A research report from Skyquest, a global market intelligence, innovation management, and commercialization organization, expects the U.S. cold storage market to grow from $43.2 billion in 2023 to $118.8 billion by 2031. According to the report summary, the compound annual growth rate during the forecast period is 13.5%. The U.S. Cold Storage Market is witnessing several vital trends driving its growth, including the increasing adoption of automation and technology and the growing popularity of e-commerce, resulting in demand for faster delivery times.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The frozen segment for temperature setpoints in the -10 to -20°F range holds a commanding position in the U.S. cold storage market, accounting for more than 81% of the market share. This is a crucial insight for industry professionals, highlighting the strong consumer preference for frozen ready-to-cook meals due to their microwave cooking support and ease of packing techniques. The chilled segment is also poised for significant growth in the coming years, presenting further opportunities for market expansion.

The U.S. cold storage market is diverse, with each region offering unique characteristics and market drivers. With its large population and high demand for cold storage facilities, California stands out as a dominant player. However, it’s the rapid growth in North Carolina and South Carolina that is particularly noteworthy. These regions are expected to witness compound annual growth rates (CAGR) of over 15.2% and 14.7%, respectively, from 2022 to 2030. This growth is underpinned by the development of transportation facilities, technological advancements, and increased adoption of frozen foods, providing stakeholders with confidence in the market’s potential.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

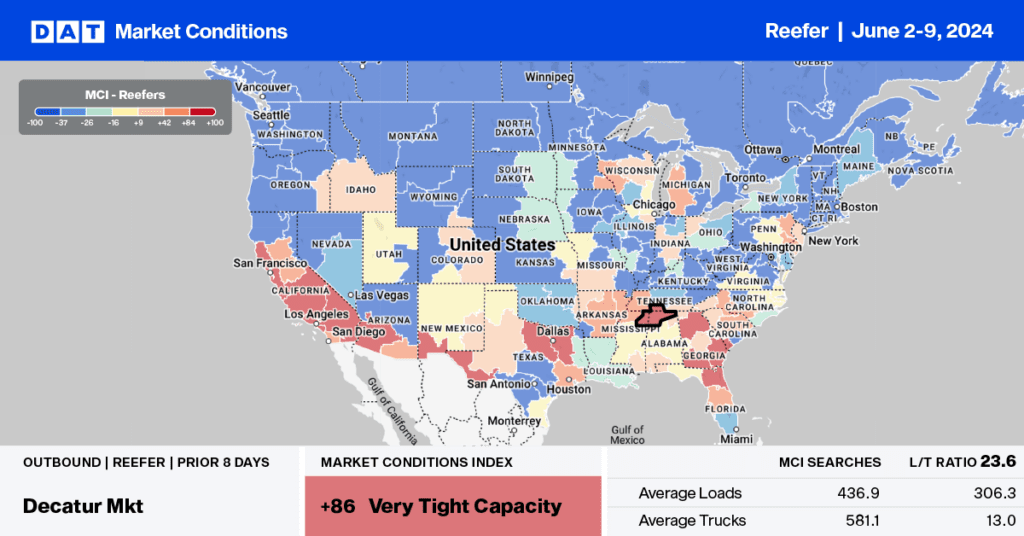

This time last year, the USDA reported a shortage of trucks in Nogales for loads of Mexican produce and in Florida as watermelon season rolled on. This year, all 17 growing regions report an adequate supply of reefer equipment as national produce volumes lagged last year by 4%. Unlike last year, where Mexican imports in southern Texas reported a slight surplus of capacity, last week’s capacity loosened further, reporting a net surplus of trucks.

The Mexico produce season is starting to look like the peak arrived earlier this year, with a volume around 6% lower than last year. Most imports from Mexico cross into the U.S. in Pharr, TX, in the McAllen market, where volumes were up slightly last week, but linehaul rates were down 15% w/w to $2.43/mile. California produced 36% of produce truckloads last week, trailing last year by 9% when the state accounted for 40% of loads at the end of May. Florida accounted for 22% of last week’s produce volume, and compared to last year’s 14% shipment volume at the end of May, Florida is having a great season.

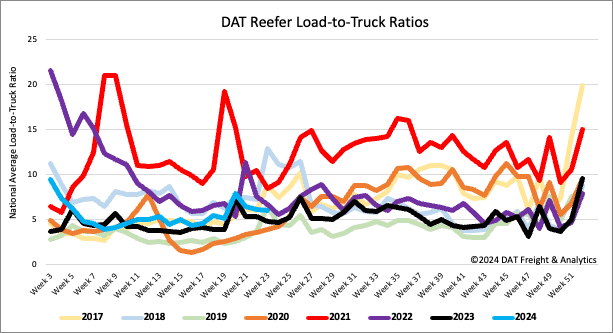

Load-to-Truck Ratio

With produce season starting to ship meaningful volumes in the lead-up to Independence Day, load post volumes increased by 3% last week but were down 9% year-over-year (y/y). Carrier equipment posts were 4% higher last week, resulting in the reefer load-to-truck ratio decreasing slightly to 6.06.

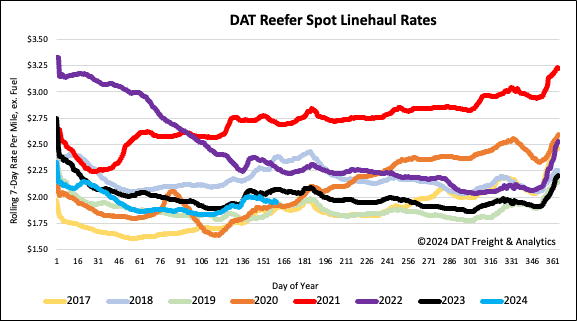

Spot rates

The national average reefer linehaul rate ended last week at just over $1.97/mile, up by less than a penny per mile. At this level, reefer linehaul rates are $0.12/mile lower on a 7% higher volume of loads moved than Week 23 last year.