The Port of Baltimore’s six public marine terminals handle autos, roll-on/roll-off (RoRo), containers, forest products, and project cargo. The port also handles more RoRo farm and construction machinery than any other U.S. port. Baltimore’s proximity to the Midwest’s major farm and construction equipment manufacturers has helped it become the leading U.S. port for combines, tractors, hay balers, and importing excavators and backhoes.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

According to PIERS import data, Baltimore is ranked first for RoRo tonnage with 12.4% of the national total, followed by Vancouver with 7%. Baltimore import volumes were up 5.6% y/y at the end of 2023, totaling 1.8m tons, the highest since 2018. Automobiles accounted for 64% of the RoRo volume, but Construction Equipment, Cables, and Tractors accounted for 34% of the total RoRo tonnage. The latest data from PIERS will be helpful for specialized, flatbed carriers and brokers looking to take advantage of the annual peak in machinery imports, typically in March/April.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

In rain-soaked Los Angeles, the volume of loads moved dropped 17% last week while trucks were in short supply, driving up linehaul rates for outbound loads by 3% w/w to an average of $2.12/mile. Loads from Los Angeles to Phoenix paid carriers an average of $2.92/mile last week, the highest since July and $0.34/mile higher than February last year.

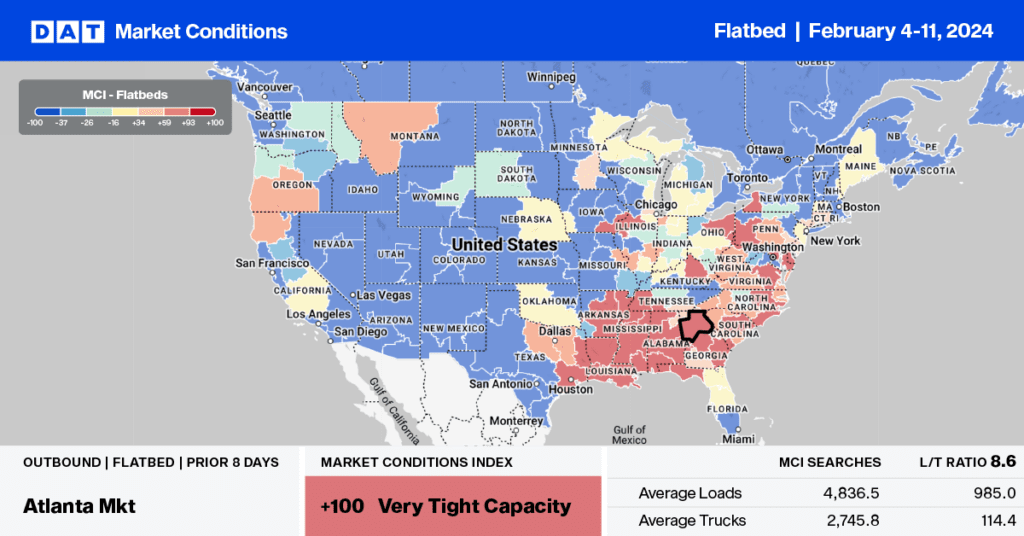

In the Pacific Northwest, flatbed capacity was tighter last week in Medford, where line haul rates increased by $0.22/mile to $2.36/mile following three weeks of decreasing rates. In the Southeast, in the two largest flatbed spot markets, linehaul rates in Birmingham and Montgomery decreased by $0.04/mile to a combined average of $2.16/mile last week. Loads from Birmingham to Lakeland paid carriers an average of $2.61/mile, almost $0.20/mile lower than last year.

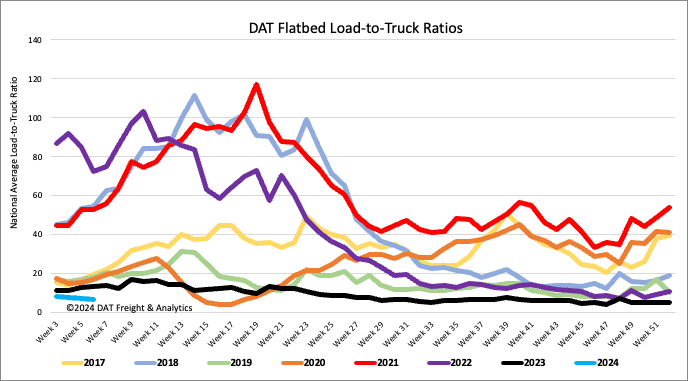

Load-to-Truck Ratio (LTR)

Flatbed load post (LP) volumes were the lowest in eight years following last week’s 7% decrease and 55% lower than last year. Carrier equipment posts (EP) were primarily flat, resulting in last week’s load-to-truck ratio decreasing by 8% to 6.91, the lowest flatbed LTR recorded since 2017.

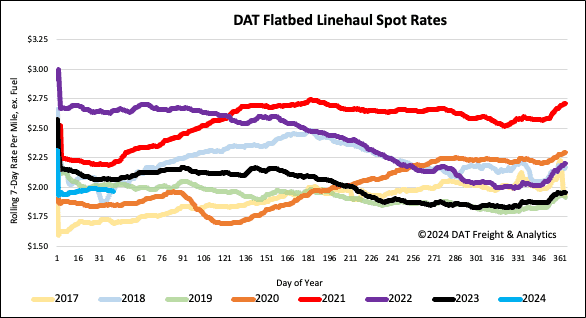

Spot rates

Flatbed spot rates decreased for the first time this year following last week’s $0.02/mile decline. At $1.99/mile, the national average is around $0.10/mile lower than last year, and the same as in 2018, a strong year for flatbed carriers.