Demand for fresh produce remains strong, even though most fall crops have already been harvested in the U.S. and spring is still a few months away. As we get closer to Christmas, a larger proportion of fresh fruit and vegetables are imported from Mexico through a handful of border crossings in California, Arizona, New Mexico, and Texas.

McAllen, TX, is the easternmost border crossing for those produce moves, so it’s a gateway to population centers on the East Coast and parts of the Midwest. Volume is heating up right now for reefers out of McAllen. Some of the crops are imported, but others are grown on the U.S. side of the border, as McAllen’s location in the Rio Grande Valley is a fertile area throughout most of the year.

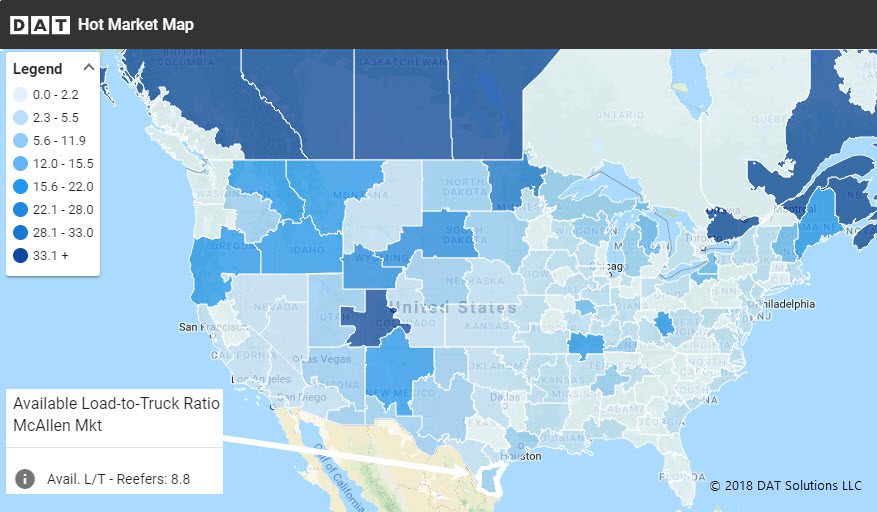

McAllen, TX, is a key origin point for fresh fruit and vegetables in the winter months, as crops are harvested in the Rio Grande Valley on both sides of the U.S.-Mexico border. Last Tuesday, there were 8.8 reefer loads per available truck on DAT load boards, and that number shot up to 13.2 on Friday — both are well above the national average of 6.3. Load volume continues to rise, so rates are also trending up on key lanes originating in McAllen.

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

Recently, temp-controlled loads got a big boost in four major lanes originating in McAllen.

- Spot rates rose 6¢ last week to $2.84 per mile from McAllen to Dallas

- McAllen to Chicago paid $2.03 last week, including fuel, up a penny from the week before

- McAllen to Elizabeth, NJ added 3¢, to $2.25

- The lane from McAllen to Atlanta lost a few cents, but still averaged 2.27 per mile last week

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.