The 2025 potato season in Washington and Oregon is projected to see a slight decrease in shipments despite a favorable harvest characterized by good size and quality, largely due to reduced demand for processed potato products. In Washington, the second-largest potato producer in the U.S., acreage is expected to decline from 159,500 acres in 2024 to between 145,000 and 150,000 in 2025. Notably, only 10% of the state’s potatoes are allocated to the fresh market, with key growers like Del Christensen & Sons and Norm Nelson Inc. anticipating regular harvest schedules and distributions primarily focused on retail.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Similarly, Oregon, the fourth-largest potato producer, is facing volume reductions tied to decreased processed potato acreage. The state produced 26.875 million cwt valued at $1.1 billion from 43,000 acres in 2024, with around 5-10% going to the fresh market. Notable growers such as Organically Grown Co. are focusing on organic varieties amid these trends, with harvesting expected to begin in late July and an emphasis on specialty potatoes alongside a broad organic product offering.

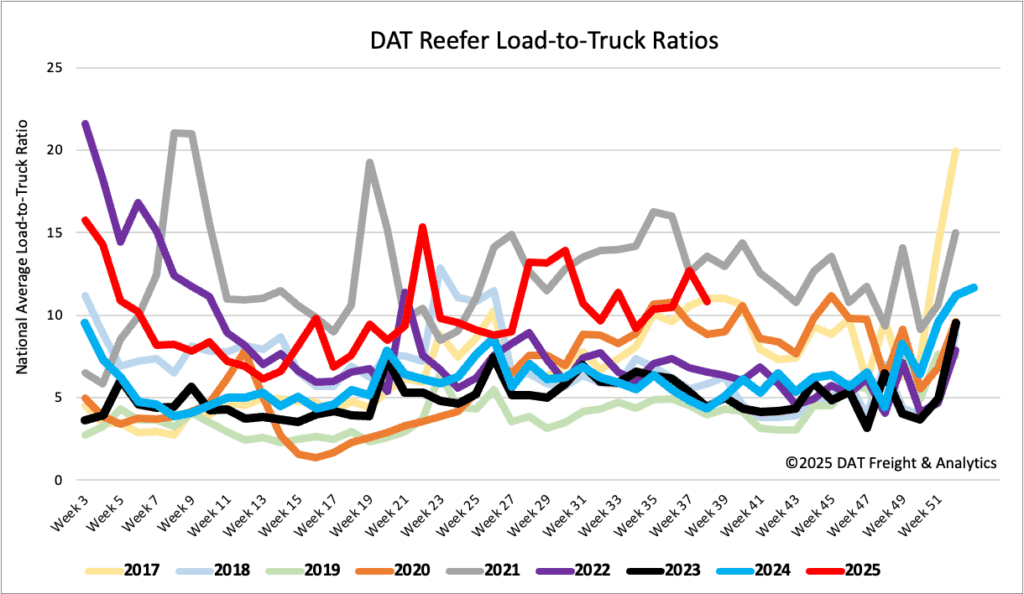

Load-to-Truck Ratio

Last week, reefer volumes saw a predictable 26% decline after the Labor Day surge, primarily due to a 12% drop in national truckload volume of fruits and vegetables. The shortened work week also led to fewer carrier equipment posts, resulting in the reefer load-to-truck ratio settling at 10.8 for the week.

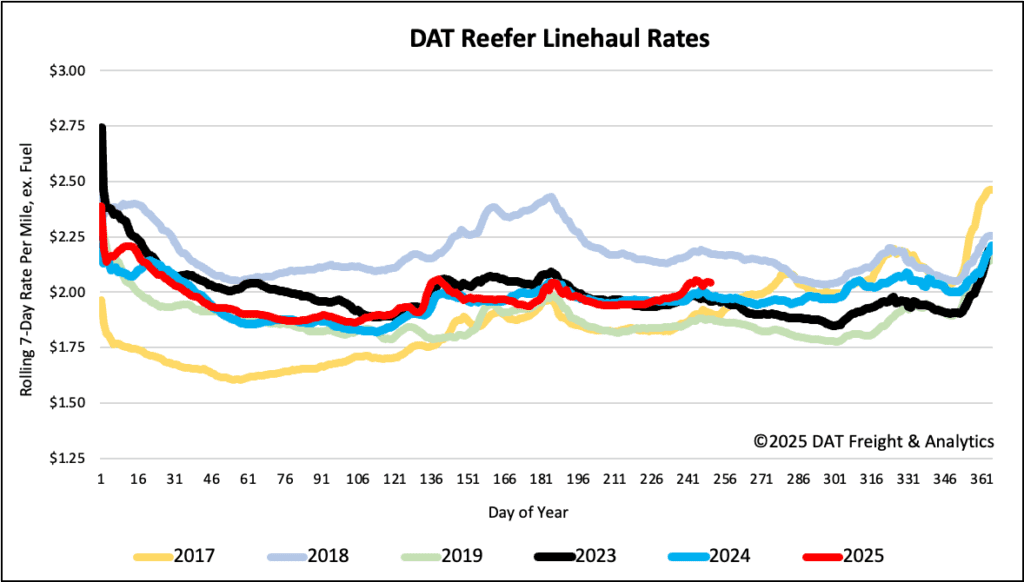

Spot rates

The combination of carriers taking time off following the Labor Day weekend, carriers continuing to exit the industry, carriers of all sizes reducing their fleet size, resulting in tighter capacity last week in the spot market. Spot rates ended the week around $0.07 per mile higher than the last two years, averaging $2.06 last week. We will monitor if this trend persists as the industry returns to full operation next week.