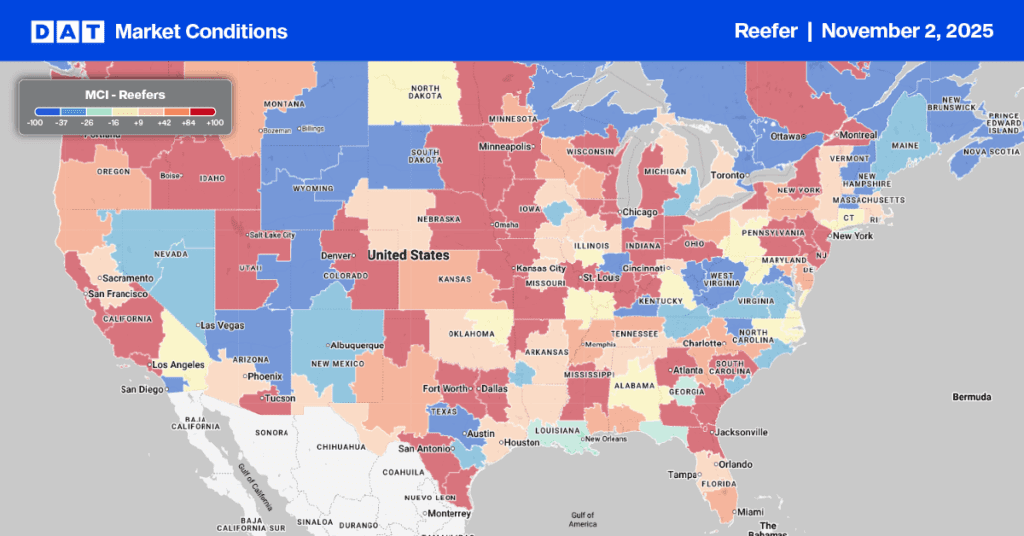

Ongoing supply chain disruptions are expected to impact this year’s Thanksgiving celebrations, with manufacturers facing a shortage of both ingredients and packaging to ship finished goods. On top of that, refrigerated truck capacity is as tight as it’s ever been. Shippers are paying record-high prices to move loads this season — even over $6.00/mile on some lanes!

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Refrigerated truckload volumes have already been strong in the top five turkey producing markets (North Carolina, Minnesota, Arkansas, Missouri and Indiana). Even though spot rates have been on the rise in these areas (up $0.03/mile to $3.45/mile this week — excluding fuel), recent news of some Thanksgiving-related categories having elevated and worsening out-of-stock rates has many on the edge of their seats.

According to IRI, a global leader in consumer data and analytics, product availability for several food categories look questionable this year, including:

- Whipped toppings

- Liquid gravy

- Frozen pie and pastry shells

- Refrigerated pies

- Bakery pies

Compared to the same time last year when in-stock rates were 1% to 9% lower than the recent two-month average, the most recent data shows in-stock rates are already 5% to 11% lower for the week ending October 19.

Among these challenged categories, liquid gravy had the lowest in-stock rates this week. It’s down 11% from last year and down 9% compared to the last two-months average availability.

One of the key findings of the IRI report is that shoppers should expect lower levels of promotions and an increased need for substitutions. According to the report’s press release:

“While some of these categories typically see high levels of promotion as the holidays approach, retailers will have less incentive to promote this year given the high demand and low in-stock rates. As a result of availability, lesser anticipated promotional levels and continuing inflation, shoppers may need to substitute items across key Thanksgiving categories (e.g., substituting fresh for frozen desserts) or try to find their favorite products at other stores.”

What does this mean for brokers and carriers?

For some, it will be more of the same characterized by unbalanced lanes as some commodities surge. while others fall away. There will also be more empty miles between loads and longer load/unload times as shippers struggle to staff warehouses and loading docks to meet seasonal demand.

For others, it could mean a different mix of temperature-controlled freight requiring different equipment types and product handling. The latter comes with a higher need for driver training to handle the different loads to haul.

Regardless, turkey producers — like everyone — have been hit hard by labor shortages resulting in the price of turkeys increasing by 68% over the last two years. Planning, communication and setting realistic expectations will be key to avoiding service failures and ensuring drivers get home for Thanksgiving this season.