There was a surge in produce imports last week, according to the USDA. Truckloads volumes are currently up 62% year over year, with just under 33,000 loads shipped compared to the 20,000 loads of domestic truckloads of produce.

Domestic shipments are down 44% y/y, which is significant for carriers and brokers as it represents a decrease of close to 16,000 fewer truckloads per week for this time of the year.

Mexico is the largest source of produce imports, with 33% of loads crossing in the McAllen, TX, market followed by 24% in Nogales, AZ, and 20% in Laredo, TX. This time of the year tomatoes, avocados, cucumbers, peppers and limes account for around 50% of the total volume.

Canadian produce imports are dominated by potatoes, which represented 46% of loads last week, followed by carrots (14%), cucumbers (9%) and mushrooms (7%). Of that, 58% of potatoes cross into the U.S. via commercial crossing zones in Maine and originate on Prince Edward Island – the number one potato producing province in Canada.

Find reefer loads and trucks on the largest on-demand freight marketplace in North America.

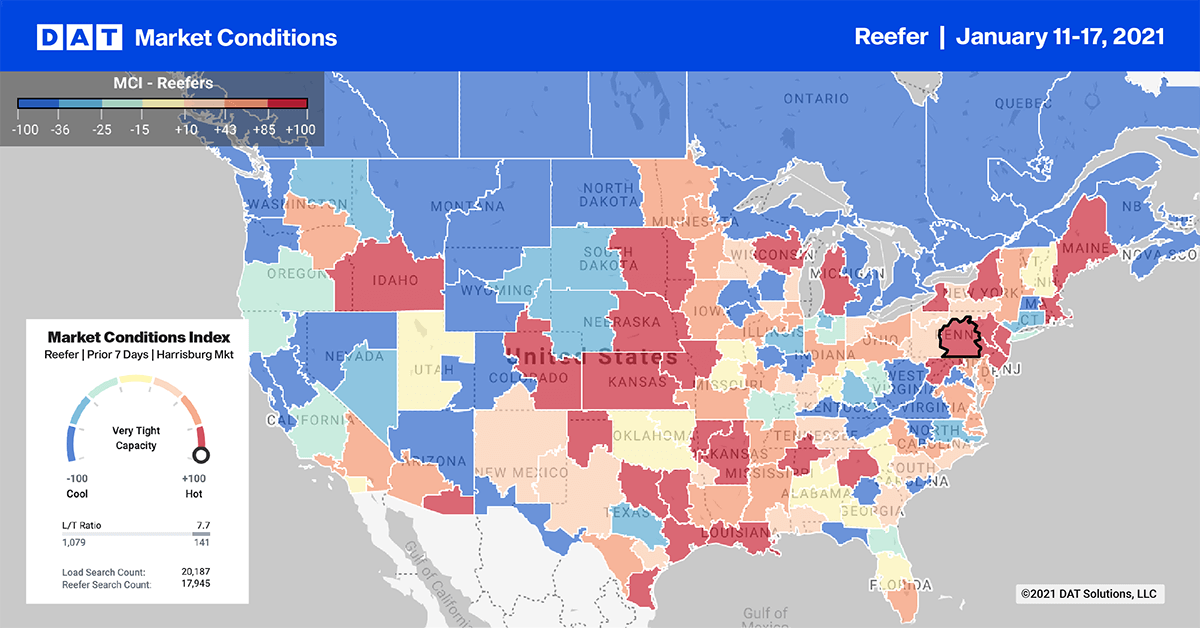

Reefer load post volumes dropped in all top 10 markets last week, putting downward pressure on spot rates, which fell on average by $0.15/mile as available capacity loosened rapidly.

New Jersey (#1) regained the top spot but volumes dropped considerably decreasing by 26% w/w driving down rates by $0.09/mile. A similar volume drop in Atlanta forced rates down by $0.16/mile. In McAllen (#7) in the Rio Grande Valley in Texas, outbound volumes dropped by 30% w/w driving down rates by $0.11/mile.

Spot rates

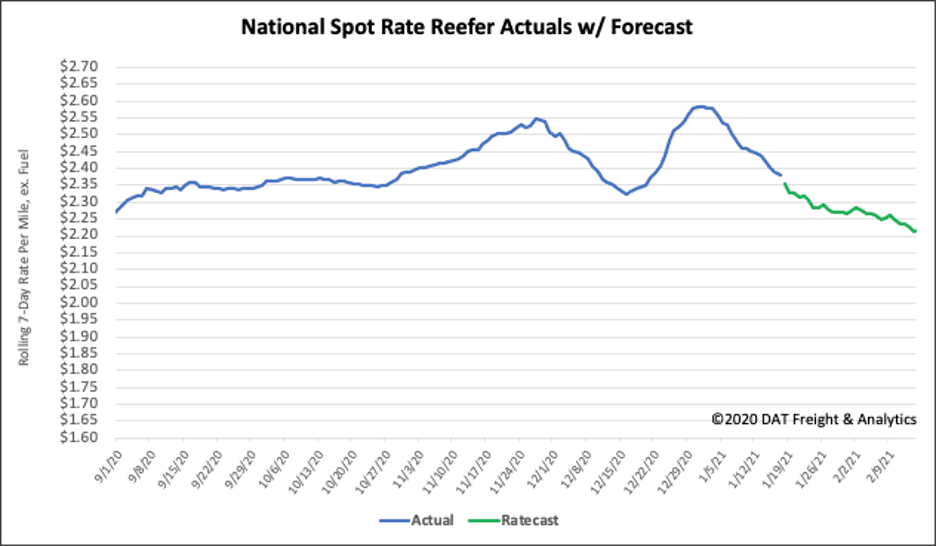

Spot rates in the reefer sector decreased the most last week, dropping by $0.08/mile to $2.38/mile, which is $0.46/mile higher than the same week in 2020 when rates were $1.92/mile. Interestingly, reefer rates are just $0.01/mile higher than the same week in 2018 ,when capacity was considered to be the tightest in a decade.

This year promises to be a very different year in terms of what’s driving the reefer market, but a drop in reefer rates this quarter should continue to track along with 2018.