California produce volumes were not doing well before Hurricane Hilary hit the West Coast, but now that the damage assessments are in, growers expect to lose around one-third of this season’s grape crop. According to the USDA, this comes at peak-harvest time, when volumes are already 5% lower than last year. “The impact of the hurricane and its aftermath is devastating and heartbreaking,” said Kathleen Nave, president of the California Table Grape Commission. “To say that the grower and farmworker community is in shock is an understatement.”

With approximately 30% of the crop harvested when the hurricane hit, it is projected that 35% of the remaining crop — 25 million boxes — has been lost. Nave said, “The revised estimate for the California crop is 71.9 million 19-pound boxes. The last time the crop was under 75 million boxes was 1994.”

Hurricane Idalia, on the East Coast, made landfall with winds close to a Category 4 storm. According to the Georgia Department of Agriculture, damage to pecan and sweet corn crops has been reported, as well as damage to several poultry farms. The pecan crop was the hardest hit. Several large growers have reported 10,000 to 15,000 trees down from their orchards. According to Lenny Wells at the University of Georgia Extension, “All affected growers I have spoken with along the storm’s path estimate at least 50% crop loss in the form of nuts blown from trees.”

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

According to the USDA, Delaware, Maryland, and eastern Virginia reefer markets experienced a slight shortage of trucks last week for loads of watermelons, which are up 38% year-over-year (y/y). Outbound reefer rates in Maryland averaged $2.48/mile following last week’s $0.23/mile increase, and on the Denton, MD, to Atlanta lane, loads were paying $2.14/mile, the highest since February.

Outbound reefer rates in Texas increased $0.07/mile last week to an average of $1.85/mile. In the larger Houston market, linehaul rates also increased by $0.07/mile to $1.74/mile, while on the southern border in Laredo, spot rates increased by $0.10/mile to $1.69/mile for outbound loads.

On the West Coast, in Fresno – California’s largest produce market – rates dropped for the fourth week, averaging $2.08/mile, down $0.12/mile in the last month. In other large reefer markets, spot rates were up $0.02/mile in Chicago and Joliet, averaging $2.44/mile, while in Atlanta, spot rates were up $0.06/mile to $1.88/mile last week.

Load to Truck Ratio (LTR)

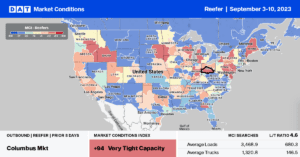

California produce volumes continue to lag and are now the lowest since 2016, impacting the reefer spot market. According to the USDA, outbound truckload volumes in California and nationally are around 7% lower than last year. Spot market load post volumes are roughly half what they were a year ago, resulting in last week’s reefer load-to-truck ratio (LTR) increasing slightly from 4.28 to 4.40, the lowest LTR in seven years.

Spot Rates

Lower spot market load post volumes and loosening capacity following Labor Day erased the gains from the prior week. The result was last week’s $0.02/mile decrease. At $1.98/mile, reefer linehaul rates are $0.24/mile lower than last year and $0.08/mile higher than 2019.