After moving slowly across the Atlantic and devastating several islands in the Bahamas, Hurricane Dorian reached the East Coast of the U.S. last week. Although the storm stepped down from the category 5 that hit the Bahamas, supply chains were disrupted along the East Coast, from Florida northward. Our thoughts go out to all who were affected by this wide-ranging hurricane.

Now that communities are attempting to recover and emergency freight is on the move, truckload capacity has tightened and boosted rates for vans, reefers and flatbeds. The trend of rising rates started even before Hurricane Dorian, and over the past two weeks van spot rates have increased 3% nationwide — with certain lanes rising much higher. In general, lanes headed in the direction of the hurricane moved higher. On the top 100 lanes last week, 68 saw higher rates and just 26 were lower, with 6 remaining neutral.

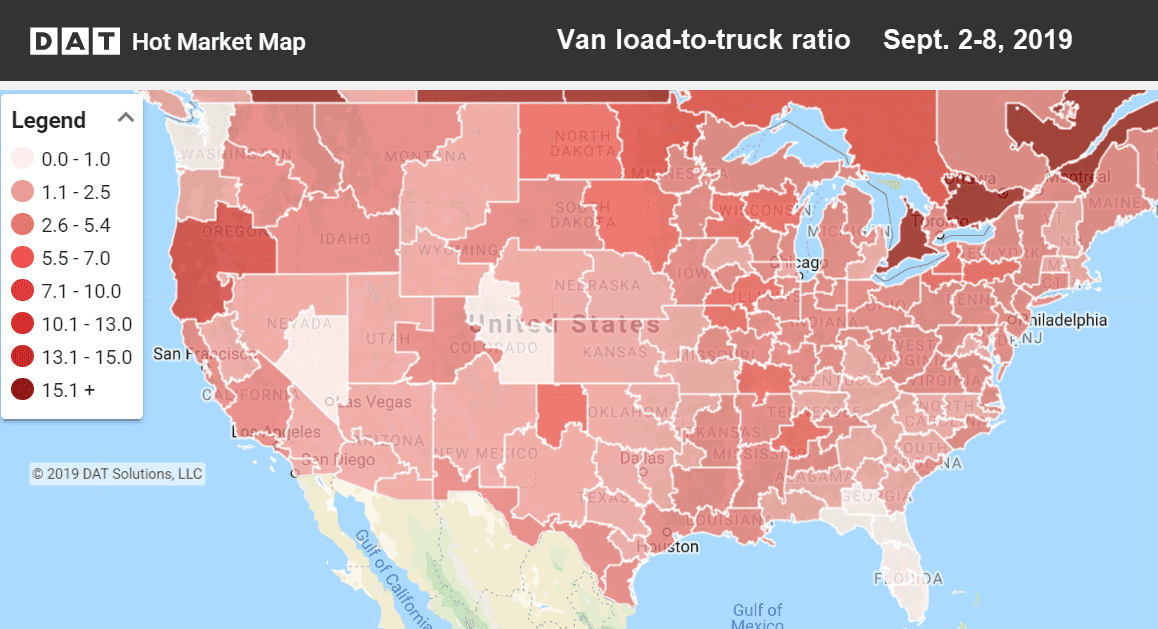

Hot Market Maps show the number of available trucks vs. available loads and are available in the DAT Power load board and DAT RateView.

Load-to-truck ratios continue to climb

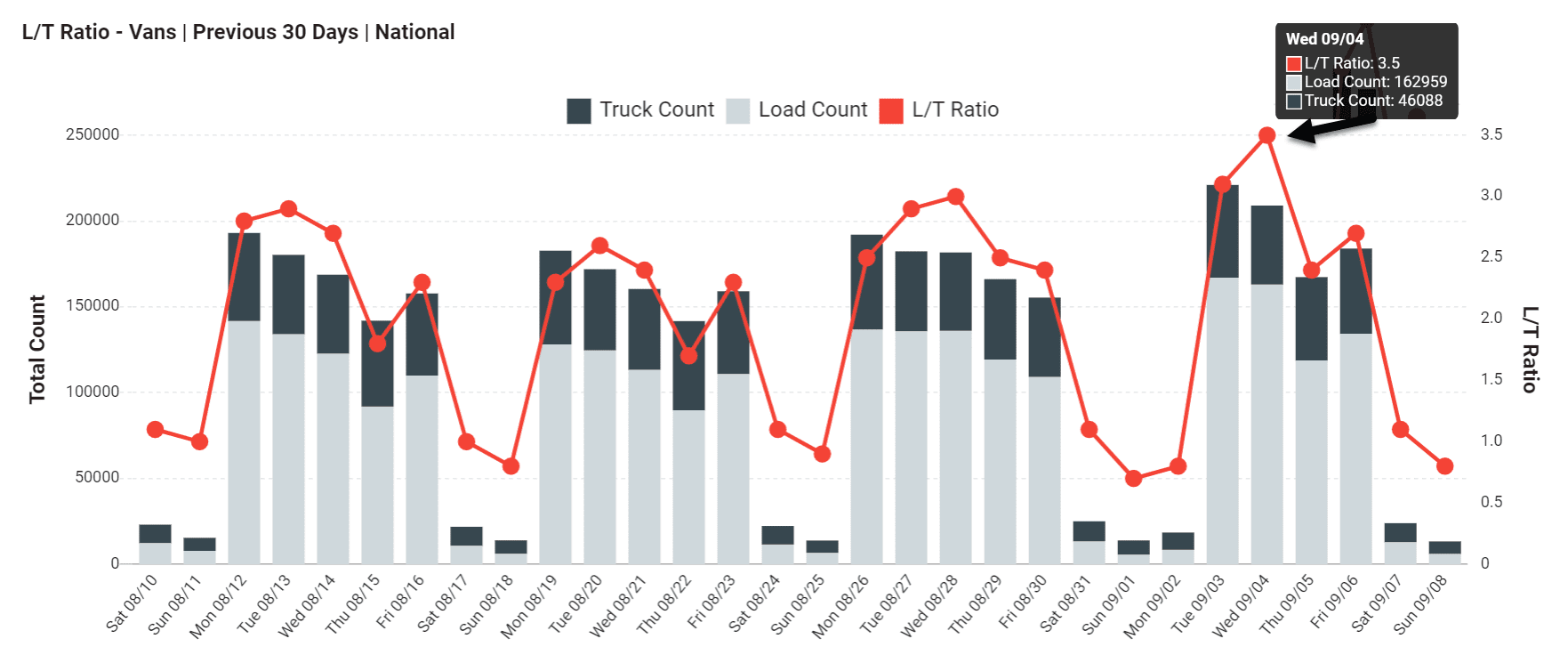

Van load counts and load-to-truck ratios have been steadily increasing over the past few weeks. Rates tend to rise when the load-to-truck ratio exceeds 2.5, and the ratio hit a peak of 3.5 last week, and 3.0 the week before.

Van load-to-truck ratios have been increasing in the past few weeks and last Wednesday the ratio peaked at 3.5 loads per truck. (Graph from DAT RateView.)

Rising

Lanes that moved freight closer to the hurricane zone saw the largest increases last week, such as:

- Charlotte to Lakeland, FL, jumped 19¢ to $2.37/mi.

- Allentown to Richmond, VA, increased 15¢ to $2.58/mi.

- Philadelphia to Charlotte also increased 15¢ to $1.68/mi.

- Atlanta to Miami gained 14¢ to $2.82/mi.

There were also a few examples of price increases on lanes moving away from the impacted areas:

- Fayetteville, NC to Buffalo shot up 19¢ to $2.37/mi.

Falling

Some markets already shipped higher volumes in the prior week and had a downturn.

- Memphis to Indianapolis dipped 9¢ to $2.04/mi.

- Columbus, OH, to Buffalo dropped 7¢ to $1.78/mi.