By Christina Ellington, DAT iQ

The Georgia peach season has begun, according to Georgia’s oldest operating peach packinghouse Dickey’s farms, and the latest USDA crop report. The Georgia Peach festival welcomes the start of the peach season on June 3rd. The festival attracts over 10,000 visitors in the week-long festival. The festival’s main highlight is the World’s Largest Peach Cobbler, which everyone can enjoy.

Georgia ranks third in the nation in the annual production of peaches, with more than 15,000 acres and more than 1.7 million bushels of peaches annually. Georgia’s peach industry is concentrated in Peach, Crawford, Taylor, and Macon counties.

The largest peach-producing states in the U.S. are California, South Carolina, and Georgia. The peach season typically starts in April and lasts through September. According to the Packer, the peach season in South Carolina has also begun. Ginny Gohagan, marketing program specialist for the South Carolina Department of Agriculture, said, “After the freeze event we had in March, volume in May is expected to be a little lighter than normal. We should be back up to normal production volume in June and throughout the rest of the summer and into the end of the season in September.”

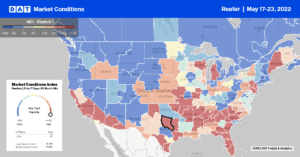

According to the USDA, truck capacity was tight in two produce regions last week, Eastern North Carolina (sweet potatoes) and Central and Southern Florida (vegetables). In addition, a slight shortage was reported in the San Luis Valley in Colorado (potatoes), Georgia (onions), and Michigan (potatoes). Outbound reefer load posts are increasing out of the Columbia, SC market and are up 3.35% w/w. Load posts in the Raleigh, NC market are up 14.82% w/w as of May 14th.

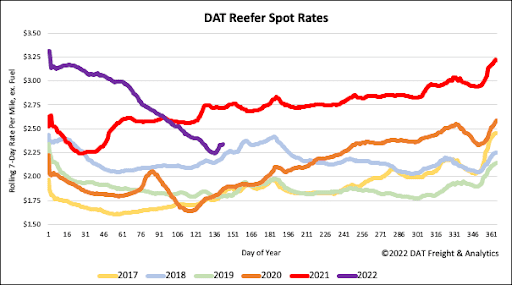

All rates cited below exclude fuel surcharges unless otherwise noted.

With peach volumes yet to return to normal for this time of the year, growers found plenty of reefer capacity last week, pushing down reefer spot rates by $0.37/mile to $4.47/mile after jumping by $0.84/mile the week prior. Loads south from the Macon market to Orlando are currently at $4.04/mile or about $0.10/mile lower than the previous year. In contrast, capacity tightened for loads 900-miles north to Elizabeth, NJ, where spot rates are close to $1.00/mile higher than the April average at $2.89/mile this week. Ratecast is forecasting reefer rates on this lane to peak around $3.14/mile around Independence Day.

After dropping for the previous three weeks, reefer capacity tightened last week in Fresno, pushing up spot rates by $0.18/mile to an outbound average of $2.35/mile. On the 3,000-mile lane to Hunts Point, NY, spot rates have been steadily increasing for the last eight weeks and are now $0.33/mile lower than the previous year at $2.54/mile. Loads east to Atlanta are also up this week, averaging $2.38/mile but also $0.15/mile lower than the previous year. Loads from Fresno to Phoenix also increased and are $0.15/mile lower than the last year averaging $2.98/mile this week. Seattle loads out of Fresno are averaging $3.38/mile this week or around $0.45/mile lower than the previous year.

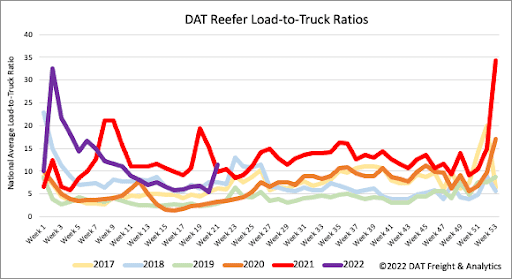

Reefer carriers typically take more time off during International Roadcheck Week than their flatbed and dry van counterparts. Equipment post volumes predictably dropped by 18% last week, while load post volumes surged ahead of next week’s Memorial Day long weekend, the official start of the 2022 grilling season, which runs through to Labor Day. As a result, the reefer load-to-truck (LTR) ratio more than doubled from 5.4 to 11.5.

It’s not unusual to see reefer rates heat up this time of the year following last week’s $0.08/mile jump in reefer linehaul spot rates. Rather than being demand-driven as we’d expect during produce season, spot rates were up last week due to far more reefer carriers taking time off last week than in previous Roadcheck Weeks. With the last week’s national average at $2.35/mile excl. FSC, reefer rates are still $0.38/mile lower than the previous year and $0.13/mile higher than in 2018, when a similar number of carriers took time off during Roadcheck Week that year.