Like the proponents of autonomous trucks, who have struggled to demonstrate a viable economic model in the truckload sector, early adopters of electric vehicles are in the same boat. According to Ryder System, which manages 25,000 trucks and vans for thousands of retailers and manufacturers, as trucks get heavier, the difference in operating costs between battery-electric vehicles and diesel trucks grows more pronounced.

In an excellent article by Paul Berger at the Wall Street Journal, Robert Sanchez, the chief executive of Ryder, said, “The economics just don’t work for most companies.” There’s a simple reason, and it has to do with battery weight and the resulting reduction in payload. At a recent conference, an investor in battery-electric vehicles was asked about the economics of reduced truck payload for truckload carriers. The surprising response was, “We’ve never thought about that.”

Berger writes that Ryder’s experience illustrates state and federal governments’ challenges as they push truckers out of heavily polluting diesel rigs and into zero-emission vehicles. It suggests that truck makers will need to make significant advances in battery weight, range, and charging times if battery-electric trucks are to seriously challenge diesel rigs in a highly competitive freight sector that runs on thin margins.

Ryder Class 8 truck study results

Despite the lower energy and maintenance costs, battery-electric trucks cost about three times as much to purchase as diesel rigs, according to the Ryder “Electric Vehicle Total Cost to Transport Analysis” released this month.

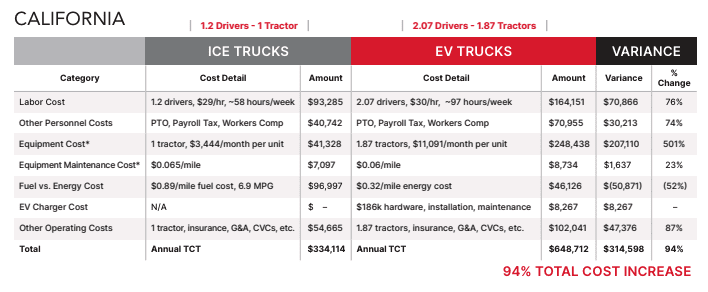

To understand the economic impacts of utilizing electric vehicles (EVs) in place of internal combustion engine (ICE) vehicles, Ryder used quantitative data from representative network loads and routes from Ryder’s dedicated transportation operating models, which include approximately 13,000 vehicles and professional drivers. The analysis factored in the cost of the vehicle, maintenance, drivers, range, payload, diesel fuel versus electricity, and the required EV charging time.

The Class 8 comparison assumes hauls ranging from 100 to 500 miles, one to two daily trips, about 109,000 miles annually, and 1.2 local Class A drivers per diesel vehicle (typical for an ICE unit in Ryder’s dedication transportation operations). The average payload in this scenario is 29,000 pounds for an ICE unit.

At this time, the maximum payload for an EV is approximately 22,000 pounds. Given the payload differences between ICE and EV heavy-duty commercial vehicles and accounting for EV charging time and equivalent delivery times, Ryder estimates that nearly two EVs and more than two drivers are needed to equal the output of one ICE vehicle.

The chart below shows the comparison results for a single ICE heavy-duty tractor and equivalent EV in California. Due to the increased number of tractors and drivers needed, the annual total cost to transport (TCT) to convert to EVs is nearly double, with a variance of $314,000 or 94%.

The cost of the vehicles is the most significant contributor at more than 500%, followed by operating costs at 87%, labor costs at 76%, and other personnel costs at 74%. Fuel and energy savings are 52%.

Mass adoption roadblocks

Inflationary impact: Ryder’s analysis estimates cost increases of 94% to 114% to convert heavy-duty trucks to EVs and 56% to 67% to convert mixed fleets of 25 vehicles, depending on the geographic region. Suppose businesses pass the increased cost of transportation onto consumers through higher prices, based on the average cost impact to convert mixed fleets. Ryder estimates such increased costs could add approximately 0.5% to 1% to overall inflation.

Charging infrastructure: The Clean Freight Coalition (CFC), an alliance of truck transportation stakeholders, has stated that there is no network in the U.S. where over-the-road professional truck drivers can stop for legally mandated rest breaks and charge a vehicle battery simultaneously. According to a report released by the CFC, preparing today’s commercial vehicle fleet for electrification would require an investment of nearly $1 trillion in charging infrastructure and electric service upgrades.

The International Council on Clean Transportation (ICCT) also estimates that nearly 700,000 chargers will be needed nationwide to accommodate the one million Class 4, 6, and 8 EVs anticipated to be deployed by 2030. These EVs will consume 140,000 megawatts of electricity daily, equivalent to the daily energy needs of nearly 5 million American homes.

Along with these findings, the Joint Office of Energy and Transportation recently released a zero-emission freight corridor strategy that would only achieve a national charging network in the U.S. between 2035 and 2040. Progress will be slow, and in a tight-margin truckload sector, battery-electric trucks’ economic benefits must improve before we see broader adoption rates.