Freight markets have been slowly rebounding in May, with the normal seasonal uptick providing some relief for transportation companies that have suffered during the COVID-19 crisis.

With some businesses starting to reopen and the country looking for its economic footing, demand for truckload shipments is picking up. As a result, load-to-truck ratios on DAT Load Boards have steadily increased in recent weeks. That signals tighter capacity, which has pushed truckload rates higher, especially in produce regions where harvests are hitting supply chains.

But even with these improvements, the national average van rate for May is still below the April average. The pace of these improvements hasn’t matched the pace at which freight markets tanked in April, so many carriers are still struggling in the current business climate.

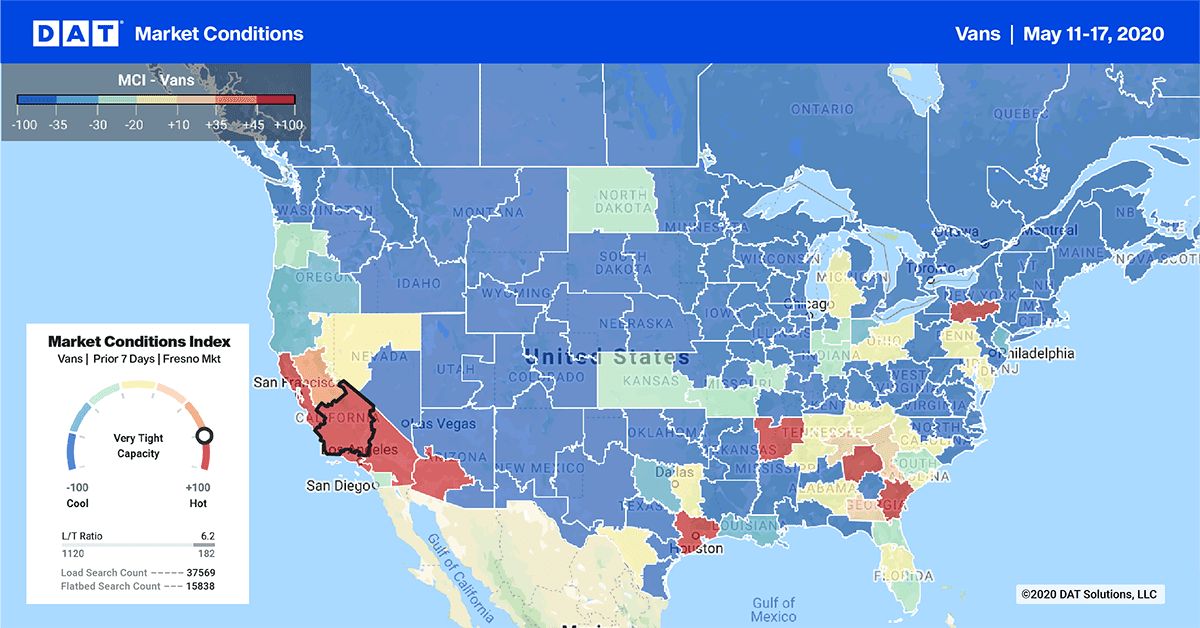

The Market Conditions map above shows more areas emerging from the cold blue that took over the entire country after large swaths of the economy shuttered. The typical seasonal trend is for activity to pick up across the southern half of the country, followed by more activity up north as temperatures rise. That trend is playing out now, and the recent upticks in port activity continued last week. The band of improved conditions in the Northeast is worth highlighting.

Biggest increases

Carriers had pricing power in California last week, with rates rising on higher volumes out of Los Angeles and Stockton. And for the second week in a row on the top 100 van lanes, rate increases outnumbered decreases.

Note: The rates listed below are averages from last week, based on actual transactions between carriers, brokers and shippers.

- The average rate for van loads going from Los Angeles to Phoenix rose 18 cents last week to $2.52 per mile

- L.A. to Seattle also improved 18 cents at an average of $2.36 per mile

- Seattle to Spokane, WA, averaged $2.69 per mile, up 22 cents from the week before

- There was a lot of improvement out of Atlanta, and the lane to Charlotte, NC, rose 13 cents on higher volume, averaging $2.13

Get regular updates on how the coronavirus is affecting freight markets at DAT.com/COVID-19.

Notable decreases

We’re no longer seeing the massive declines in prices that were across the board in April. Recent declines have been relatively small, and last week they were largely relegated to lanes that are traditionally low-paying already.

In Denver, demand for inbound freight often outweighs the outbound freight in that market, so low prices are nothing new there. But of the eight lanes we track out of Denver every week for these market update reports, five averaged less than $1 per mile last week. One outlier was the lane from Denver to Albuquerque, NM, which held steady at $1.60 per mile.