The fall holidays of Halloween and Thanksgiving signal harvest time for pumpkins, creating more demand for reefer carriers. Smaller pumpkins are already on farm stands around the country. Pumpkin is used to make soups, desserts, and breads, and many Americans include pumpkin pie in their Thanksgiving meals. What’s lesser known is the history of pumpkins in the carving of jack-o’-lanterns displayed at homes nationwide.

The term jack-o’-lantern has been used to describe a lantern made from a hollowed-out pumpkin since the 19th century, but the term originated in 17th-century Britain, where it was used to refer to a man with a lantern or to a night watchman. At that time, men whose names were unknown were called Jack. Thus, an unknown man carrying a lantern was sometimes called “Jack with the lantern” or “Jack of the lantern.”

In Ireland and Scotland, Jack’s lanterns began with carving scary faces into turnips or potatoes and placing them into windows or near doors to frighten away evil spirits. Immigrants from these countries brought the jack-o’-lantern tradition to the United States and soon found that pumpkins were much easier to carve.

Today, Halloween is back in a major way, and according to the National Retail Federation (NRF), consumers will spend an unprecedented $108.24 per person on Halloween in 2023, and a record 73% of consumers plan to celebrate Halloween this year, up from 69% last year and before the pandemic when just 68% of adults were celebrating.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

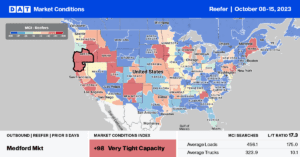

At $1.96/mile, outbound reefer rates in Oregon and Washington state are precisely where they were this time last year and on track to the end the Fall produce season at $0.15/mile to $0.20/mile higher than current rates. Seattle outbound spot rates averaged $1.73/mile last week, up $0.04/mile compared to the prior week, and in Portland, rates were up $0.11/mile to $2.08/mile. Solid gains were reported on the Portland to Denver lane, where rates averaged $2.28/mile, a 12-month high and $0.21/mile more than last year. Ratecast forecasts spot rates on this lane to peak at $2.59/mile, $0.31/mile higher in the first few weeks of December.

In Reno, NV, outbound capacity tightened last week following a $0.42/mile hike in reefer spot rates, which averaged $2.35/mile. In Houston, spot rates increased by $0.05/mile to $1.59/mile for outbound loads, while further west in the El Paso and Tucson markets, spot rates increased by $0.06/mile to $1.62/mile. In Atlanta, reefer spot rates dropped by $0.05/mile to $1.71/mile, and on the high-volume lane to Orlando, rates cooled to $2.60/mile, $0.50/mile lower than last year.

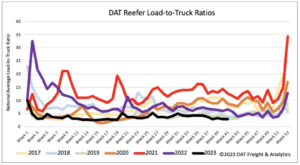

Load to Truck Ratio (LTR)

The volume of Reefer load posts (LP) decreased by 5% last week, influenced by the 13% y/y decrease in national produce truckload volume in California, the largest market for truckload produce at this time of the year. Carrier equipment posts decreased by 5% w/w, resulting in last week’s reefer load-to-truck ratio (LTR) remaining flat at 2.87.

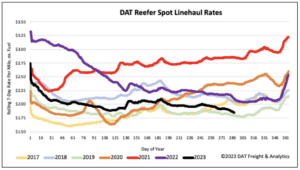

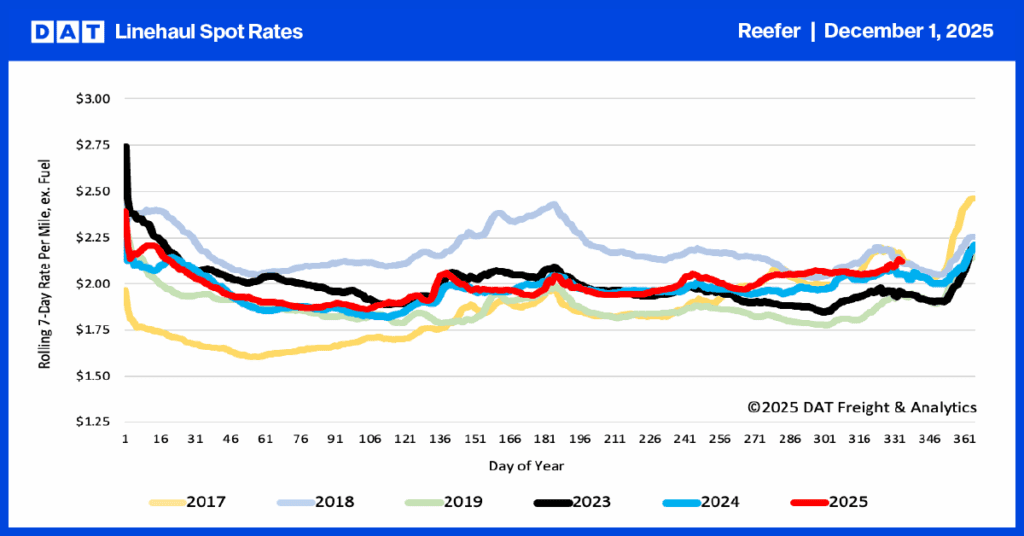

Spot Rates

Following last week’s $0.02/mile decrease, reefer linehaul spot market rates are $1.88/mile – $0.26/mile lower than last year and just $0.05/mile higher than in 2019. Even though the USDA reports 2% higher Fall produce volumes in Washington state, which accounted for around 10% of truckload volume, volumes in the cooler northern tier of the country are insufficient to impact national reefer demand.