Food prices are rising ahead of Independence Day, but not because of tariffs—inflation and supply-demand dynamics are the main drivers. The all-American BBQ relies mostly on domestic supply chains, insulating it from trade wars. Rabobank’s 2025 BBQ Index shows a 4.21% increase in the cost of a typical American BBQ for 10 adults, primarily due to domestic supply and demand rather than tariffs.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Beef prices are up due to strong demand and declining domestic supply, while beer prices are less affected by tariffs due to local supply chains, with a trend toward upscale options. Consumer preference shifts to hard seltzers and ready-to-drink cocktails could pose inventory challenges. The price increases are mainly driven by domestic factors and a resilient supply chain.

The Rabobank BBQ Index assumes an average American BBQ situation—a mix of family and friends—ahead of summer grilling season. That includes 10 adults with each consuming one cheeseburger with lettuce and tomato, one chicken sandwich with lettuce, tomato and a slice of cheese, two handfuls of chips, two beers, a soda and a few scoops of ice cream.

Independence Day fun facts

- 150 million hot dogs are eaten every 4th of July in the U.S.—enough to stretch from D.C. to L.A. more than 5 times.

- Watermelon is the #1 most consumed fruit on July 4—around 700 million pounds.

Americans spend over $1.5 billion on beer for the July 4th weekend—more than any other holiday. - More than 68 million cases of beer are sold in the two weeks leading up to Independence Day.

- The 4th of July is one of the busiest days of the year for breweries, distributors, and beer truckers.

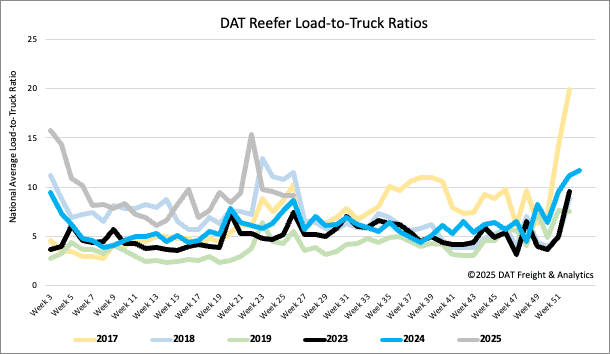

Load-to-Truck Ratio

Reefer load postings decreased 1% again last week, weighed down by lower produce volumes in the spot market. According to the USDA, fruit and vegetable volumes in the seventeen growing regions were down 9% last week, following last week’s 4% increase. Reefer equipment postings decreased slightly, resulting in the reefer load-to-truck ratio remaining mostly unchanged at 9.12.

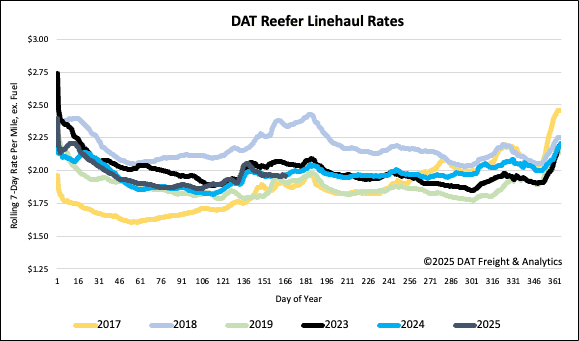

Spot rates

Last week, the national average for reefer spot rates saw a modest increase of one cent per mile, reaching $1.98 per mile. This rate is slightly below last year’s figures and falls $0.10 per mile short of 2023 levels. This decline compared to 2023 is notable, as month-to-date produce volumes were 10% higher in June 2023. Currently, month-to-date produce volumes are down 9% (or 6,500 fewer truckloads) compared to last year.