The Port of Oakland is a central hub for exports in Northern California. Its strategic location and modern infrastructure make it popular for companies shipping goods overseas. The Port of Oakland handles various exports, from agricultural products to manufactured goods.

Most container ships sailing from the Port of Oakland are specifically heading to China and Japan, with Oakland being the last port of call for many Asian vessels on their westbound voyage. Timing is everything, and in the refrigerated food sector, whether it’s fresh produce, fresh proteins, or everything with shortened shelf life, the vessel with the shortest transit time is always in demand. Everyone wants their freight on the ship at the last possible minute. Cold foods like pork and fresh produce are held anywhere from a few hours to a day or two at most.

A significant amount of refrigerated exports is processed via CoolPort, a 280,000-square-foot distribution center capable of shipping one million tons of beef and pork annually. CoolPort offers 90 dock doors and the capacity to load 18 rail cars concurrently, contributing to the Port of Oakland’s ranking as the eighth-busiest container port in the United States and number one for reefer exports nationally.

The Port of Oakland accounted for 16% of total U.S. refrigerated exports in June, according to IHS Markit/PIERS. Even though export TEU (twenty-foot equivalent unit) volume was down 5% m/m, exports are up 13% year-to-date and 2% y/y. The majority of exports go to Japan and Korea, with meat (61%), oranges (18%), and cheese (6%) being the top three commodities exported. Compared to June last year, the export volumes of meat and oranges are up 22% and 58%, respectively, while cheese exports are down 23% y/y.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

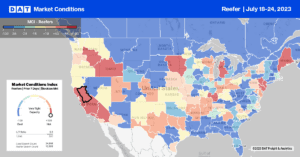

Capacity tightened slightly in Stockton following a $0.03/mile increase to $2.41/mile for outbound loads, the only market in California to report an increase. State-level rates in the Golden State were flat last week at $2.48/mile, which was $0.36/mile lower than in 2022. According to the USDA, produce volumes in California are 34% lower y/y following last week’s 11% decrease, impacting lower trucking demand in major produce markets like Fresno, where rates dropped to $2.19/mile for the fourth week. In nearby San Francisco, home to the “Summer Salad Bowl” in the Salinas-Watsonville area, spot rates were flat at $2.16/mile last week after dropping $0.09/mile in the previous four weeks.

In the Macon, Georgia, market, home to the leading peach-producing county, reefer spot rates jumped by $0.07/mile last week to an outbound average of $2.54/mile. Macon to Miami loads paid carriers $2.98/mile, $0.15/mile higher than last month but over $0.80/mile lower than in 2022.

In Philadelphia, home to the Packer Avenue Marine Terminal (where most South American refrigerated imports arrive), reefer spot rates increased for the fourth week to $1.88/mile following last week’s $0.08/mile gain. In June, the Port of Philadelphia was the number one port for refrigerated import tonnage.

Load to Truck Ratio (LTR)

Reefer spot market volumes were almost identical to Week 29 in 2019, following last week’s 6% decrease. Load posts for all refrigerated temperature settings were just over half what they were a year ago, impacted by lower produce volumes in the 32 to 45 degrees F range. According to the USDA, this was 9% lower than the previous year following last week’s 7% decrease. Carrier equipment posts were 1% lower than in 2019 following last week’s 4% decrease, resulting in the reefer load-to-truck ratio (LTR) decreasing slightly from 3.72 to 3.65, almost identical to 2019 when the LTR was 3.15.

Spot Rates

At the midpoint in what’s turning out to be the hottest single month for temperatures on record, the July reefer spot market is following seasonal trends and cooling off rapidly. Reefer linehaul rates have dropped $0.11/mile since July 4, following last week’s $0.05/mile decrease to a national average of $1.97/mile. The national average linehaul rate is $0.29/mile lower than in 2022 and only $0.10/mile higher than in 2019.