As was the case with Valentine’s Day, when truckloads started moving two weeks prior, this week is the peak shipping week for flowers ahead of Mother’s Day. Most activities center in Miami, just 3.5 hours of flying time from where most Mother’s Day roses and carnations are grown.

According to the USDA, in 2023, 63% of rose and carnation stems were imported from Columbia, 35% from Ecuador, and 1% from Guatemala. 88.8% landed at Miami International Airport (MIA) before being trucked all over the U.S. and Canada. An additional 7.7% were shipped via West Coast airports, including Los Angeles (5.9%) and San Diego (1.8%). Around 20% of the annual volume arrives two weeks before Valentine’s Day and Mother’s Day.

Behind the scenes are dozens of 747 jumbo jet air freighters loaded with flowers arriving from South America at MIA daily. Global floral supply chains follow a south-north pattern – fresh cut flowers in Europe arrive from South America from Kenya (the largest producer of roses in the world). In North America, flowers mostly come from South America. All are close to the equator, where growers have natural light all year round, reducing the need for artificial illumination.

Why Miami when can you fly directly to most major capital cities?

Miami has a large perishables-handling infrastructure and is ideally located to handle domestic air-to-truck logistics and international air-to-air transfers. MIA also has an efficient consolidation center for southbound traffic of all kinds in the US and Europe/Asia.

According to international air freight expert Jesse Cohen, “The freighters that provide the big lift in the market need high volumes of good two-way traffic to be profitable, so it is safer and more efficient to schedule MIA schedules vs. other airports. There are many other traffic opportunities in MIA for non-flower traffic (to/from Central America and the Deep South), and many freighters fly multi-stop schedules to maximize their loads across all seasons. The bottom line is economies of scale and overall efficiency.”

It’s not all roses for truckers, though

According to one trucker DAT spoke to this week, “Floral loads are all driver unloads as some places don’t even have docks. They’re very unpopular loads as they’re all time-sensitive, so you have to haul butt because it takes so long to unload box by box. My last load had 2,500 boxes spread over four stops”.

To compensate, some large floral carriers typically impose a surcharge allowing repositioned equipment to be moved to meet the increased need for additional capacity during this peak holiday. According to truckload carrier PRIME Inc., “A temporary 20% holiday surcharge will apply to all products shipped outbound from California from April 25, 2024, through May 8, 2024. A temporary 10% holiday surcharge will apply to all products shipped outbound from Florida from April 25, 2024, through May 8, 2024.”

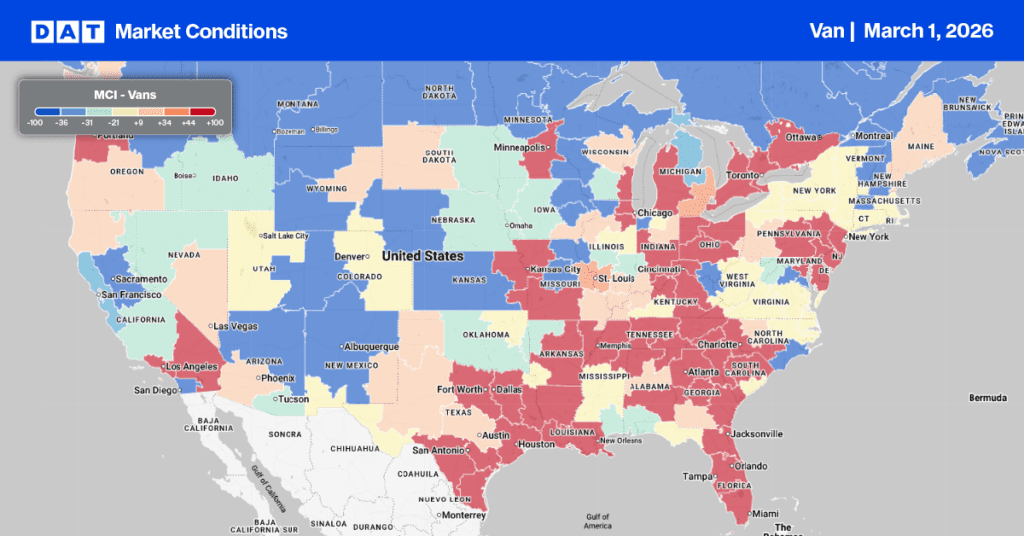

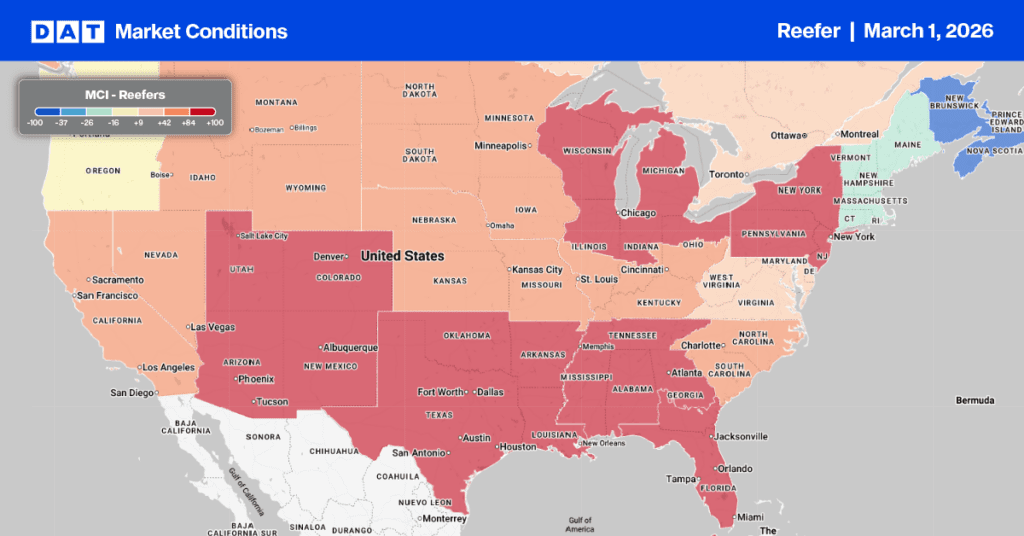

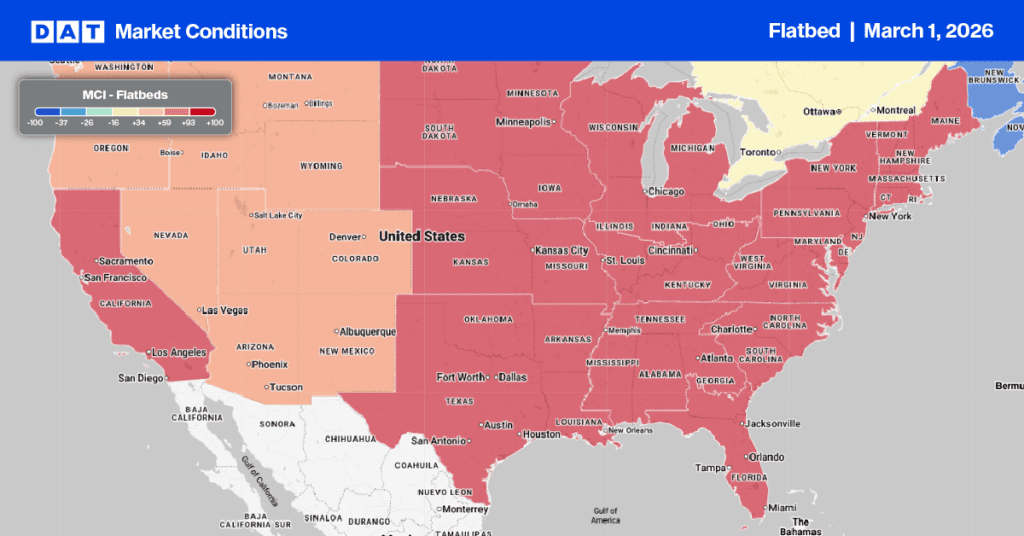

What will truckload capacity look like in the next two weeks?

While most of the Mother’s Day floral shipping volume occurs two weeks prior, outbound reefer capacity in Miami tightens at the start of April each year, especially on high-volume lanes, including Maimi to Atlanta. Last year, linehaul rates jumped by 66% on a 40% higher volume of loads moved in the six weeks leading up to Mother’s Day. In 2022, a similar trend occurred, with linehaul rates increasing by 64% on a 54% higher load volume.

In DATs Ratecast, outbound reefer linehaul rates on the regional lane from Miami to Atlanta are expected to increase early this week, peaking around $2.48/mile, almost $0.03/mile higher than last year.