Even in the midst of winter when produce loading opportunities in most areas are on the decline, ports like Philadelphia and Wilmington, DE, are flush with imports (Chile, Peru, Guatemala, Central America, Brazil and the Caribbean).

Even Florida, which is often regarded as a backhaul market, offers some of the best opportunities for carriers this time of the year. Florida volumes are strong this time of the year. There’s a tremendous variety of produce for hauling in Florida including winter vegetables, tomatoes and strawberries. And with the short-haul ELD exemption increased to 150-miles, a lot of growers are taking advantage by adding multiple pickups and drops to each full load (without incurring any drive-time in the drivers log).

Find reefer loads and trucks on the largest on-demand freight marketplace in North America.

Reefer load post volumes in Philadelphia (No. 5) increased 22% w/w, but with plenty of capacity entering the market, rates dropped $0.08 to $2.57/mile (excluding fuel). Further north in Elizabeth, NJ, (No. 1) volumes increased 4% w/w, but rates also dropped $0.15/mile to $2.19/mile. The majority of outbound Elizabeth loads were destined for Atlanta, where capacity was tighter, pushing rates increased close to $0.20/mile to $2.44/mile.

On the West Coast, outbound load post volumes in Twin Falls, ID, (No. 2) increased 46% w/w, although rates declined $0.04/mile to $2.76/mile. Available capacity was much tighter further to the north in Seattle, where rates jumped $0.18/mile to $2.02/mile following a 63% w/w surge in outbound volume.

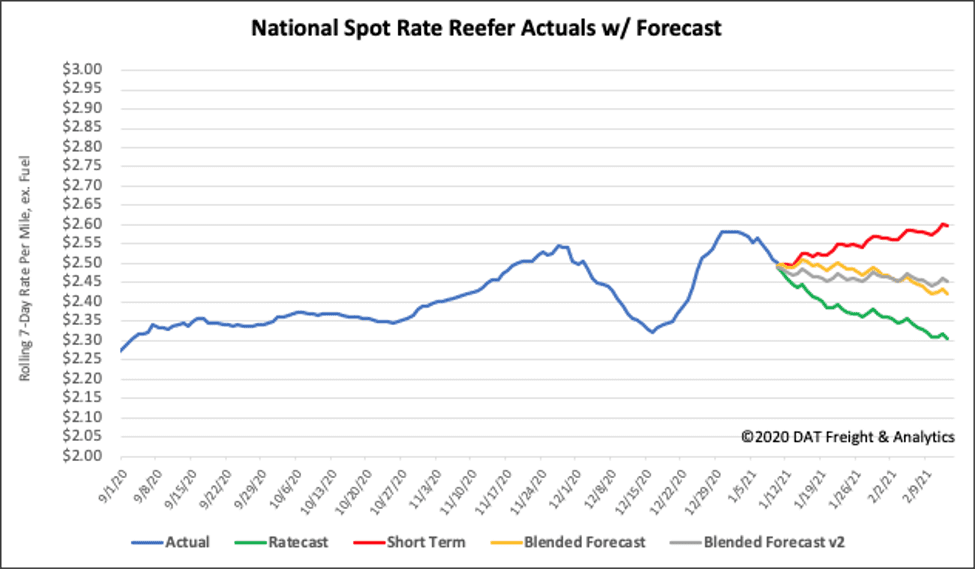

Spot rates

Spot rates in the reefer sector dropped $0.05/mile to $2.50/mile last week, which is $0.52/mile higher than the same week in 2020 when rates were $1.98/mile.

How to interpret the rate forecast

- Ratecast Prediction: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset.

- Blended Scenario: More heavily weighted towards the longer-term models.

- Blended Scenario v2: More heavily weighted towards the shorter-term models.