The U.S. blueberry picking season typically spans from June to mid-August, with regional variations. Southern states like Florida and Georgia begin harvesting as early as April, while California’s season can start in March and conclude by early summer.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

U.S. blueberry production is divided between wild (lowbush) and cultivated (highbush) varieties. Maine is the leading producer of wild blueberries, accounting for nearly all of the country’s wild crop. For cultivated blueberries, Michigan holds the top spot, closely followed by Oregon, Washington, and Georgia. Other significant producers include New Jersey, California, and North Carolina. The Pacific Northwest (Oregon & Washington) and the Northeast (Maine & New Jersey) are major blueberry-producing regions, with Michigan remaining the largest single source of cultivated berries.

North American (Canada, U.S., & Mexico) blueberry production has seen a 22% year-to-date decrease this season, according to the USDA. The U.S. blueberry production forecast for 2025 anticipates a slight dip from approximately 740.5 million pounds in 2024 to around 721 million pounds. This decline is attributed to several factors, including weather-related disruptions, particularly in the Southeast, as well as broader issues such as climate instability and biological threats like fungal outbreaks and invasive species that are impacting global yields.

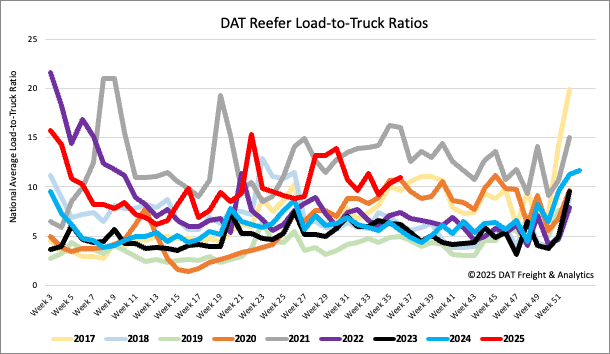

Load-to-Truck Ratio

Reefer spot market volumes remained flat last week, though they were 35% higher than last year and aligned with the Week 34 long-term average. Concurrently, carrier equipment posts decreased by 5% for the second consecutive week. This led to a 6% rise in the reefer load-to-truck ratio, which reached 10.91.

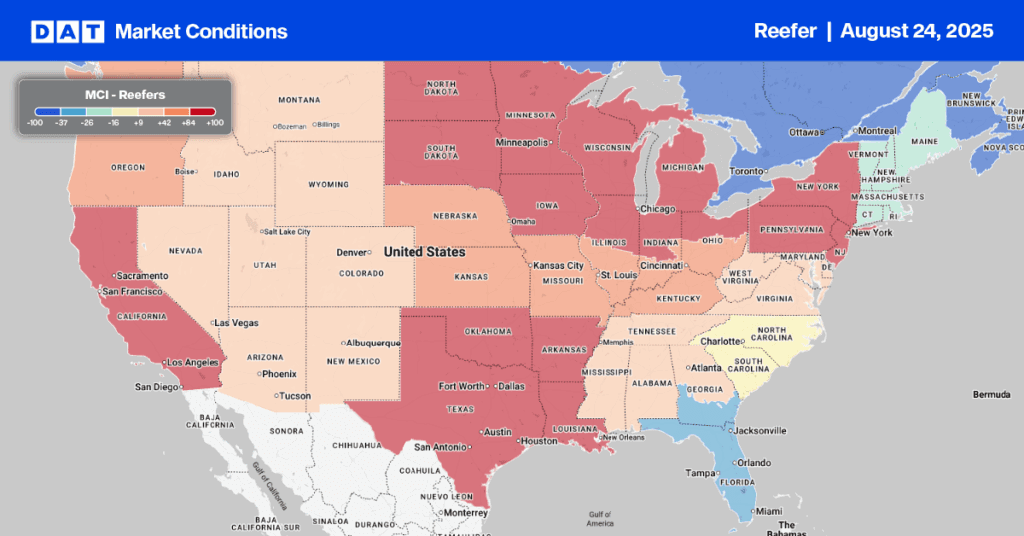

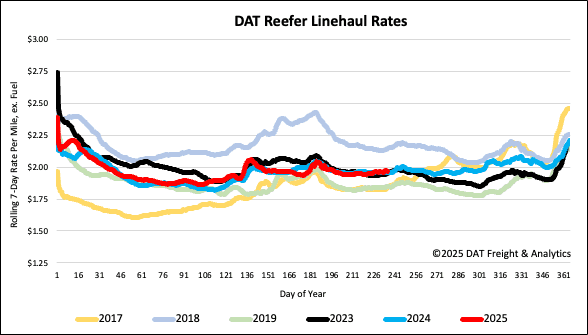

Spot rates

National reefer rates have remained stable for the second consecutive week, holding at just over $1.97 per mile—a figure nearly identical to both last year and 2023. This stability comes as late summer and early fall produce begins to affect capacity in the Pacific Northwest, where spot rates saw a $0.06/mile increase to $1.85 last week. The Spokane market experienced particularly tight outbound capacity, with rates rising by $0.09 per mile to $1.83/mile on a 3% increase in loads moved.