Avocados From Mexico wants to make a touchdown on Sunday, February 11, 2024. The Super Bowl is the biggest occasion of the year for Avocados from Mexico, with peak-shipping season coinciding with the NFL end-of-season event in Las Vegas, NV. Over the course of a year, U.S. truckload carriers will move around 95,000 truckloads of avocados, with 97% crossing the southern border in Texas. The commercial zone crossing in Laredo accounts for 55% of the volume, followed by 42% in Pharr, TX.

According to the USDA, import volumes of avocados are tracking around 8% higher than last year. As is typically the case when the Super Bowl is held in the West, truckload volumes from Mexico tend to shift westward, crossing into the U.S. in Nogales, AZ, in the Tucson market and a day drive by truck to Las Vegas.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

According to Avocados From Mexico, the brand has almost doubled the volume of Mexican avocados imported to the U.S. in seven years to meet the growing demand. Today, 8 in 10 avocados in the U.S. come from Mexico, with a new record of almost 2.5B lbs of Mexican avocados imported to the U.S. in 2023. That’s the equivalent of almost 60,000 refrigerated truckloads!

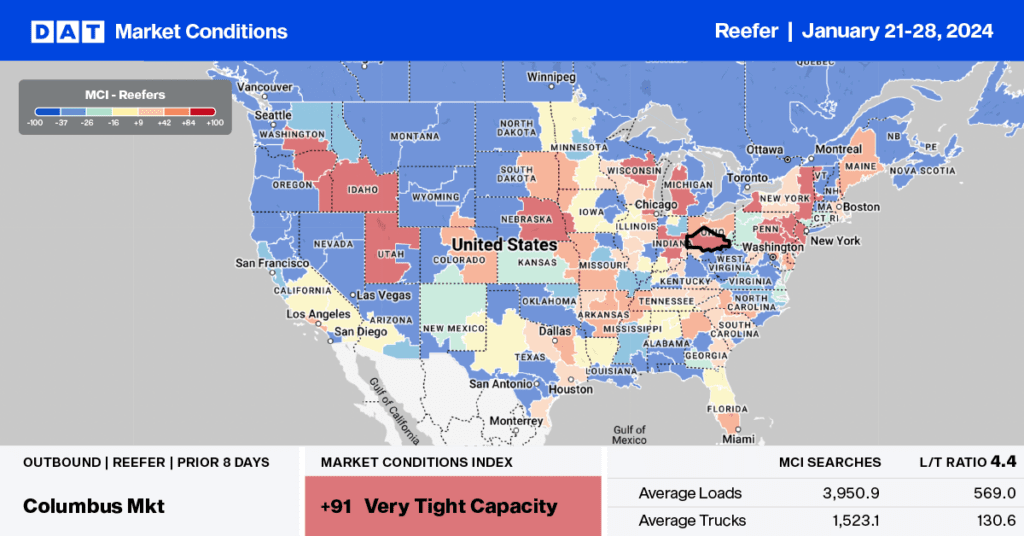

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

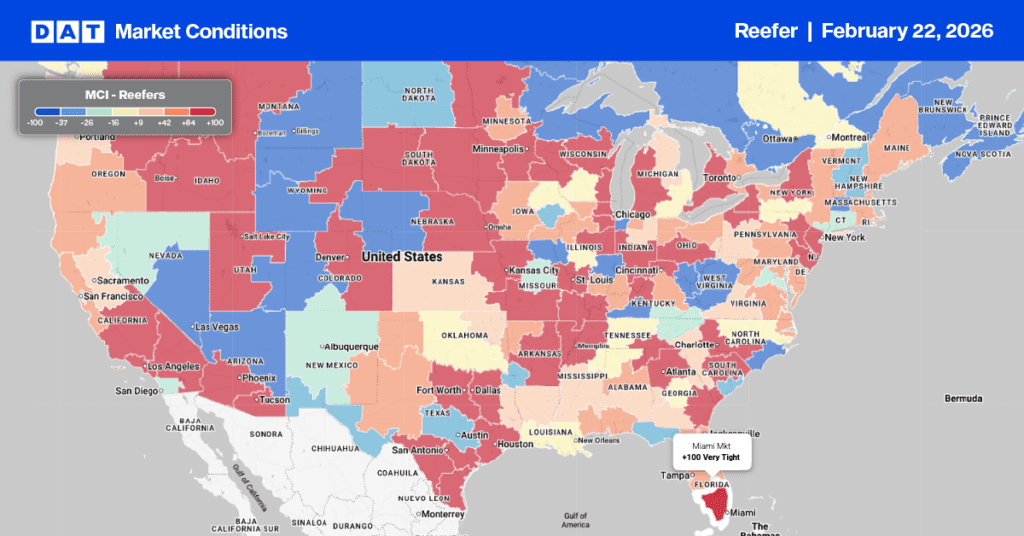

The Chicago market took the number one spot for load post (LP) volumes last week with a 3% market share, even though LP decreased by 25% following four weeks of solid gains. Available capacity remained tight – reefer line haul rates were up $0.07/mile to $2.57/mile for outbound loads. The volume of loads moved is around 2% lower than last year, while linehaul rates are close to 3% higher.

In rain-soaked California, there were areas where the USDA reported a shortage of trucks, pushing outbound spot rates in the Salinas-Watsonville market up by $0.14/mile to $2.28/mile last week. Regional loads to Los Angeles paid carriers $2.94/mile, the highest in 12 months, while long-haul loads north to Seattlenpaid $2.88/mile, almost $0.45/mile higher than last month.

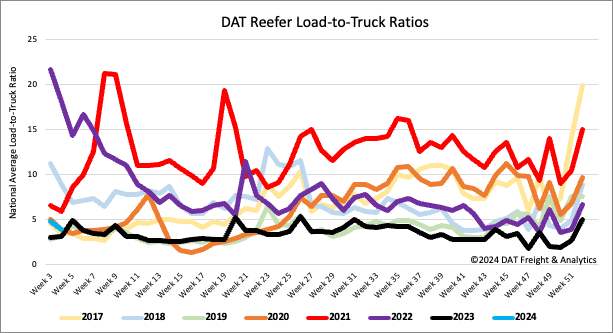

Load to Truck Ratio (LTR)

Following the surge in reefer load post (LP) volumes in the prior week due to the extreme cold, volumes erased those gains, dropping by 20% w/w. Equipment posts were mainly flat, resulting in last week’s reefer load-to-truck ratio (LTR) decreasing by 20% w/w to 3.85.

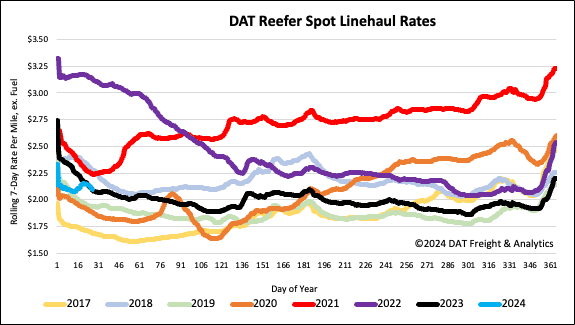

Spot rates

Although the national average reefer spot rate dropped $0.03/mile to $2.11/mile last week, there were pockets in the reefer market where trucks were in demand. According to USDA data on truck availability, there was a slight shortage of trucks in the Pacific Northwest for loads of onions, potatoes, and winter vegetables in four of the six produce regions in California following last week’s heavy rain. Reefer spot rates were $0.01/mile lower than last year, and compared to the start of 2020, when the market was oversupplied, linehaul rates were $0.15/mile higher last week.