Traditionally the impact on spot rates over the summer resulting from increased demand for fruit and vegetables is significant. In a typical year, reefer spot rates increase on average by $0.29/mile between mid-April and July 4. Last year that didn’t happen mainly due to the multi-year drought in California, resulting in national reefer rates increasing by only $0.02/mile. The 2023 produce season is shaping up much like last year as produce demand wavers as we head into the 100 days of summer between Memorial and Labor Day. According to the USDA, weekly truckload volumes are down by 12-14% compared to last year, and because 2022 was exactly a great year anyway, there’s cause for concern this season.

To gauge consumer demand for produce, two indices are worth tracking. The first is the Tindex from Technomics, which captures data for the foodservice sector, including consumer visit tracking and distributor sales information viewed as a leading indicator of the broader economy. The Tindex dates back to January 2019, and according to the latest release, the April reading of 105.5 represents a 0.6% decrease m/m, the third consecutive month of deceleration. The slide is driven by the full-service restaurants, where traffic and volume are down yearly.

The second index worth tracking is the Restaurant Performance Index (RPI) the National Restaurant Association (NRA) produced. The RPI, which measures the health of the U.S. restaurant industry, fell 0.8% in April due in large part to declining same-store sales and customer traffic readings. According to the NRA, “Although a majority of restaurant operators continued to report positive same-store sales, customer traffic levels declined in April. Looking ahead, restaurant operators remain cautiously optimistic about sales in the coming months, but their outlook for the overall economy is more pessimistic.” According to the foot traffic data compiled by Placer.ai, Dining foot traffic is down 5% y/y for the month of April and so far May data is following the same trend. Placer.ai tracks the foot traffic of numerous industries through anonymous location data from tens of millions of mobile devices.

All rates cited below exclude fuel surcharges unless otherwise noted

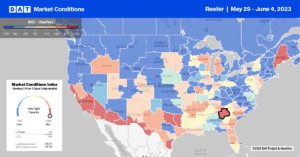

Our MCI index shows tightness along the entire southern border this week, with the USDA reporting a slight shortage of trucks in Nogales, AZ. Regional reefer linehaul rates are around $0.36/mile lower than the previous year at an average of $2.36/mile. Spot rates in the Tucson market were slightly higher at $2.47/mile, with reefer rates from Nogales to San Diego at $2.75/mile last week, almost the highest in a year and $0.27/mile higher than the previous month. Loads to Ontario at $2.61/mile are also the highest in 12 months. San Francisco outbound reefer rates at $2.16/mile increased by $0.02/mile last week, with loads from Salinas to Hunts Point, NY, also the highest in 12 months at $2.19/mile and forecast to peak at $2.26/mile later this month.

Capacity in Houston tightened last week, where spot rates jumped by $0.09/mile to $2.04/mile. Regional loads 350 miles to the east in New Orleans were flat at $3.36/mile, while loads north to Dallas are the highest in 12 months at $790/load or $3.28/mile. The USDA reported a slight shortage of trucks in parts of Florida last week, with outbound reefer rates in Jacksonville up by $0.04/mile to $2.52/mile. State-level rates in Florida continue to cool as the produce season winds down, dropping by $0.20/mile in the last three weeks to an average outbound rate of $2.13/mile.

Load to Truck Ratio (LTR)

Reefer volumes dropped by 11% w/w impacted by lagging produce volumes. According to the USDA, national produce volumes are 8% lower than last year, impacting overall reefer spot market volumes. Affected by severe weather at the start of the year, California volumes are down 42% y/y and the lowest since 2000, with the shortfall being picked up by Mexico, where produce imports are up by 15% y/y. Equipment posts were 15% lower last week, resulting in the reefer load-to-truck (LTR) increasing slightly from 3.73 to 3.89.

Spot Rates

Reefer linehaul rates were flat for the third week at a national average of $2.05/mile. This level’s reefer spot rates are just $0.11/mile higher than in 2019. Compared to the same time the previous year, spot rates are $0.33/mile lower than the last year.