Got hand sanitizer? Canned soup? What about toilet paper? No? Well, you may have to get in line.

Costco is one of the chains that has seen high traffic in recent weeks, with consumers waiting in long lines line to purchase emergency supplies. Individual stores have started to limit the number of popular items that each shopper can take home, while the chain continuously replenishes stocks of bottled water, cleaning products, tissues, paper towels and shelf-stable foods, according to a report in Forbes magazine. For the time being, consumers’ hoarding behaviors could boost demand for dry van loads, benefiting carriers and logistics companies of all sizes.

Paper towels and toilet paper were nowhere to be found this weekend at a Costco store in Beaverton, Oregon. (Photo by Matt Sullivan, DAT)

Many retailers and manufacturers built up inventories last year to get ahead of tariffs with China. Those companies have a cushion that can carry them through a temporary surge in demand for most products. If Chinese factories don’t return to full production soon, or if the coronavirus threat causes U.S. consumers to stay home, however, those same retailers may face hard times this spring, says the Wall Street Journal.

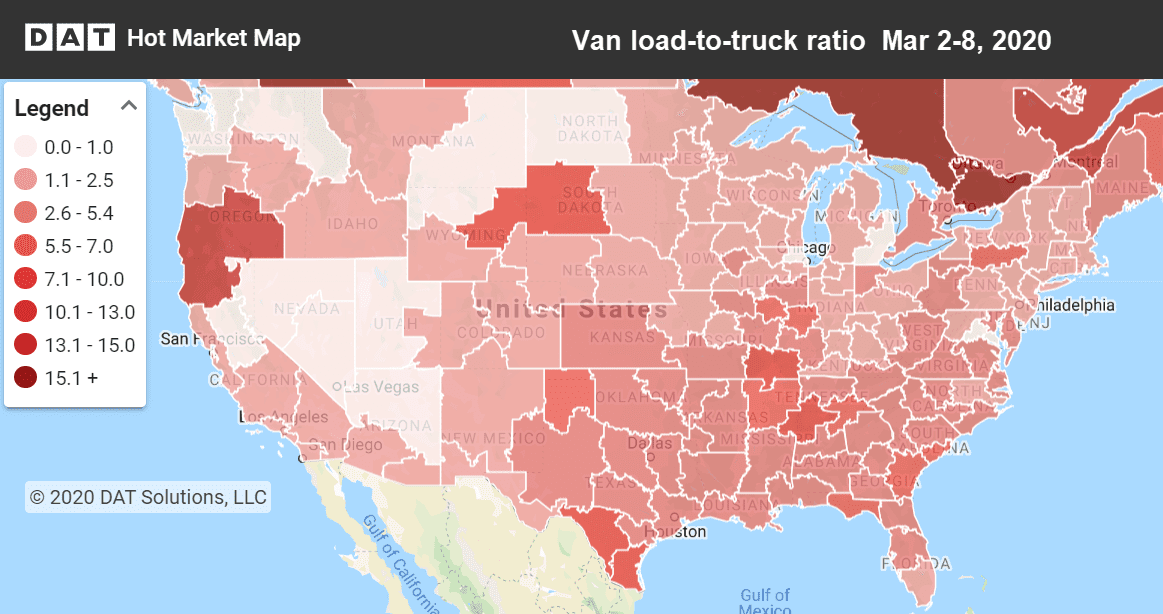

Load-to-truck ratios are higher now than they were at this time last year, as seasonal demand picks up and retailers restock depleted inventories. Interactive Hot Market Maps in DAT Power and DAT RateView reveal these and other truckload capacity trends in 135 freight markets across the U.S.

While Chinese factories are slowly coming back online, some goods are getting held up because of a truck driver shortage — not in the U.S., but in China. A bounce-back in May could drive imports up more than 9% year over year in May, however, according to the National Retail Foundation, as quoted by MarketWatch.

Those trends could add up to a busy spring for vans, with some quiet periods between now and the end of May. For now, spot van prices are trending up seasonally, with more lane rates rising than falling.

- Atlanta to Columbus added 10¢ to $1.53 per mile, but Columbus to Atlanta lost 2¢ to $1.92. That’s a net gain, but still not great.

- Chicago to Los Angeles hit $1.56 per mile, up 9¢, and L.A. to Chicago slipped 2¢ to $1.20. A lot of miles for not a lot of money.

- Dallas to Houston jumped 9¢ to $2.09, and Houston to Dallas got a 4¢ boost, to $1.93.

- Memphis to Charlotte rose 7¢ and Charlotte to Memphis dropped 4¢ to $1.49 per loaded mile.

Some of the lanes that lost traction last week weren’t paying all that well to begin with.

- Dallas to Laredo rates fell 7¢ to $1.18, and Laredo to Dallas held steady at $2.09.

- Denver to Phoenix dropped 7¢, as well, to $1.28 per loaded mile, while Phoenix to Denver edged down 2¢ to $1.90. (Loads picking up in the center of Phoenix could pay more.)

- Stockton, CA, to Salt Lake City fell 9¢ to $2.05 per mile, and Salt Lake City to Stockton lost 4¢ to $1.47.

- Buffalo to Charlotte fell 6¢ to $1.80 and the return trip from Charlotte to Buffalo dropped 4¢ to $2.16 per mile.