All rates exclude fuel unless otherwise noted.

California is the largest producer of fruits and vegetables for the U.S. domestic market (at 58%), according to the USDA. Starting April 1, we’ll see increasing truckloads of produce, which will level off and stay constant for the rest of the year.

While most produce will have steady harvests, California will ship 53% of its annual orange crop between now and June and 73% of its grape crop between August and November.

The 2021 produce season is shaping up like no other for California brokers, carriers and shippers, given how tight capacity already is and how much higher reefer spot rates are compared to this time last year.

According to the USDA, California’s Central Valley, which is about 50 miles wide and 400 miles long, produces around 80% of the state’s produce volume. It also encompasses both the Fresno and Stockton freight markets.

Reefer rates have been increasing for both these markets for the last three weeks, reaching $2.71/mile for loads to all destinations last week.

Denver and Seattle are the top two long-haul (>250 miles) reefer load destinations out of the Central Valley — both receiving about 4% of the load volume each week. Fresno to Denver loads average $3.40/mile this week, which is $1.26/mile higher than last year. Loads on the Fresno to Seattle lane currently average $3.75/mile, which is $1.54/mile higher than last year.

Find loads and trucks on the largest load board network in North America.

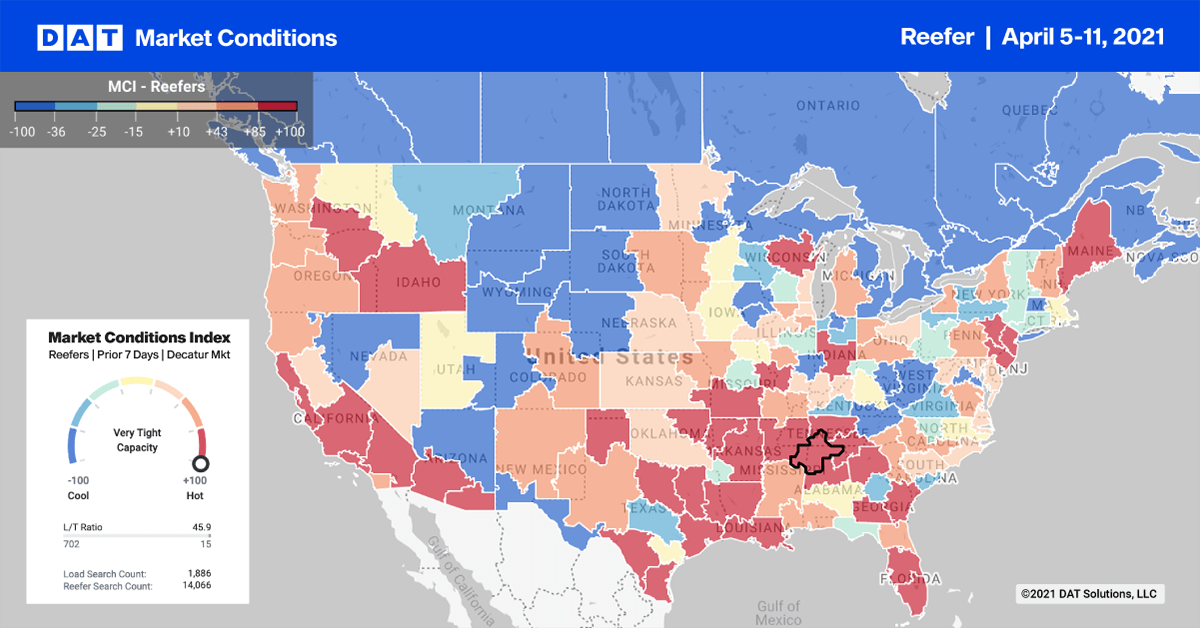

Reefer load posts in the top reefer markets tracked along with dry vans. Volumes dropped by 6% week over week — rates remained flat at an average of $2.62/mile (excluding fuel).

The following produce markets reported fewer load posts last week while capacity tightened and increased spot rates:

- Miami: $2.28/mile

- Fresno: $2.68/mile

- McAllen: $2.67/mile

- Laredo: $2.59/mile

Capacity was generally much tighter in Texas last week. Rates increased for the third week in a row and went up by $0.02/mile to an average of $2.57/mile. The Pacific Northwest also saw tighter capacity in Seattle following a 25% increase in reefer load posts this week. This drove up spot rates by $0.42/mile to an average of $2.14/mile.

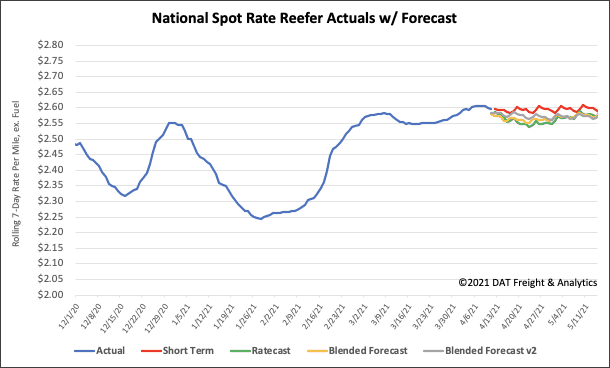

Spot rates forecast

Combined with fewer reefer load posts and more truck posts last week, reefer spot rates dropped $0.04/mile to $2.62/mile. Compared to this time last year, reefer spot rates are $0.84/mile higher and remain at record high levels — even $0.51/mile higher than this time in 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset.

- Blended Scenario: More heavily weighted towards the longer-term models.

- Blended Scenario v2: More heavily weighted towards the shorter-term models.

> Learn more about rate forecasts from DAT iQ