The Hass Avocado Board shows total avocado volume in the U.S. market is on track to exceed 3 billion pounds in 2025 — a 4% increase from the previous year and reflects the fruit’s growing popularity and the strength of the avocado industry’s supply chain. In truckload terms, that’s almost 75,000 refrigerated loads that will cross the southern border this year with the heaviest avocado truckload volumes from Mexico entering the U.S. through two Texas crossings: Pharr (Hidalgo/Pharr–Reynosa International Bridge) and Laredo.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Pharr is consistently described as the top U.S. port for avocado imports and the premier “produce bridge” nationally. It handles thousands of 40,000-lb avocado loads each year, ranking first in the value of avocado imports at this crossing. Along with Laredo, the other primary gateway, these two Texas ports collectively manage over 90% of the truckloads of avocados imported from Mexico leading up to the Super Bowl.

Mexico is the world’s leading avocado producer, generating 30% of the global supply. Typically, 80–85% of their exports are shipped to the United States annually. USDA data indicates that the peak shipping period is usually in late January. At this time, McAllen typically processes approximately twice the volume of spot market reefer loads as compared to the nearby port of Laredo, making it a market to watch for reefer carriers in late January.

Reefer Market Conditions

Following the post-Thanksgiving catch-up, national load post volumes saw a 16% decrease last week. Despite this national trend, specific markets experienced capacity tightening. For example, brokers faced tight capacity in Fresno, where a 14% surge in load post volumes drove reefer rates up slightly, by a penny per mile, to $2.04. Capacity was also extremely tight on the southern border in Laredo. Load post volumes there spiked by 43% last week, pushing outbound spot rates significantly higher by $0.88 per mile to reach $2.66.

Last week’s national reefer load-to-truck ratio settled at 14.71.

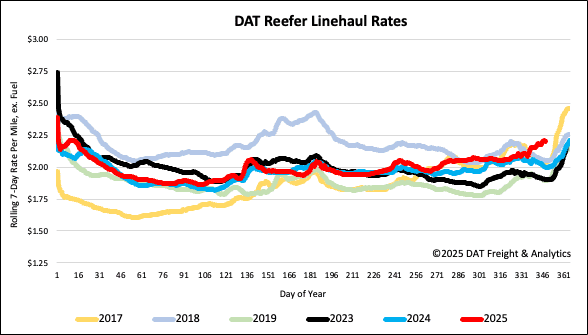

Reefer National Spot rates

The national 7-day rolling average spot rate rose by $0.03 per mile last week, reaching a national average of $2.21 per mile. This rate is significantly higher—roughly $0.20 per mile, or 10%—than reefer spot rates from the same period last year. Excluding the exceptionally high rates seen during the Pandemic years of 2020 and 2021, this is the highest Week 50 rate ever recorded.