Trucks to haul sweet potatoes are in short supply in the Eastern North Carolina region this week, according to the USDA. When combined with increased truckload demand for fresh turkeys ahead of Thanksgiving, NC, shippers are caught in a tough place this week.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

Reefer spot rates out of the Raleigh, NC market — home to Johnson County where most sweet potatoes are grown — have already increased $0.18/mile last week to an average outbound rate of $2.78/mile.

Reefer loads from Selma, NC to Boston are up $0.25/mile compared to last year to an average of $3.65/mile. Loads south to Orlando are slightly less at $3.57/mile. Loads north to Hunts Point, NY are averaging $4.63/mile this week, which is almost $1.03/mile higher than the same week last year.

North Carolina accounts for 66% of annual sweet potato volume followed by Mississippi (15%) and California (13%). The current harvest is later than usual with potatoes “not sizing up as quickly” due to weather factors.

North Carolina ships 81% of their annual volume between November and August each year, with November being the highest volume month at 2,213 truckloads last year.

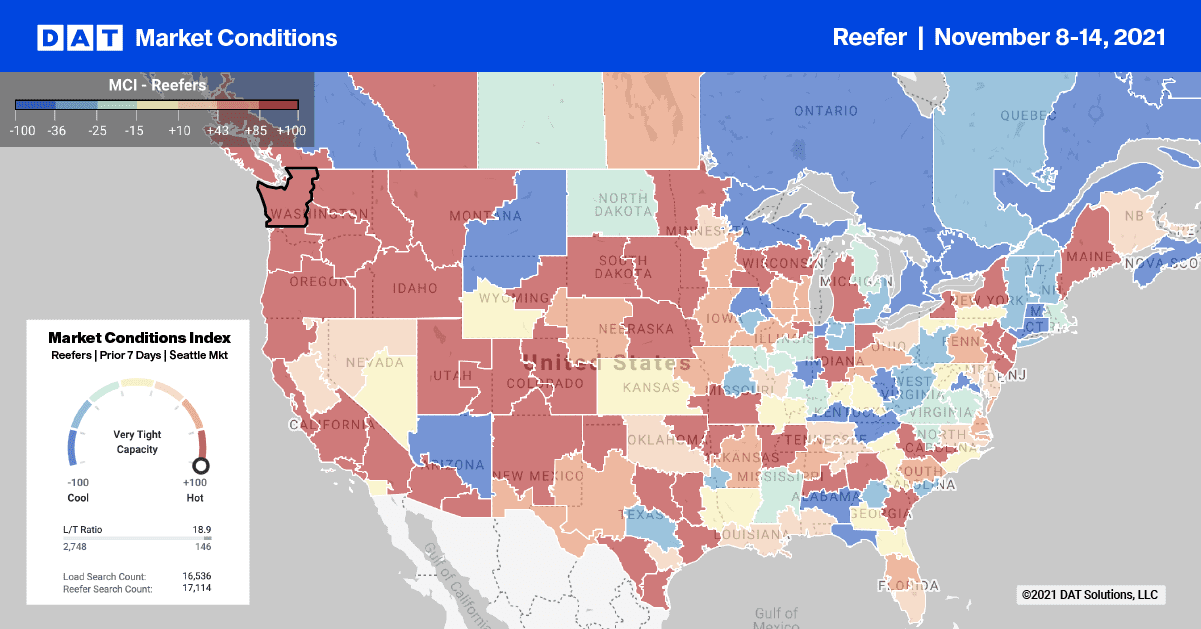

Capacity is also tight on the other coast

The intersection of fall produce and Christmas Tree season is keeping reefer capacity tight in the Pacific Northwest.

In Twin Falls, ID, reefer spot rates were up $0.27/mile last week to an outbound average of $2.61/mile. In fact, capacity was tight in the entire Pacific Northwest region including Pendleton, Spokane, Medford, Portland and Seattle freight markets.

Spot rates were up $0.09/mile to an average of $3.16/mile last week. Spot rates from Seattle to Stockton and Los Angeles are up $0.85/mile compared to last year to $2.39/mile this week. Loads from Seattle to Dallas hit a 12-month high of $3.18/mile, which is just over $1.00/mile higher compared to the same time last year.

Spot rates

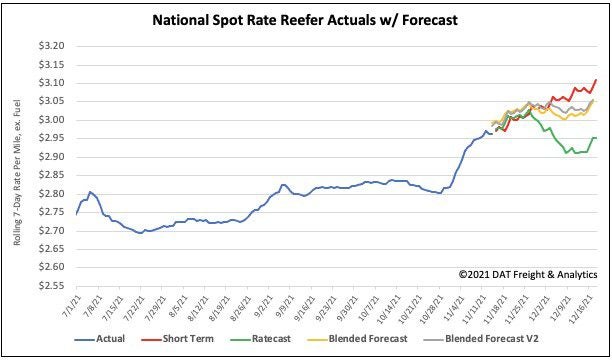

The reefer spot rate ended last week where it started at a national average of $2.96/mile, which is 17% or $0.51/mile higher than this time last year.

Of our Top 70 lanes (for loads moved), spot rates:

- Increased on 36 lanes (compared to 29 the week prior)

- Remained neutral on 23 lanes (compared to 24)

- Decreased on 13 lanes (compared to 19)

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models