Flatbed rates and load-to-truck ratios trended down last month. The average flatbed rate for October was $2.12 per mile, 3¢ lower than the September average. However, there a some bright spots as we start November.

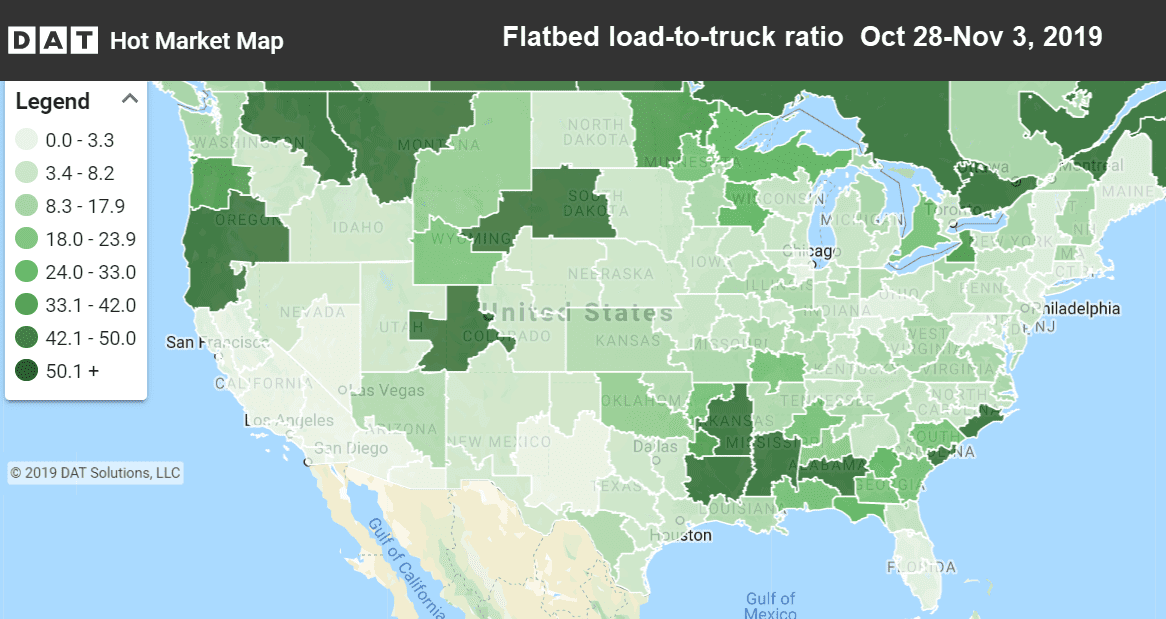

Christmas trees (and lumber) are beginning to move out of freight markets such as Spokane, WA, Missoula, MT, Rapid City, SD and Medford, OR, as you can see from the elevated load-to-truck ratios in the Hot Market Map below. Several East Coast port cites also posted higher volumes and rates last week as imports flow into the county.

Hot Market Maps in DAT Power and DAT RateView show where trucks are hardest to find. The darker the color, the less competition there is for truckload freight.

Rising Markets and Lanes

Flatbed load rates increased in several markets on the Atlantic Coast, including Baltimore, Savannah, GA, Wilmington, NC, Charleston, SC, and Jacksonville, FL. Rates coming out of Rock Island, IL also got a boost despite colder weather in the Midwest.

- Savannah, GA to Greer, SC (Greenville market) jumped 72¢ to $3.33/mi. after freight volumes doubled there

- Rock Island, IL to Indianapolis shot up 69¢ to $3.50/mi.

- Roanoke, VA to Cleveland recovered 34¢ to $2.43/mi.

- Jacksonville, FL to Miami rose 23¢ to $2.67/mi.

Falling Markets and Lanes

Both Dallas and Houston have seen lower flatbed activity and lower rates. Oil production has slowed in Texas and they’ve had to deal with adverse weather, including flooding in Houston and a tornado in Dallas.

- Houston to Wichita dropped 48¢ to $2.03/mi.

- Houston to New Orleans fell 28¢ to $2.37/mi.

- Raleigh to Miami plunged 58¢ to $2.34/mi.

Related: Retail freight helps boost van rates

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.