One of the more fascinating logistical moves occurs over WInter: the shift in production and processing of leafy greens from California’s Salinas Valley, or America’s Salad Bowl, to the desert region in southeast California, southwest Arizona and northwest Mexico. The major freight market for leafy green produce surrounds Yuma, Arizona. According to the Arizona Farm Bureau, the area near Yuma transforms into the “Winter Salad Bowl,” producing almost all vegetables (lettuce, broccoli, kale, and cauliflower) consumed in the United States during winter.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

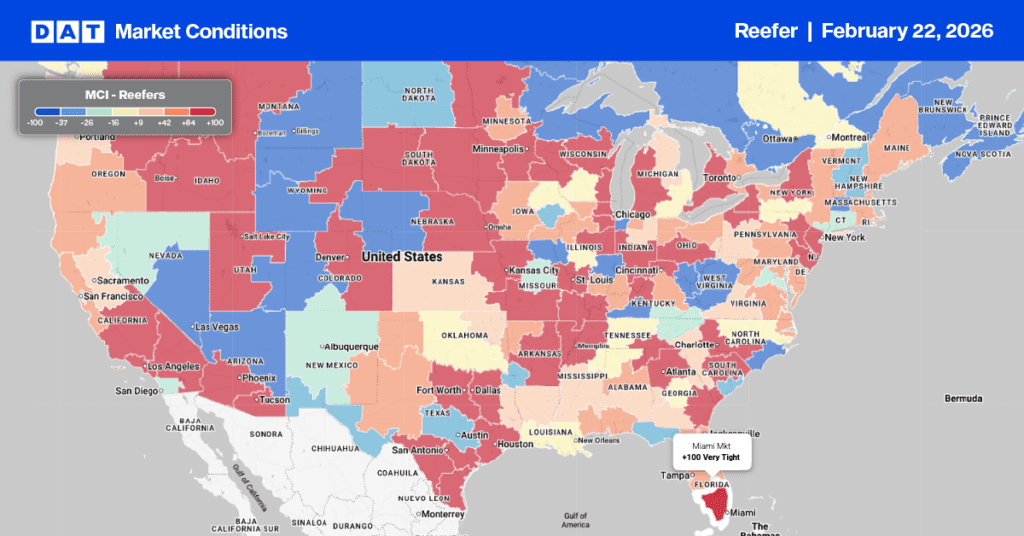

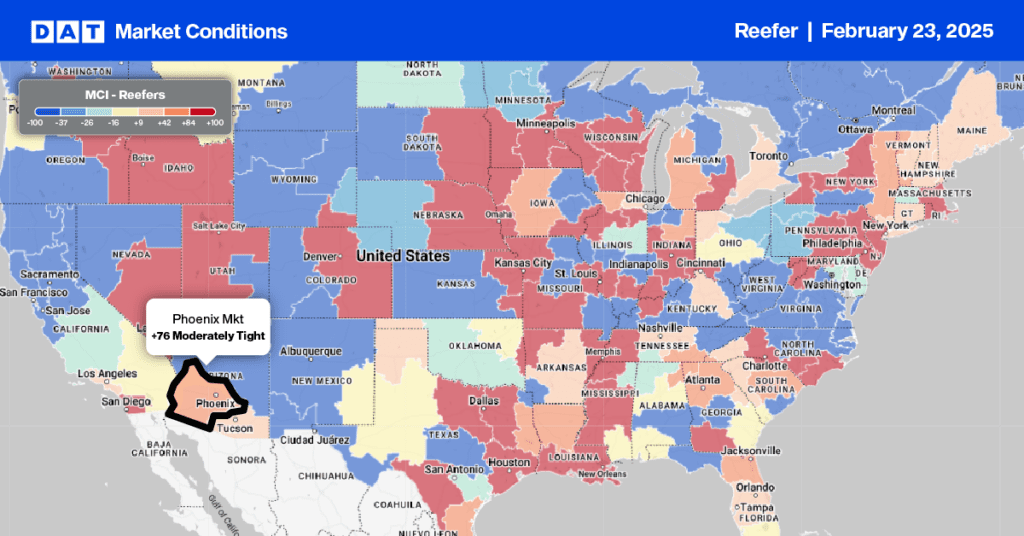

The USDA is reporting record-high volumes of lettuce this season in Arizona, almost double the 2024 season, boosted by solid volumes through the Nogales border crossing from Mexico. Reefer capacity is also much tighter with the USDA reporting a slight shortage of trucks last week in Arizona. Reefer carriers were paid an average of $2.19/mile for outbound Arizona loads last week, which is $0.12/mile or 6% higher than last year.

Load-to-Truck Ratio

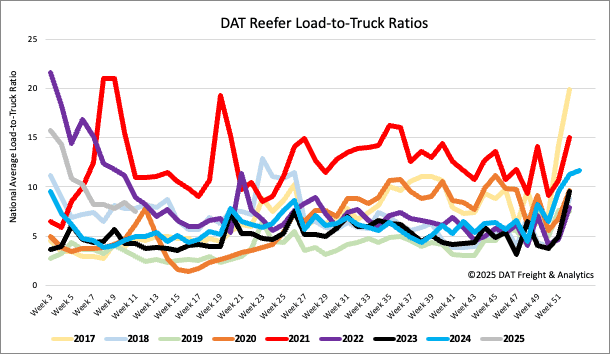

Reefer load post volumes dropped by 15% last week, but remained 12% higher than last year. Last week’s reefer load-to-truck ratio (LTR) ended at 7.47.

Spot rates

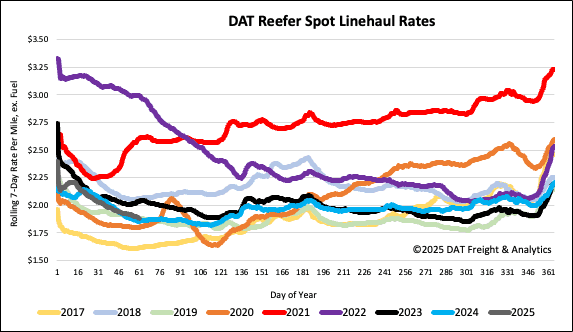

Even though the volume of loads moved was up 4% last week, reefer linehaul rates fell sharply, dropping by $0.05/mile to a national average of $1.91/mile. Reefer spot rates have dropped by $0.31/mile, or 14%, since the start of the year but remained $0.03/mile higher than last year and the long-term Week 9 average (excluding the years impacted by the pandemic).