The substantial development of new warehouses along our interstates has been hard to miss in the last two years. Newmark has conducted a report that explores factors driving accelerated sector growth and quantifies key metrics for top U.S. cold storage markets experiencing expansion. According to Newmark, national cold storage development hit an all-time high of 9.8 million square feet (an estimated 216.2 million cubic feet) by the end of 2022, driven by a proliferation of users and operators as the sector grows and evolves. The number of cold storage establishments grew 8.6% from 2020 to 2021 and an additional 7.5% from 2021 to the first half of 2022, eclipsing the annual average of 2.2% observed from 2013 to 2020.

Primary demand drivers of this recent momentum in growth include:

- Acceleration of food and grocery e-commerce and supportive last-mile operations, particularly in fast-growing Sunbelt metros. Many consumers pivoted to online grocery shopping and meal services during the initial phases of the pandemic and are now accustomed to the convenience.

- Industry consolidation. Lineage Logistics, Americold, and others increased their share of the U.S. cold storage market through mergers, acquisitions, and development to support their top clients’ robust demand for cold storage space. Lineage Logistics and Americold accounted for 71.0% of the storage capacity of the top 25 markets in 2022, compared to 61.0% in 2019. Third-party logistics companies increasingly enter this segment, providing additive and complimentary fulfillment and logistics services.

- Aging inventory. The average age of cold storage facilities in the top U.S. markets is 37 years, presenting challenges due to inefficient systems that generate higher operating costs and increased risk for product spoilage. Demand for modern functional space has driven the need for new development supporting supply chain optimization, adoption of warehouse automation, and energy cost reduction.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted

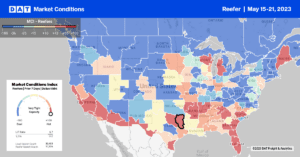

The combination of surging spot market volumes and the capacity crunch resulting from the International Roadcheck 72- safety blitz last week sent spot rates climbing in most reefer markets last week. As produce season cools in Florida following the Mother’s Day shipping surge, reefer linehaul rates dropped by $0.15/mile the previous week to $2.06/mile, while further north in Georgia markets where produce season is underway, rates increased by $0.17/mile w/w to $2.27/mile. In McAllen, TX, where most imported produce crosses the border, rates increased by $0.01/mile w/w to $2.18/mile.

On the West Coast in Fresno, linehaul rates increased by just over 13$ last week to an outbound average of $2.13/mile, up $0.25/mile in the last week and $0.42/mile in the previous month. Loads from Fresno to Hunts Point, NY, are the highest in 12 months at $2.42/mile. Reefer capacity was also tight in Ontario, where rates increased by $0.28/mile to $2.34/mile.

Load to Truck Ratio (LTR)

A slight shortage of reefer trucks was reported in all six growing regions in California and Eastern North Carolina again last week by the USDA as produce season volumes start to climb. Even though national volumes are still around 14% lower than the previous year due to the later start to the season (due to adverse weather in California), truckload volumes have increased by just over 14% since the beginning of March.

Reefer spot market volumes surged last week, rising by 60% w/w and are just 17% lower than the previous year. As is always the case, reefer carriers take more time off during International Roadcheck Week than their dry van and flatbed counterparts. Carrier equipment posts dropped 19% w/w, almost doubling the reefer load-to-truck (LTR) from 2.73 to 5.40, identical to last year.

Spot Rates

Reefer rates in May have increased by almost $0.15/mile following last week’s $0.09/mile hike. The national average reefer linehaul rate ended last week at $2.05/mile; the first-time spot rates have been back over $2.00/mile since March. At $2.05/mile, reefer spot rates are now $0.24/mile higher than in 2019 and $0.16/mile lower than in 2018.