According to Professor Jason Miller, a supply chain expert at Michigan State University, trucking companies need more good news as demand remains weak. The latest release of the for-hire trucking ton-mile and revenue indexes (TTMI), based on output across 41 freight-generating industries, showed February’s seasonally adjusted ton-mile reading jumped 1.5% from January’s low reading (which occurred due to the polar vortex) but remains down roughly 2% year-over-year (y/y).

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Miller’s analysis brings to light a crucial fact: despite the solid year-over-year gains in imports and robust retail trade sales, most for-hire trucking demand is driven by domestic manufacturing. Unfortunately, domestic manufacturing is experiencing a significant downturn that deeply impacts the trucking industry. Understanding why the strong import gains haven’t translated into stronger demand for trucking services is important. Miller said, “Imports don’t account for a significant portion of the freight we handle compared to what we manufacture domestically. This is a crucial point that many stock analysts, who focus on import-centric retail trade, seem to overlook.”

In a recent LinkedIn post, Miller summarized the current truckload market outlook as follows: “For the dry van truckload market to turn from bear to bull, we either need a much larger loss of capacity (unlikely to happen quickly) or for demand to improve substantially, which will require a sharp rebound in domestic manufacturing activity (also unlikely to happen quickly). As such, I would pencil in “blah” conditions for the immediate future.”

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

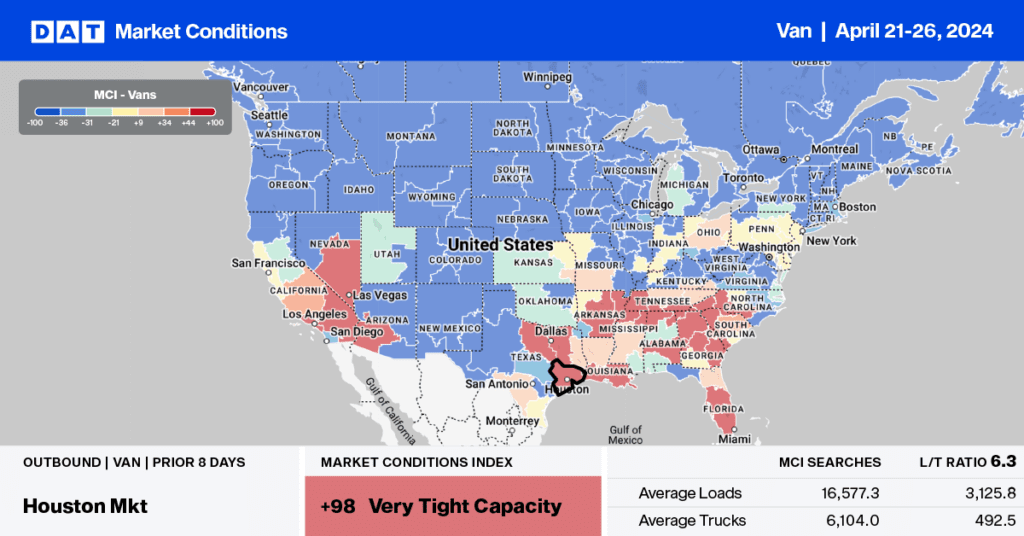

In the nation’s Top 5 dry van spot markets (Los Angeles, Dallas, Chicago, New Jersey, and Atlanta), the average linehaul rate decreased by $0.01/mile to $1.50/mile. Los Angeles showed strength at $1.65/mile on a 5% higher volume of loads moved last week, although state average outbound rates are almost identical to last year. The general trend of higher volumes and lower linehaul rates extended to Dallas/Ft Worth and Atlanta. At the same time, loads moved flattened in New Jersey, resulting in outbound linehaul rates dropping by $0.02/mile to $1.16/mile last week.

Savannah, the nation’s fourth-largest port for containerized imports, saw outbound linehaul rates jump by $0.08/mile to $1.65/mile last week, almost identical to 2019. On the number one lane to Atlanta, regional loads were paying $557/load last week on a 6% higher volume of loads moved, $26/load lower than last year. Available capacity was tighter on the 600-mile haul to Bowling Green, KY, where volumes were 7% lower last week, while linehaul rates increased to $1.21/mile.

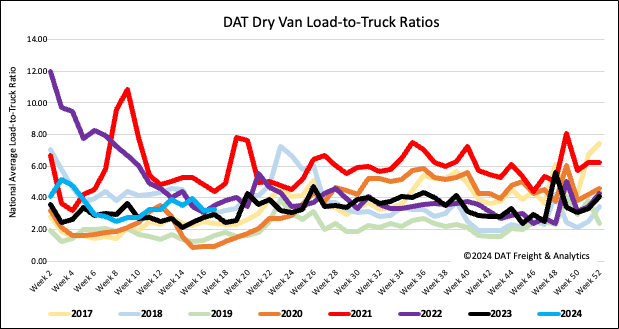

Load-to-Truck Ratio

Dry van load post volume was flat last week, tracking just over 17% lower than last year. Equipment posts reversed course, decreasing by 3% w/w, resulting in the dry van load-to-truck ratio increasing by 2% w/w to 3.25.

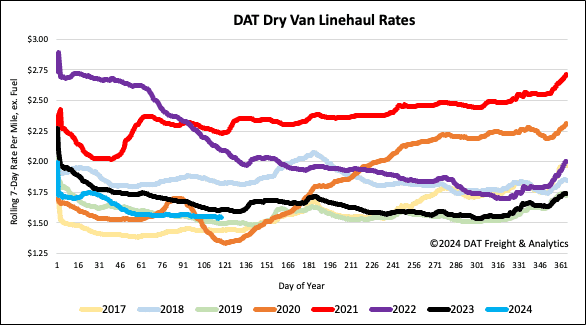

Linehaul spot rates

The national average dry van linehaul rate decreased by almost a penny per mile for the third week to just under $1.56/mile last week. Compared to last year, linehaul rates are $0.06/mile lower on a 9% higher volume of loads moved.