If it’s not bad enough that there’s a shortage of traditional Thanksgiving foods this year due to unprecedented supply chain disruptions, we’re now looking at a shortage of both real and artificial Christmas trees! On top of that, consumers can expect to pay more for either type this season.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The America Christmas Tree Association (ACTA) predicted an artificial tree shortage due to COVID-19-related delays in shipping and manufacturing. Some are stranded among the 530,000 shipping containers on the 75 cargo ships waiting to unload off the coast of Los Angeles.

Artificial Christmas tree retailers have also reported having to raise prices by 20-30% this season. Real trees are suffering much the same fate. Trees of all sizes have suffered and are compromised following record-high temperatures and droughts across the Pacific Northwest.

According to the ACTA:

“These price increases are the result of extreme weather events in the Pacific Northwest and Midwest, supply chain congestion in and out of ports, and shipping container shortages. The economic instability caused by COVID-19 and the impacts of extreme weather has affected all parts of the global and U.S. supply chain, and Christmas trees are no exception. These challenges mean that there will be fewer live and artificial Christmas trees available this year, and those that are available will cost more than before.”

When does peak-shipping season occur?

Next week signals the start of peak-shipping season for real Christmas trees. Afterall, everyone wants trees in shops and in parking lots the day after Thanksgiving.

The 2021 U.S. Capitol Christmas Tree, hauled by System Transport, has already begun its three week 4,000-mile journey from California to the White House. And pine trees are already being shipped for use in the manufacture of holiday decorations.

The majority of trees are produced in the Pacific Northwest (PNW), but North Carolina also provides a significant amount. Just six counties in Oregon and North Carolina account for just over half of the 25-30 million trees harvested nationwide. Oregon is the market leader in terms of production with 92% of trees exported out of the region, mostly to California.

The typical shipping season in the Pacific Northwest (PNW) begins in the first week of November with Christmas trees bound for Hawaii. This is followed by trees for the Midwest and the East Coast. The week before Thanksgiving is the busiest time of year by far, and that’s when the majority of loads move to Texas, then California and other Western states.

How will this impact truckload carriers and brokers?

The Christmas tree harvest coincides with peak season for fall produce, including potatoes, onions, pears and apples. This results in tight capacity and rate increases out of key markets like Oregon and North Carolina.

For carriers and brokers it’s a short shipping season characterized by remote loading locations involving helicopters, specialty trailers, and urban deliveries with multiple drops — not the easiest freight to haul. DAT brokers in the PNW inform us the shorter hauls to California can go in a dry van. However, anything to the Midwest or East Coast requires a reefer to protect the trees from both heat and freezing.

Most customers want ice blown over the top of the trees to keep them cold and prevent them from drying out, although there are customers who only want dry vans, even on such a long trip. They believe the air from the reefer unit dries the trees out and the chute for the air flow limits the number of trees that will fit in the trailer.

Weekly reports

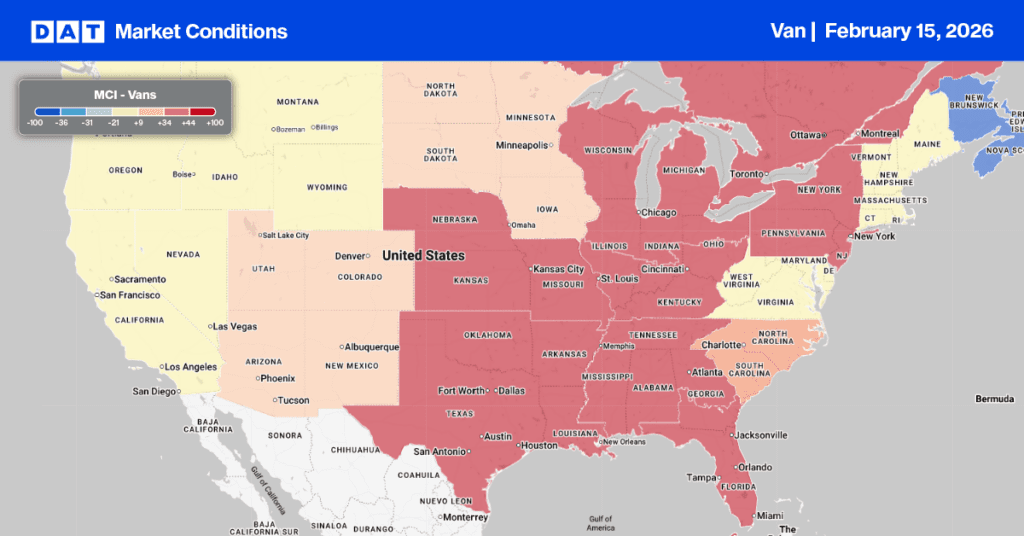

- Dry van

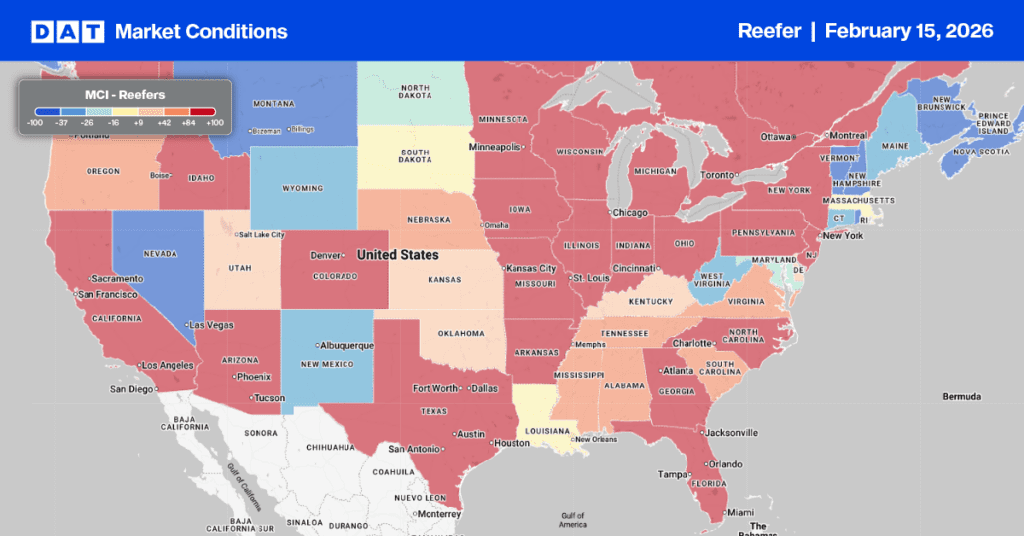

- Reefer

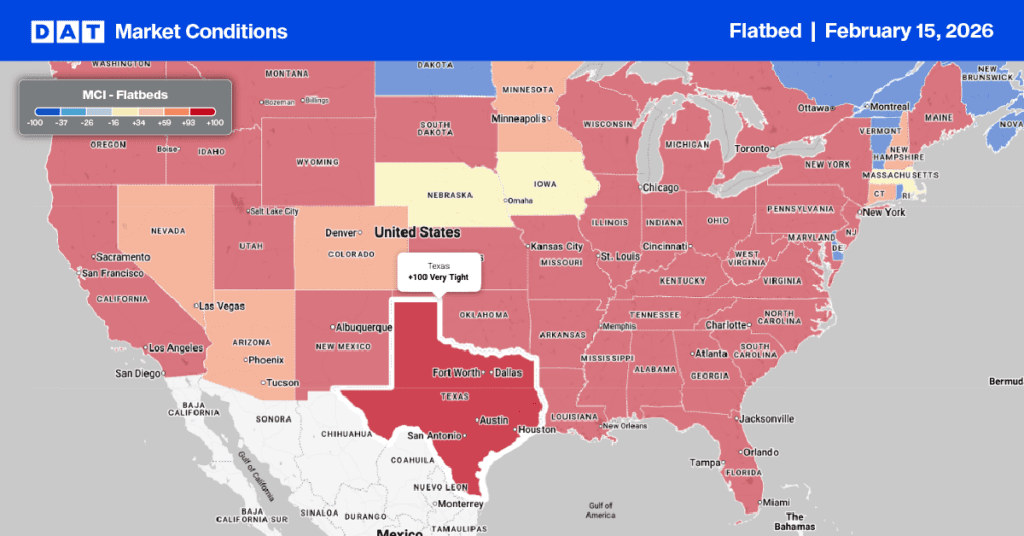

- Flatbed