The American Trucking Associations’ For-Hire Truck Tonnage Index decreased 4.5% in February after increasing by 1.8% in January. Compared with February 2020, the index is down by 5.9%. For the 2020 calendar year, the index was 4% below the 2019 average.

“February’s drop was exacerbated, perhaps completely caused, by the severe winter weather that impacted much of the country during the month,” according to Bob Costello, ATA Chief Economist. “Many other economic indicators were also soft in February due to the bad storms, but I continue to expect a nice climb up for the economy and truck freight as economic stimulus checks are spent and more people are vaccinated.”

Find loads and trucks on the largest load board network in North America.

Load posts in the top 10 flatbed markets dropped last week by just over 4%. Capacity remained tight though, pushing up top 10 market outbound rates by $0.03/mile to an average of $2.49/mile, excluding fuel surcharges.

Load posts in Atlanta increased by 6% w/w followed by an increase in spot rates to an average of $2.49/mile.

Capacity was tighter in Texas last week even though volumes in Houston and Dallas dropped by 4% and 7% w/w respectively. As a result, rates increased by an average of $0.07/mile for all outbound loads.

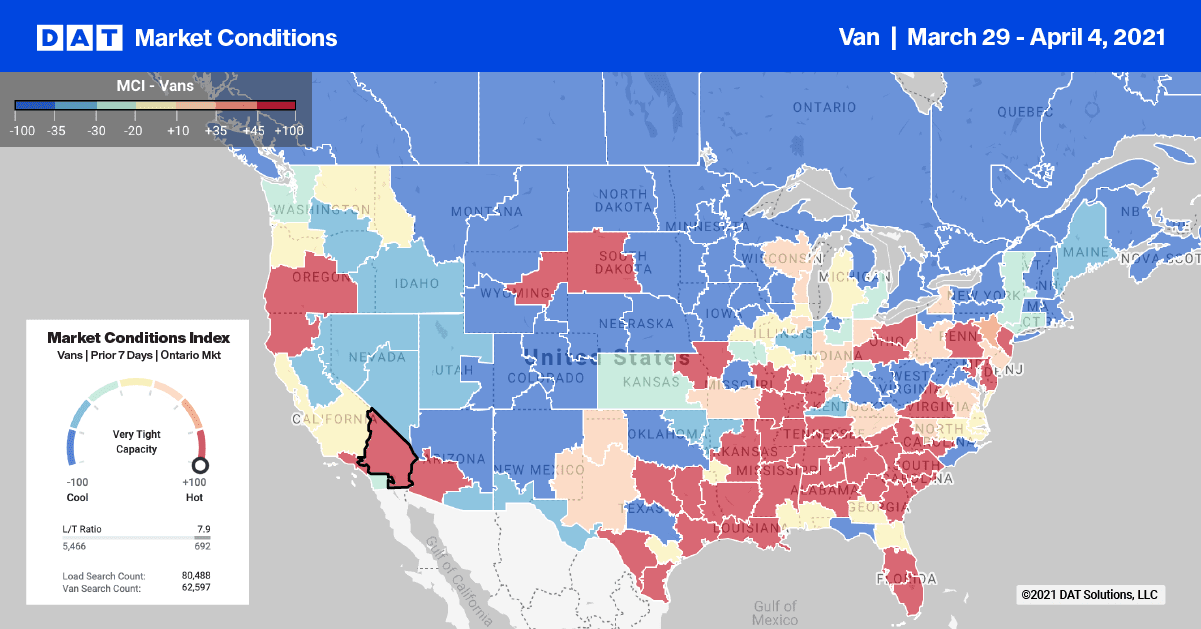

On the West Coast in Ontario, CA, and Los Angeles, higher volumes and tighter capacity drove up spot rates by $0.06/mile to $2.96/mile (excluding fuel) in Ontario and $2.87/mile in Los Angeles.

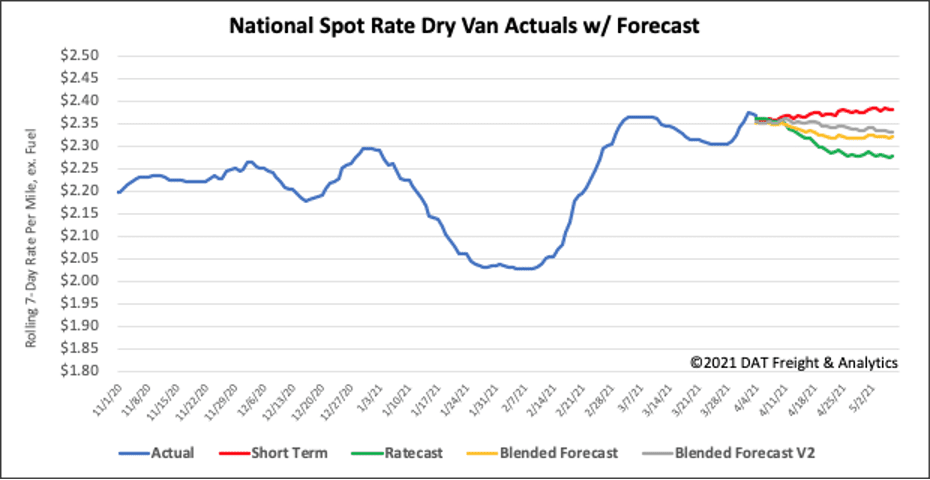

Spot rate forecasts

Dry van spot rates continued climbing last week, increasing $0.03/mile to end the week at $2.39/mile, excluding fuel. Spot rates remain up 31% compared to the same week in 2020.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset.

- Blended Scenario: More heavily weighted towards the longer-term models.

- Blended Scenario v2: More heavily weighted towards the shorter-term models.