A popular saying in the commodity market is, “high prices cure high prices.” When prices rise, producers are willing to produce and sell more to maximize profits. This leads to higher supply, which will eventually reduce prices.

On a recent Odd Lots podcast, Stinson Dean, CEO and Founder of lumber trading firm Deacon Trading, echoed the saying in response to the soaring lumber prices.

After a year of record lumber prices due to the housing boom and month-over-month growth in residential construction, single-family housing dropped more than 13% in April. Single-family building permits dropped 4% in April. These lead housing starts by 1-2 months and are a good indicator of future flatbed demand. New permits are also down 10% since the 12-month high recorded in January this year.

April’s sharp decrease in home starts and building permits is a result of builders slowing production in order to deal with skyrocketing commodity prices and shortages of land and labor.

“The decline in single-family permits indicates that builders are slowing construction activity as costs rise,” says Robert Dietz, Chief Economist of the National Association of Home Builders. “While housing starts were strong at the beginning of the year, due to home builders constructing homes that were sold pre-construction, higher costs and limited availability of building materials have now paused some projects.”

The U.S. still built 408,000 more single-family homes in April compared to April last year. So while demand remains strong in the flatbed sector, April’s numbers suggest there may be some headwinds down the road.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

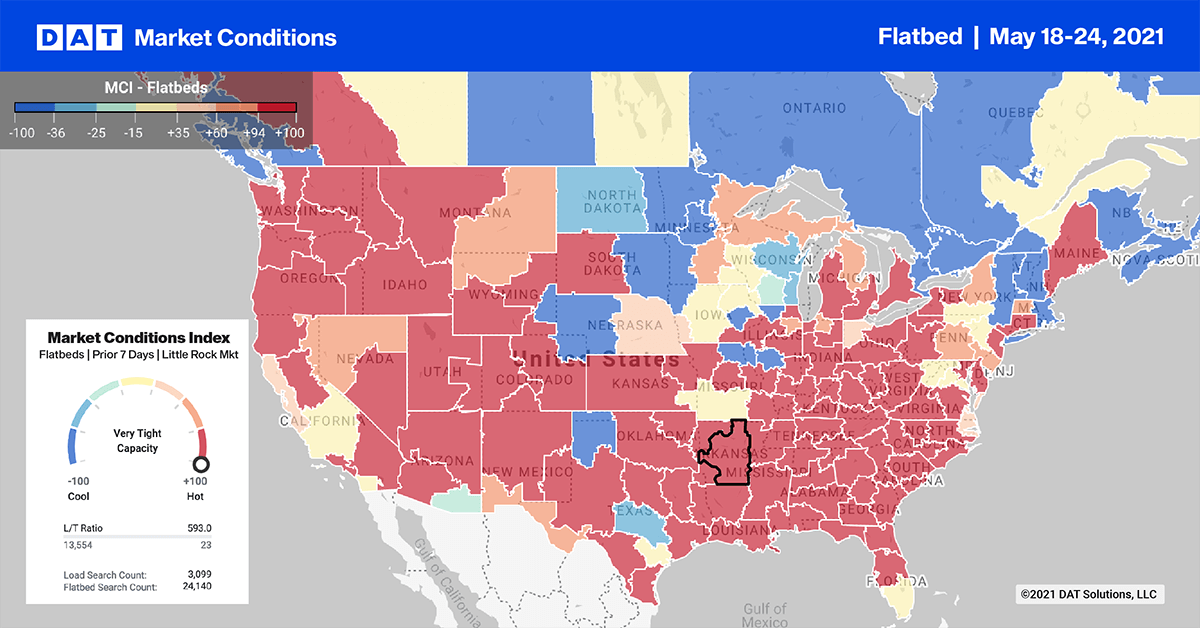

Flatbed rates in the Top 10 markets increased by $0.03/mile last week to an average outbound rate of $3.54/mile. Volumes increased slightly, moving up by 3%.

But of the three equipment types, flatbed seems to be the most affected by the I-40 bridge closure in Memphis. Outbound load post volumes in Memphis plunged 23% last week. However, outbound rates spiked, increasing by $0.21/mile to an average of $3.71/mile.

Next door in Decatur, there was a similar effect. Volumes were down 10% while rates surged, increasing by $0.23/mile to $3.96/mile.

Spot rates

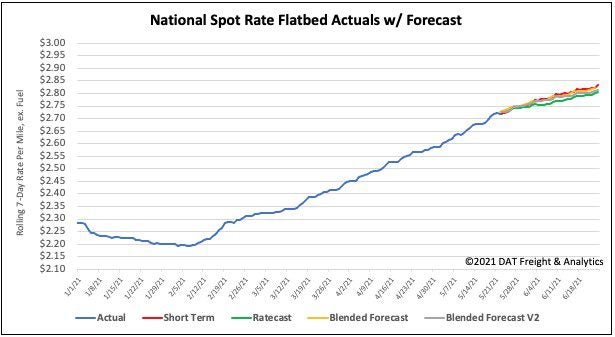

Up until last week, flatbed spot rates had been on the rise for 105 days. The rise began on Feb 9 when they were at $2.20/mile. Last week was the first week this year flatbed weekly spot rates remain unchanged at $2.74/mile. Flatbed rates are now $0.98/mile higher than the same week last year and $0.28/mile higher than the same time in 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models