The combined Ports of Los Angeles (LA) and Long Beach (LB) are typically the number one and three ports for total monthly import containerized volume, respectively. They’re also in the top five freight markets nationally, accounting for 4% of weekly truckload post (LP) volume. Around a third of imports arrive in Los Angeles monthly, with half coming from China alone. For most shippers, Los Angeles is the closest port to China in the transpacific trade lane and the most direct port of entry for imports east of the Mississippi.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

On the recent Journal of Commerce (JOC) Port Performance North America webinar, Mario Cordero, CEO of the Port of Long Beach, stated “that about two-thirds of imports end up east of the Mississippi.”. According to IHS Markit/PEIRS data, most of that volume ends up in Chicago. For refrigerated imports, which account for around 3% of total containerized imports in Los Angeles, just over half are destined for Illinois (53%), followed by Nebraska (24%). China accounts for just half of reefer imports in Los Angeles.

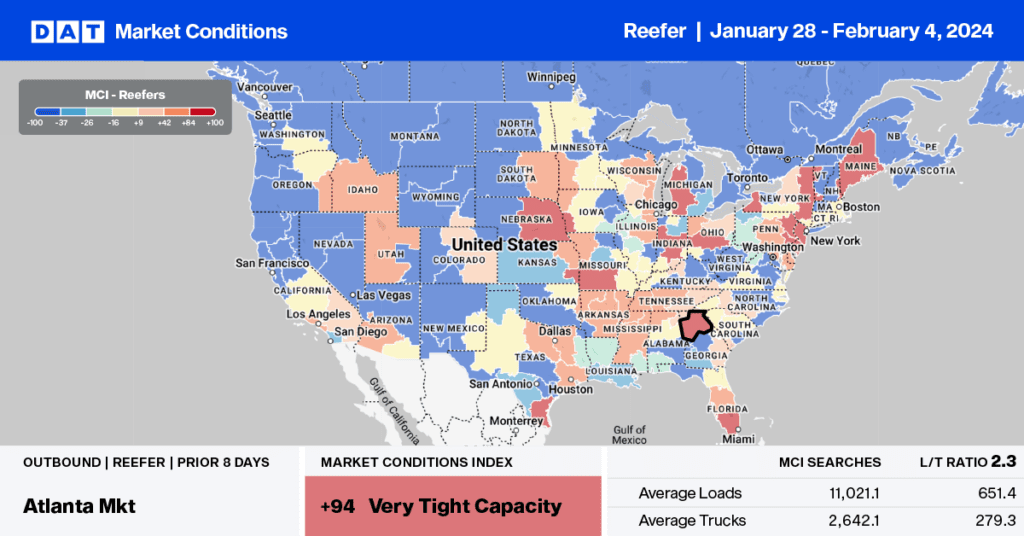

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

This week, the strawberry shipping season ramps up in the Winter Strawberry Capital of the World, centered around Plant City, FL. Even though most U.S. strawberry production comes from California (68%) and Mexico (21%) over the year, Florida and Mexico produce the bulk of the winter strawberry crop for U.S. consumers, according to the Florida Strawberry Growers Association.

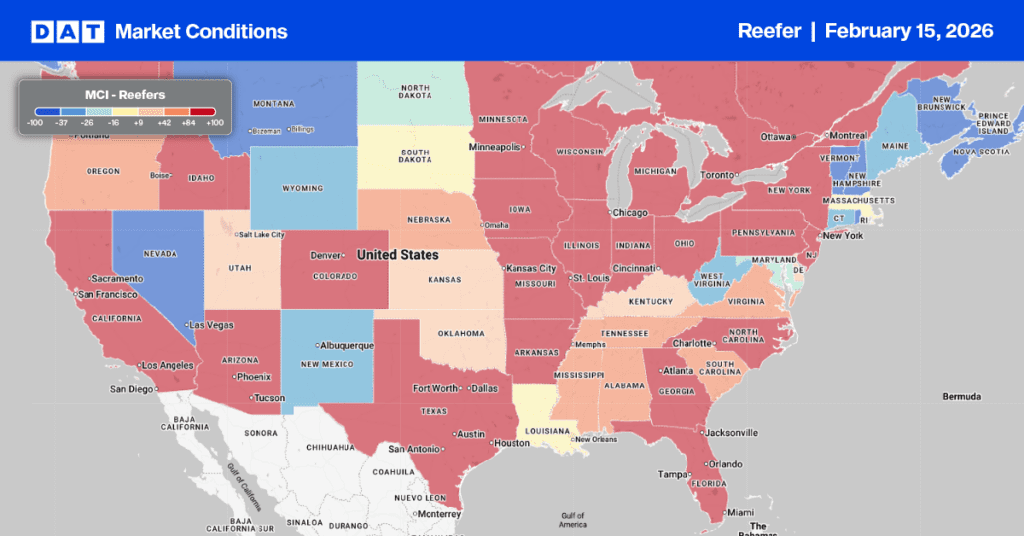

The Plant City Strawberry Festival is weeks away and marks the unofficial start of the U.S. domestic produce season this week as the Florida growing season for strawberries peaks between now and the end of March. For the first time this year, the USDA reported a shortage of reefer trucks in Florida, pushing up state-average rates by $0.08/mile to $1.46/mile. Compared to this time in prior years, outbound Florida reefer linehaul rates have the potential to increase by $0.20/mile in the next two weeks. Even though Florida produce volumes are trailing last year by 13%, strawberry truckload volumes were almost double last year, according to the USDA.

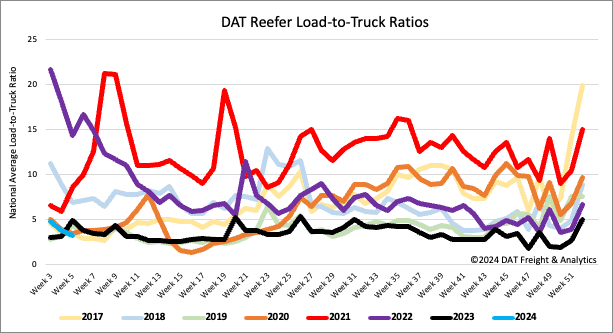

Load to Truck Ratio (LTR)

Reefer load post (LP) volumes cooled following last week’s 21% w/w decline. Volumes are around half what they were a year ago, impacted by lower truckloads of produce moving nationally, which were 18% lower than last year, according to the USDA. Carrier equipment posts were down 8%, resulting in last week’s reefer load-to-truck ratio (LTR) decreasing by 14% w/w to 3.21.

Spot rates

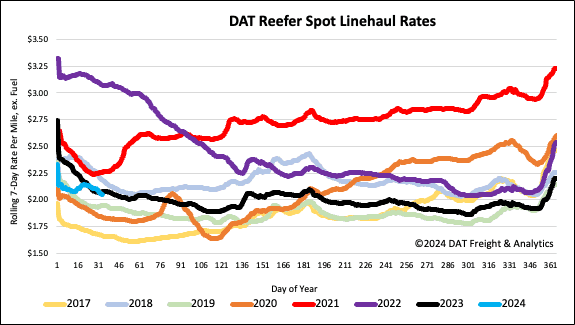

The decline in the national average reefer spot rate accelerated last week, dropping by $0.05/mile, wiping out almost all of the gains over the prior two weeks. At $2.07, reefer spot rates are $0.03/mile lower than last year, and compared to the start of 2020, when the market was oversupplied, linehaul rates were $0.21/mile higher last week.