The most recent data from the USDA highlights the damage the pandemic has had on domestic produce volumes. It’s averaging close to 8,000 fewer loads per week so far this year. Even though truckload produce volumes are down 23% this year, volumes have been steadily increasing since the start of the year and are now up 25% from the beginning of the year, which is great news for carriers and brokers.

May also sees increasingly higher domestic market volumes with the final month of the Florida winter/spring produce season. After that, Florida cools down until October when strawberry harvests begin.

According to the USDA, 58% of current Florida truckload volumes (approximately 660 truckloads per week) are tomatoes, which are followed by cabbage at 13%. Both peak in May then fall away until next season. Florida watermelon shipping also peaks in May. In 2020, just over half of the state’s watermelons (or about 12,300 truckloads) are shipped in May alone.

Find loads and trucks on the largest load board network in North America.

All rates exclude fuel unless otherwise noted.

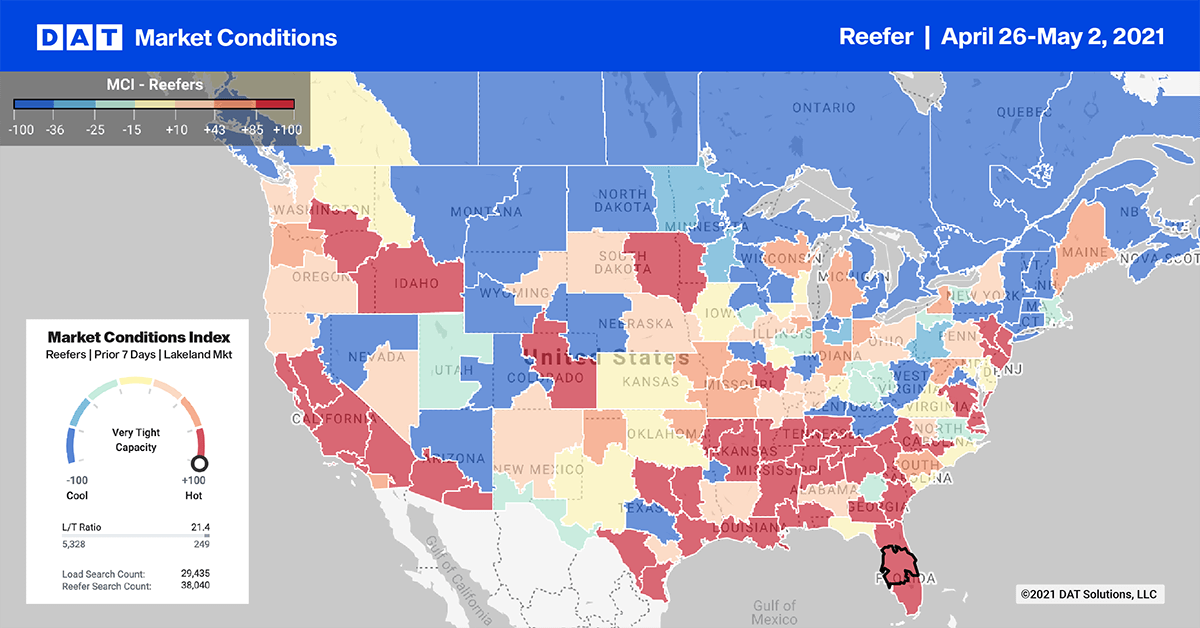

Produce markets dominated the Top 10 again last week, and reefer load post volumes increased by 6%. Spot rates also increased by $0.06/mile to an average of $2.71/mile.

- Miami was propelled by the lead up to Mother’s Day with volumes up 31%, which pushed spot rates higher by $0.25/mile to $2.73/mile on average.

- Lakeland, FL, was also buoyed by both Mother’s Day flowers and produce season, where volumes increased by 34%. Outbound rates from Lakeland also increased by $0.14/mile to an average of $2.35/mile.

- On the West Coast, there was little change in load volumes, although capacity tightened again last week. Los Angeles rates went up $0.07/mile to $3.41/mile, and Ontario, CA, rates increased $0.04/mile to $3.41/mile.

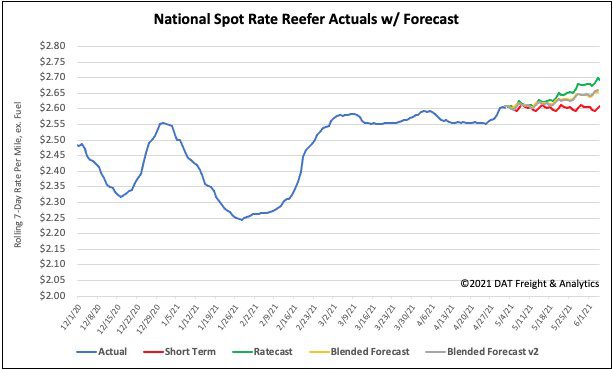

Spot rate forecast

Reefer spot rates increased last week with Mother’s Day flowers coinciding with produce season. Spot rates increased by $0.02/mile to end the week at $2.63/mile.

Compared to the same week in 2020 when rates were $1.69/mile, reefer spot rates are now $0.94/mile higher and $0.51/mile higher than this time in 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models

> Learn more about rate forecasts from DAT iQ