Agricultural imports are a crucial driver of year-round freight demand, especially for reefer and port-connected truckload carriers. Amidst trade uncertainties, these imports are particularly important for maintaining consistent freight volumes. Tariffs on U.S. agricultural imports are expected to have major impacts across the supply chain, and truckload carriers could feel the ripple effects in the second half of this year.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The U.S. imported $213 billion in agricultural products from 184 countries in 2024, with 70% being consumer-ready grocery items such as fruits, vegetables, and processed foods. Major suppliers include Mexico, Canada, and the EU, accounting for nearly two-thirds of imports. The top imported items are fruits, vegetables, coffee, and tropical products like bananas and pineapples, often driven by climate limitations, seasonality, and consumer demand.

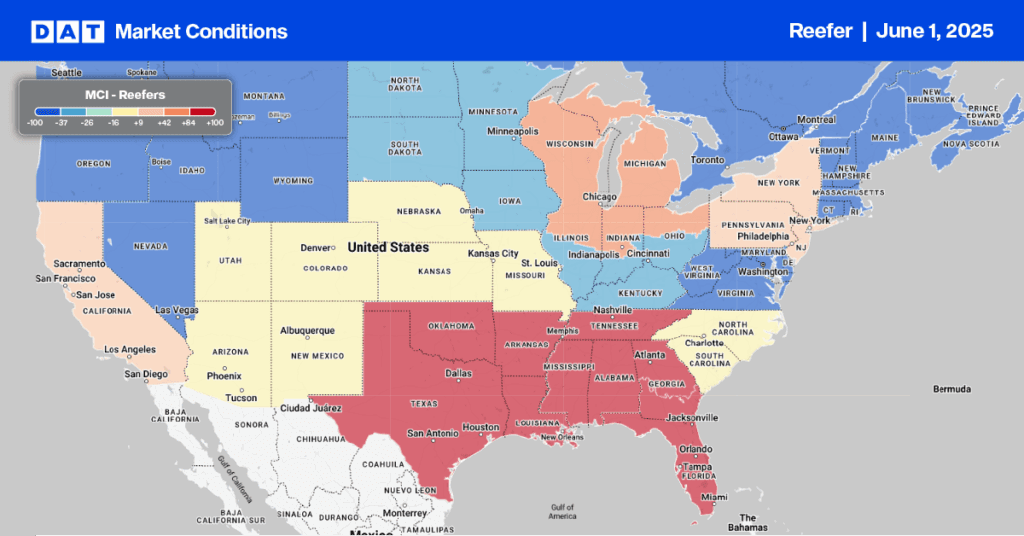

For truckload carriers, especially reefer or port freight, keeping an eye on trade policy is critical. Tariffs may look like a policy issue—but they hit your bottom line fast through freight volumes, pricing, and route demand. Some of the things DAT is watching include less freight to haul from ports and distribution centers, new port entry patterns and resulting changes in freight networks.

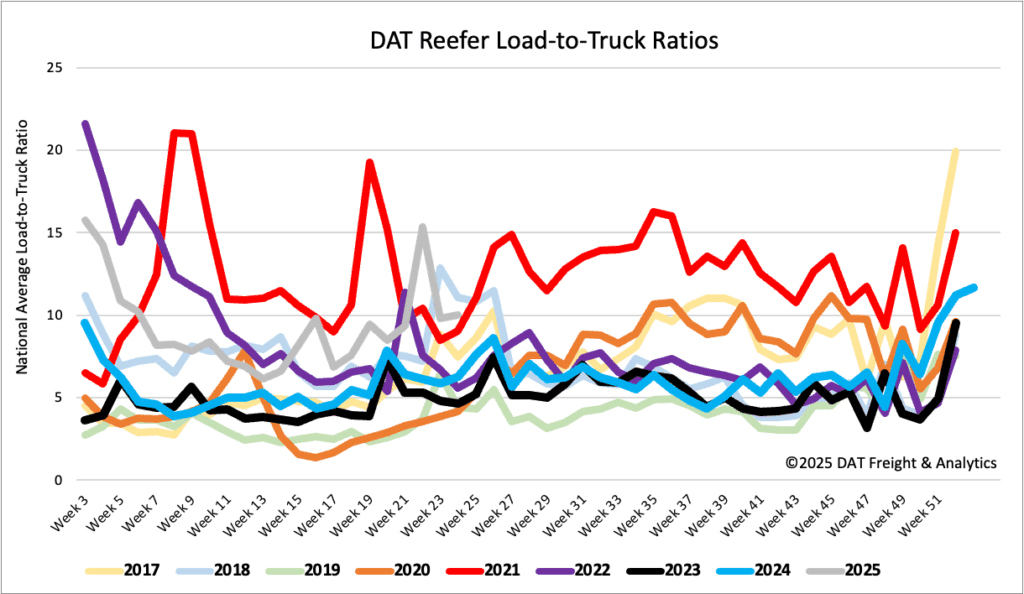

Load-to-Truck Ratio

Last week saw a 13% drop in reefer load posts; however, volumes remain 7% higher compared to the same period last year. Reefer equipment posts also declined, falling by 15% week-over-week. As a result of these shifts, the reefer load-to-truck ratio rose by 2% to 9.99.

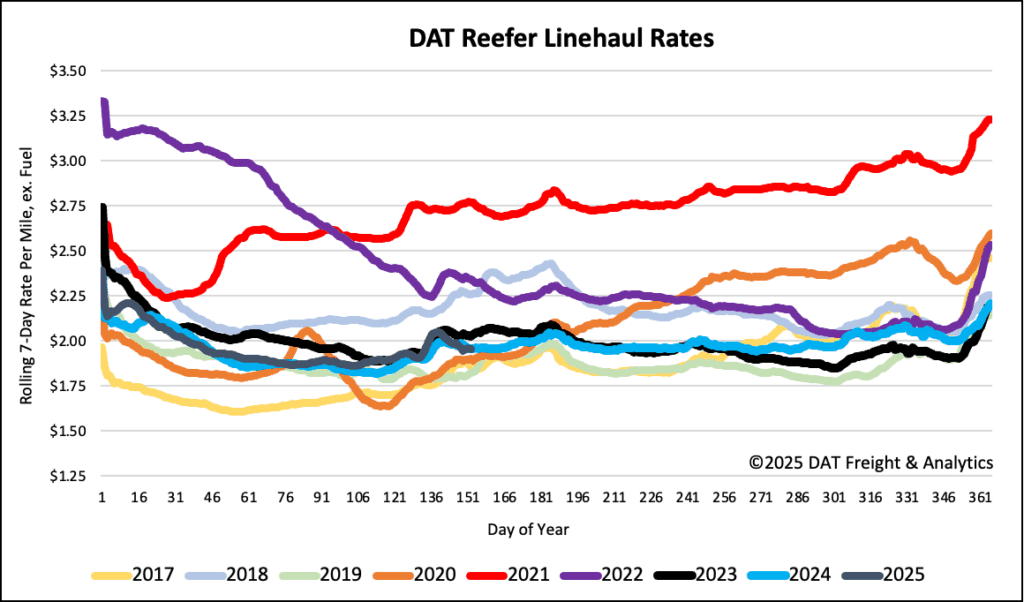

Spot rates

Reefer spot rates, typically on the rise before the July 4th holiday, have declined for the second consecutive week, decreasing by $0.05 per mile last week. Currently at $1.97 per mile, these rates are the same as last year but $0.07 per mile lower than in 2023.