Lumber prices have skyrocketed more than 300% since April 2020. This resulted in the average price of a new single-family home increasing by nearly $36,000, according to the National Association of Homebuilders (NAHB).

The latest NAHB Housing Market Index (HMI) for May 2021 reported 90% of builders experiencing shortages of appliances, framing lumber, plywood and oriented strand board, and 87% said there was a shortage of windows and doors. In contrast, when the HMI survey last covered the topic in June of 2020, fewer than 40% of builders reported a shortage of any of the listed products and materials.

The May survey included questions on the supply of 24 building materials and products and found appliances topped the list with 95% of builders reporting a shortage. Within that number 57% said there was a serious shortage.

Appliances made the list for the first time as the single highest shortage percentage recorded on any item since NAHB began collecting the information in the 1990s. For carriers, the logical outcome is reduced overall volume of building materials but potentially higher volumes of urgent freight having to move on the spot market.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

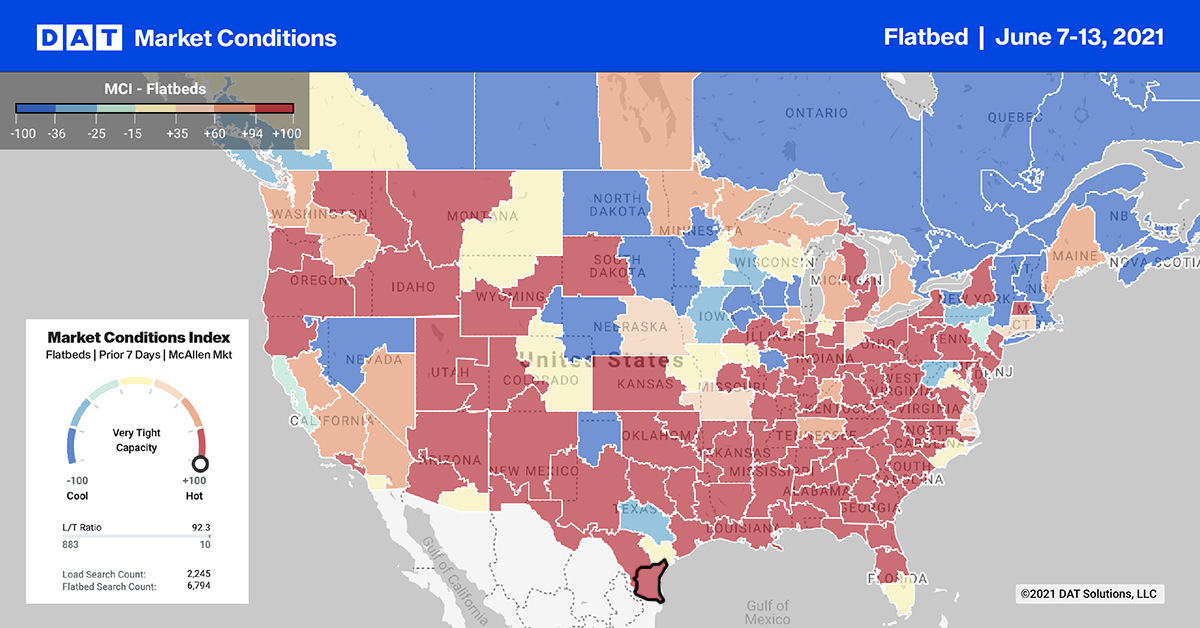

Flatbed capacity in the Top 10 markets eased slightly last week with spot rates dropping by an average of $0.03/mile to $3.64/mile even though volumes were up by 17%. Of the three equipment types, flatbed is by far the most volatile with wide fluctuations in capacity levels and spot rates each week.

Volumes were up 7% but rates spiked by $0.26/mile to $3.57/mile in Memphis, TN. In neighboring Little Rock, AR, volumes were down by 14% with spot rates dropping by $0.25/mile to $3.68/mile. Houston saw volumes were up 6% with rates also increasing by an average of $0.12/mile to $2.98/mile.

Spot rates

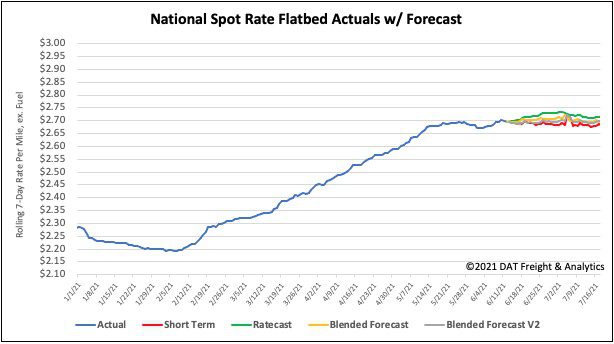

Flatbed spot rates continue to plateau with a slight increase last week of $0.01/mile to $2.70/mile. This is the fourth consecutive week where spot rates have been working in a tight $0.01/mile to $0.02/mile range — up one week, down the next. Flatbed rates are still $0.84/mile higher than the same week last year and $0.23/mile higher than the same time in 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models