We’re almost midway through Lent, and those observing the religious tradition will also abstain from eating meat on Fridays up to Easter. As a substitute, many turn to various fish recipes, and fish, including the McDonald’s Filet-O-Fish, a popular option during Lent for decades. According to McDonald’s, which uses wild-caught Alaska Pollock in approximately 300 million fish sandwiches annually, around 25% of Filet-O-Fish sales occur during Lent.

The iconic sandwich was invented in the ’60s by Lou Green, a Cincinnati franchise owner who was losing business on Fridays and desperate to save his floundering hamburger restaurant, the first McDonald’s in the Cincinnati area. Most of his clientele were Roman Catholic and abstained from meat every Friday and during Lent. To boost sales, he created the Filet-O-Fish — a sandwich that saved his restaurant and created much-needed winter demand for reefer carriers out of the Pacific Northwest.

In the lead-up to and during Lent, DAT sees a bump in reefer volume and spot rates in Seattle as surging volumes of Alaska Pollock is caught, processed, frozen within hours, and shipped nationwide. Wild-caught Alaska Pollock is widely distributed in the North Pacific Ocean, with the largest concentrations in the eastern Bering Sea, made famous by the TV series Deadliest Catch.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

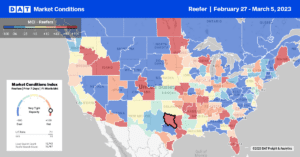

Spot market volumes surged last week in the Pacific Northwest, increasing by 48% w/w. Washington state outbound spot rates increased by $0.09/mile to an outbound state average of $1.84/mile, with the most significant gains reported in Oregon, where reefer spot rates jumped by $0.15/mile to $1.87/mile last week. Capacity was loose on most long-haul lanes outbound from Portland last week, with some regional lanes reporting tighter capacity. Loads from Portland to Stockton at $1.27/mile were $0.25/mile higher than the February average, while Los Angeles loads were up by the same amount at $0.95/mile.

Along the Gulf Coast in New Orleans, volumes were down 13% w/w, but with reefer capacity in high demand, outbound spot rates jumped by $0.32/mile to $1.90/mile after dropping for the prior three weeks. Excluding the pandemic-influenced years of 2021 and 2022, Louisiana’s state average rate of $2.36/mile are the highest in seven years. Out West in Nevada, reefer capacity was tighter following a 44% w/w increase in volume, which pushed spot rates up by $0.20/mile to $2.21/mile, the highest in the last four weeks. Reefer loads from Los Angeles to Las Vegas at $4.51/mile are up around $0.25/mile on the February average and about $0.10/mile higher than the average over the prior five months.

In the San Franciso market encompassing the Salinas Valley produce region, load posts increased 21% w/w, increasing spot rates by a penny-per-mile to $2.04/mile. Excluding 2021 and 2022, reefer linehaul rates are identical to 2018 and 2019, with spot rates typically starting to climb from now through July 4. Long-haul loads from Salinas to Brooklyn are flat at the moment at $1.87/mile but, according to Ratecast, are forecast to peak around $2.18/mile in early June, which is slightly higher than last year’s June peak.

Load to Truck Ratio (LTR)

Boosted by 14% higher w/w volumes of produce from Mexico and end-of-month, reefer spot market volumes took off last week, increasing by 23% and reversing the previous three-week slide. National produce volumes are still down 9% y/y, driven by lower Florida and California volumes. Still, import volumes from Mexico are up 14% y/y, adding to a 50% w/w surge in reefer volume along the southern border. Even though we’re past the peak in Avocado shipping season, last week’s volumes are just over double the previous year. Reefer equipment posts decreased by 3% last week, increasing the reefer load-to-truck (LTR) from 3.37 to 4.29.

Spot Rates

After plateauing for the prior two weeks, the national average reefer linehaul rate increased to $2.05/mile following last week’s penny-per-mile increase. Reefer spot rates are just under $1.00/mile lower than the previous year and just $0.02/mile lower than in 2018.