On the cost side, staples like beef, coffee, eggs, and cocoa have risen sharply, with food costs up 21% over four years — outpacing broader wholesale inflation. Slim margins (3–5%) leave little room for error, and tariffs from President Trump’s trade war risk pushing prices higher still. Labor costs and shortages compound the strain, as many restaurants struggle to find qualified applicants and must consider raising wages to compete. Immigration crackdowns have also tightened the workforce.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

On the demand side, diners are eating out less, leading to one of the weakest six-month growth periods for restaurant and bar sales in a decade. Low-income households — already stressed by years of high inflation — are trading down to cheaper menu items or cooking at home, and now middle-income households are feeling the pinch too. Consumers are being more value-conscious, unwilling to accept higher prices unless they match perceived quality. Grocery shopping patterns echo this caution, with people buying smaller quantities, shifting to store brands, and skipping non-essentials. While some markets like New York City see robust restaurant traffic, much of the country faces depressed volumes and an increasingly cautious consumer base.

The National Restaurant Association’s Restaurant Performance Index (RPI), which is a monthly composite index that tracks the health of the U.S. restaurant industry, held relatively steady in June, as restaurant operators continued to report mixed sales and traffic results. Restaurant operators reported somewhat softer same-store sales in June, after a majority registered higher sales in May. Looking ahead, restaurant operators are cautiously optimistic about sales gains in the coming months. However, their outlook for the overall economy continues to lean negative.

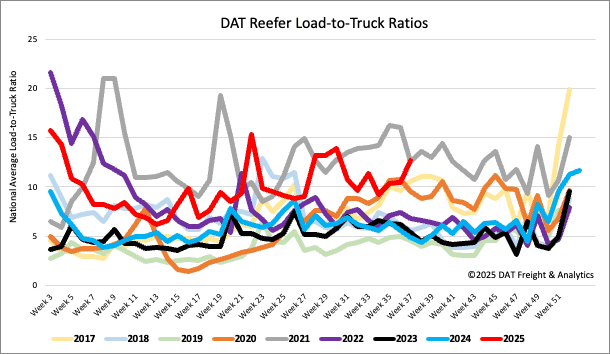

Load-to-Truck Ratio

Last week, reefer spot market volumes saw a significant increase, rising 19% week over week and an impressive 44% year over year. This surge in demand, combined with a 2% decrease in carrier equipment posts, led to a 22% increase in the reefer load-to-truck ratio, which now stands at 12.71.

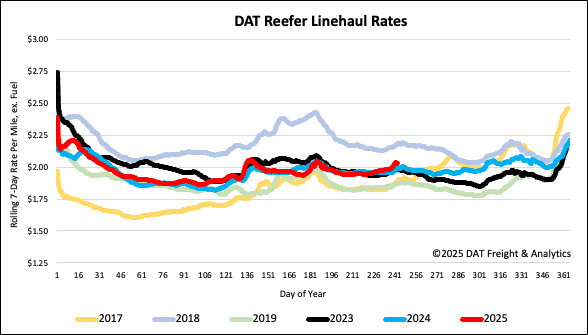

Spot rates

Labor Day weekend brought a notable tightening in reefer spot capacity, building on the previous week’s 3% rise in national load movements. This led to a $0.07 per mile increase in reefer rates, reaching just over $2.04 per mile—a figure $0.04 higher than both last year and 2023.