Fall produce season mixed with holiday season festivities typically provides a much-needed boost for reefer carriers in November. This year, though, truckload volumes nationally trailed last year by around 3%, impacted mainly by the prominent California produce market, where volumes are down 26% year-over-year (y/y). In the smaller Pacific Northwest (PNW) produce region, truckload volumes of Fall produce are 28% higher than last year and the highest since March 2020. Potatoes, apples, and dry onions account for 83% of year-to-date PNW produce volume, with apples, the most significant volume contributor, having a great year with truckload volumes 36% higher than in 2022.

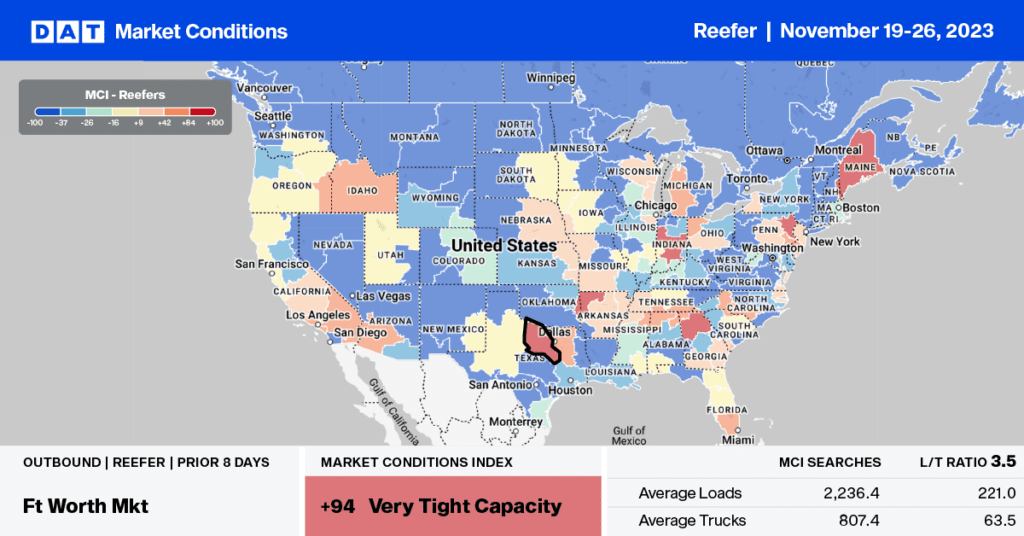

Reefer spot rates currently average $2.39/mile, excluding fuel, for outbound Washington state loads. The Spokane market averaged $2.44/mile for reefer loads, with California the most popular destination and just $0.03/mile lower than last year. On the produce import front, it’s the slack season for imports from Mexico, with volumes trailing last year by 4% and 8% in Tamaulipas, MX, the largest produce-exporting state to the U.S. Produce moves via the Pharr International Bridge into the McAllen freight market. Tamaulipas truckload produce volumes are 8% lower than last year. On our northern border, Canadian imports, representing around 5% of total produce imports, are 6% higher than last year, and in Ontario, Canada’s largest produce-growing province, produce volumes are running 10% higher than in 2022.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Atlanta outbound reefer rates increased by $0.12/mile last week to an average rate of $1.80/mile, while on the high-volume regional lane to Lakeland, FL, carriers averaged $2.94/mile, the highest since February. DAT’s Ratecast forecasts spot rates on this lane to increase another $0.22/mile to $3.16/mile by the end of the year.

In the Southwest, outbound spot rates in Phoenix increased by $0.15/mile to $2.12/mile last week and $0.03/mile higher at $2.15/mile on the regional haul west to Los Angeles. Carriers averaged $1.89/mile for loads to San Francisco last week and are on track to peak at almost $1.00/mile higher by the end of the year. In Twin Falls, ID, spot rates averaged $2.70/mile, an increase of $0.15/mile in the last week, while loads to Phoenix and Denver averaged $3.00/mile and $3.68/mile, respectively.

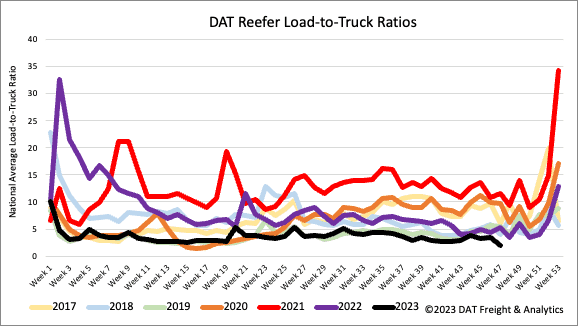

Load to Truck Ratio (LTR)

The reefer load post (LP) volume dropped by 60% w/w last week, in line with past years during the short workweek. Carrier equipment posts (EP) were down 28% w/w, resulting in last week’s reefer load-to-truck ratio (LTR) decreasing to 1.87.

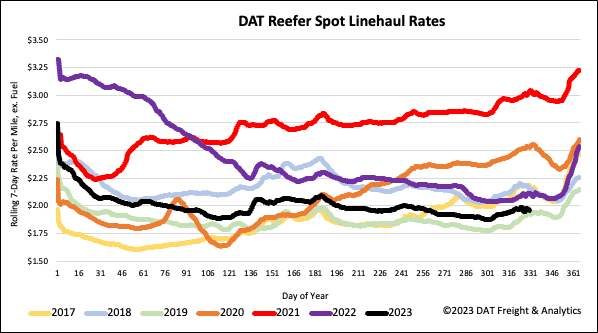

Spot rates

Reefer spot rates edged back over $2.00/mile for the first time in just over three months following last week’s $0.03/mile increase. At around $2.00/mile, the national average reefer linehaul rate has increased by $0.13/mile in the last month. Compared to last year, reefer spot market rates are $0.15/mile lower and only around $0.03/mile higher than in 2019.