The long Independence Day weekend traditionally marks the peak in produce shipping volumes, and after a slow start, national volumes recovered to be up 11% y/y for the week ending July 4. National volumes were almost identical to 2018 and 2019 volumes halfway through 2023. Like last year, weather has significantly impacted this year, with California being affected the most following the series of atmospheric rivers that lashed the West Coast in January and then again in March.

California volumes were down 30% y/y, while Mexico produce imports increased by 49% y/y as higher volumes from across the Southern border filled the supply void left by growers in California struggling to catch up. Produce volumes in the Southeast region were up 2% y/y – Georgia volumes were up 11% y/y, while the impact of Hurricane Ian late last year wreaked havoc in Florida as growers finished the season 26% behind last year.

According to the USDA, the Top 5 USDA commodities shipped by volume YTD through the week ending 6/29/23:

- Potatoes +7% YTD

- Tomatoes +10% YTD

- Lettuce +1% YTD

- Watermelons +22% YTD

- Apples -2% YTD

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Outbound linehaul rates in California increased by $0.10/mile to $2.63/mile last week, led by solid gains in Stockton, where rates jumped to $2.55/mile (up $0.17/mile w/w). Loads from Stockton to Phoenix paid carriers $2.13/mile, the highest since last December. In neighboring San Francisco, linehaul rates averaged $2.26/mile following the previous week’s $0.03/mile increase (after dropping for the three previous weeks). On the long-haul lane from Salinas to Hunts Point, NY, rates averaged $2.24/mile in June, the highest in 12 months, and $0.07/mile higher than the previous year.

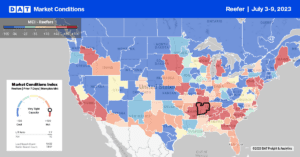

The USDA reported a slight shortage of trucks for watermelons and tomatoes in South Carolina last week, resulting in a $0.46/mile spike in reefer spot rates to an average of $2.83/mile in the Columbia market. Nonetheless, linehaul rates are $0.30/mile lower than the previous year. Regional loads from Columbia to Baltimore paid carriers $3.44/mile last week, $0.62/mile lower than the previous year but the highest since last June. Capacity was tight in Jacksonville last week, where spot rates jumped by $0.49/mile to $2.47/mile. Loads 1,200 miles north to Boston paid carriers an average of $2.63/mile last week, $0.04/mile lower than the previous year.

Load to Truck Ratio (LTR)

After a slow start, produce season finally delivered with June volumes within 3% of last year (or the equivalent of 2,300 fewer truckloads of produce this season). Despite the strong finish, produce volumes weren’t enough to lift the temperature-controlled freight market out of its slump. Overall, reefer spot market volumes dropped by 38% last week, slightly higher than the long-term average of 35% in the week after July 4. Carrier equipment posts were 14% lower last week and almost identical to 2019 levels, resulting in the reefer load-to-truck ratio (LTR) dropping by 28% w/w from 5.32 to 3.83.

Spot Rates

Reefer spot rates predictably cooled off further following last week’s $0.02/mile decrease. At $2.07/mile, the national average linehaul rate is $0.25/mile lower than the previous year and $0.10/mile higher than in 2019. Produce season typically lifts spot rates by around $0.26/mile between mid-April and the long July 4 weekend; however, that increase was just $0.16/mile this year.