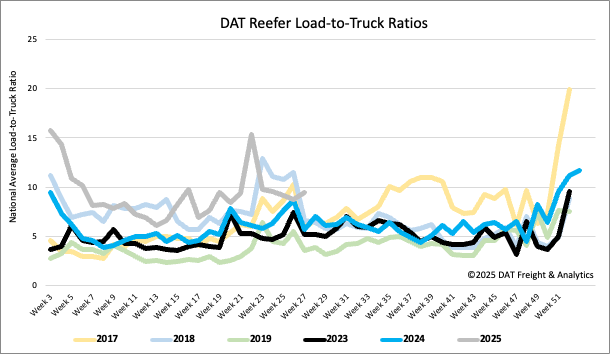

Load-to-Truck Ratio

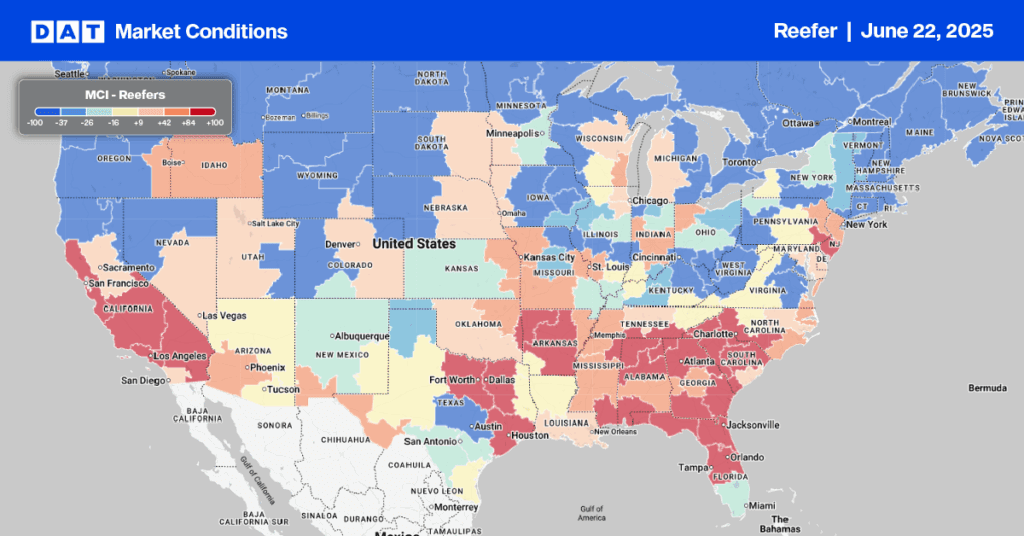

California’s last-minute 25% surge in outbound produce volume wasn’t enough to lift the national reefer market. Overall reefer load post volume saw a 3% decrease. However, reefer equipment postings dropped by 10%, leading to an 8% increase in last week’s reefer load-to-truck ratio, which reached 9.48.

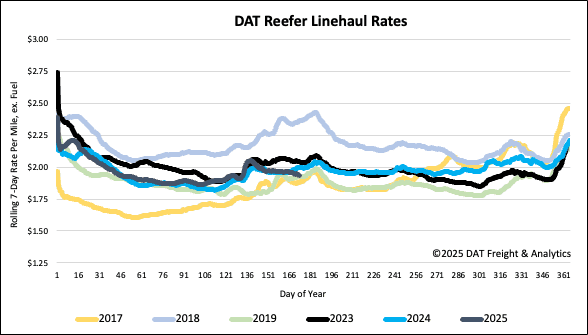

Spot rates

Unlike typical years where the reefer market heats up two weeks before Independence Day due to increased shipping, this year tells a different story. Last week, the national average for reefer spot rates unexpectedly dropped by $0.02/mile, landing just over $1.95 per mile—$0.06 per mile less than last year’s rates. Despite an anticipated surge in spot market volumes over the next two weeks, it will most likely be insufficient to trigger the usual July 4 spot rate spike.