Las Vegas has been going through a construction boom for almost a decade, with much more to come when the 2028 Olympics start in Los Angeles. On the drawing board or already underway are a high-speed rail link to Southern California, a new MLB ballpark, an NBA arena, two new mega-resorts, a 690-megawatt solar/battery storage facility, and thousands of self-driving taxis and shuttles. On top of this, the metro population of Las Vegas is expected to grow by 10% to 3.2 million residents by 2028. All of this translates into a lot of freight into the region.

More sports stadiums

The recently announced demolition of the famous 67-year-old Tropicana Resort on April 2nd this year will make way for the new Oaklands A’s baseball stadium. The 33,000-seat ballpark will be built on 9 acres of the 35-acre Tropicana site. Plans call for the $1.5 billion ballpark to include an 18,000-square-foot jumbotron, the largest stadium screen in major league baseball.

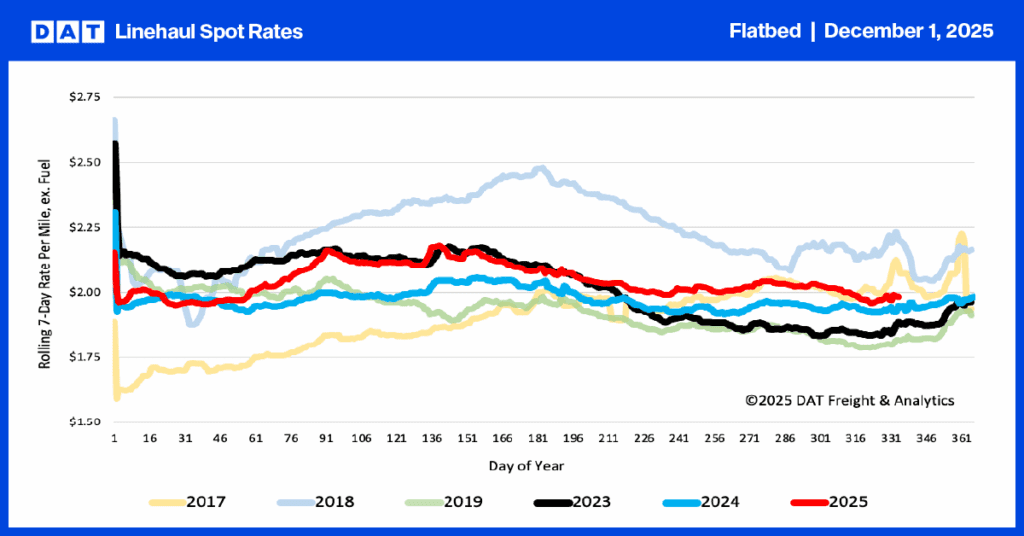

Plans also call for 2,500 parking spots on the site, with a 2.5-acre shopping plaza leading up to the stadium. All included, this means a substantial amount of freight for long-haul flatbed carriers, including machinery, glass, steel, cabling, and lumber, when the A’s begin construction on the ballpark in April 2025.

Recession-proofing Las Vegas

Since the Great Recession in late 2007, the city of Las Vegas has sought to “recession-proof” itself and, in the process, started a construction boom that created significant demand for flatbed carriers to haul millions of tons of freight into the city each month. In addition to local demand for belly dumpers, construction, and earthmoving machinery, long-haul flatbed demand is closely tracked with the development of major construction projects. In recent years, the city has seen the completion of the new Las Vegas Raiders NFL Stadium, the 87-acre $7 billion Resort World Casino, and the $1 billion Las Vegas Convention Center (LVCC) expansion.

Over the last 17 years, Las Vegas has transformed from “buffets and bingo” to a sports fan’s heaven. In the process, the city is “recession-proofing” amid a construction boom. This boom has created significant demand for flatbed carriers that haul millions of tons of freight into the city each month.

Sport and sports medicine hold the key

According to leading Las Vegas realtor Bill Margita, “Las Vegas was hit so hard by the recession that we had to figure out how to make ourselves recession-proof, and that’s why today you see so much commercial development in industries other than gaming. We studied all the cities worldwide to find out what made them recession-proof, and it came down to one thing—sports medicine.”

It’s no accident that sports is now a big part of the Las Vegas economy. In addition to the previously mentioned Las Vegas Raiders, the list of professional sports teams making their way to Las Vegas includes the Women’s National Basketball Association Las Vegas Aces team (relocating from San Antonio), the National Hockey League’s Golden Knights ice hockey team, the United Soccer League Las Vegas Lights Football Club, and the Las Vegas 51s, a Triple-A minor-league baseball team affiliated with the New York Mets. Las Vegas is also home to Ultimate Fighting Championship (UFC), the world’s largest mixed martial arts promotion company.

All these teams (as well as amateur athletes) need hospitals and sports medicine facilities, which brings us back to the current construction boom driving demand for flatbed trucking. The growth of sports and sports medicine also serves another purpose: to provide improved healthcare to the aging population seeking a warmer climate and a healthier lifestyle.

According to Margita, “Sports help cities thrive, and because baby boomers are the wealthiest generation in history and are looking to extend their productive lives as long as possible in retirement, the city realized that the best way to make Las Vegas recession-proof was to build a city around the people who live there, not just those who visit to spend money and have fun.” And if you’re wondering where the money comes from, take a look at your hotel room bill next time you’re in town. Even though the room rate may appear low, the added “resort tax” of $25 is how funds are generated for many of the current construction projects.

Flatbed demand tied to significant projects

All commercial construction projects currently underway and the associated infrastructure to support them require a substantial amount of building materials – including structural steel. Most of that steel has to be transported long distances from specialty manufacturers such as Merrill Steel, headquartered in Scholfield, Wisconsin.

Merrill Steel supplied 28,500 tons of steel to the recently completed Allegiant Stadium, home to the Las Vegas Raiders NFL team and the University of Nevada Las Vegas Rebels college football team. Merrill’s steel plants are located in Schofield, WI, and Springfield, MO, with the steel order for the stadium one of the largest the company has ever fulfilled. Translating that into truckload demand is the equivalent of almost 1,000 flatbed loads of steel.

While the final plans for the new Oakland A’s stadium are yet to be finalized, one thing is for sure: When it starts, flatbed carriers can expect more demand to run west, where there’s already a solar-powered infrastructure boom underway. In addition, there are plenty of construction projects to drive demand for inbound Las Vegas loads this year. These include a 43-story, 2,420-room casino resort project with a wedding chapel and a 2,500-seat theater, the planned 400-room Atari Hotel, and the Construction of the 218-mile and $12 billion rail system from Las Vegas to Los Angeles in time for the 2028 Summer Olympics in Los Angeles.