While overall truckload freight volume is holding steady for now, according to the latest ATA Truckload Tonnage Index, recent less-than-truckload (LTL) earning calls point to market softness following two years of volume increases. According to the Kearney 2022 Logistics Report, LTL freight transactions account for around 10% ($83 billion) of the $830 billion motor-carrier freight sector, with truckload accounting for $332 billion and private or dedicated fleets the largest at $415 billion.

The number two ranked LTL carrier in the country, Old Dominion Freight Line, which runs close to 11,000 power united from their North Carolina base, reported February tonnage was down by 12.4% y/y due to a 10% drop in shipment volume. According to Greg C. Gantt, President and Chief Executive Officer of Old Dominion, “Old Dominion’s revenue results for February reflect continued softness in the domestic economy. While our revenue decreased on a year-over-year basis, we believe our LTL shipments per day have largely stabilized, and our yield continued to improve.”

Number nine ranked LTL carrier SAIA based in Georgia, which runs close to 5,800 trucks across 190 terminals in 45 states, reported volume declines in the last quarter of 2022 and continued into the first two months of this year. February 2023 LTL shipments per workday declined by 8% m/m, LTL tonnage per workday declined by 8% m/m, and LTL weight per shipment dropped 0.1% to 1,405 pounds compared to 1,406 pounds in February 2022.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

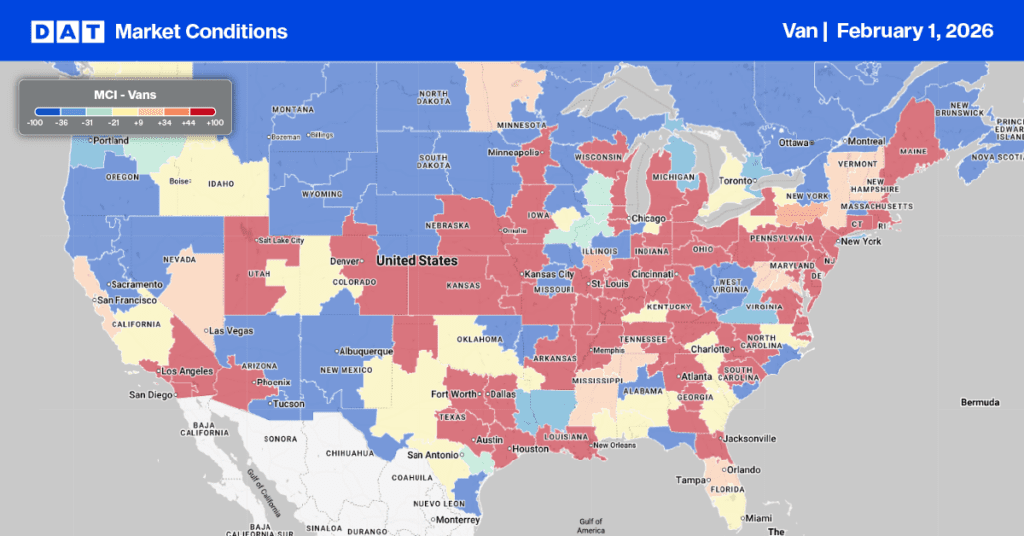

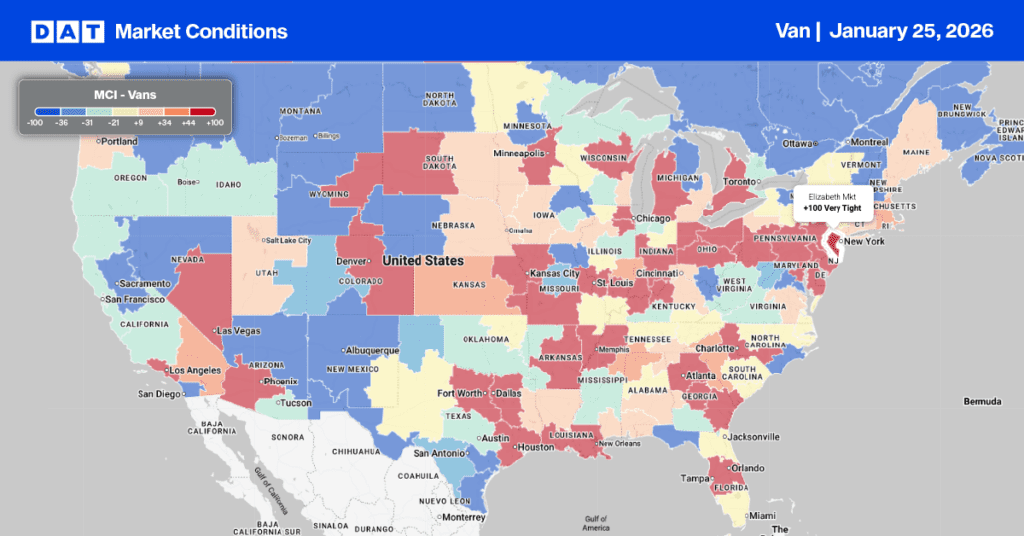

Spot rates in the top five freight-producing states (CA, TX, IL, NJ, and NY) dropped by $0.05/mile last week to an average of $1.83/mile, $0.11/mile higher than the national average. These states typically account for a quarter of the weekly spot market volume, with spot rates tracking around $0.10/mile higher than in 2019. Only five states recorded a gain last week. Arizona, Wyoming, Iowa, Texas, and New York reported a $0.02/mile w/w gain to an average of $1.83/mile also.

Solid gains were reported along the southern border in Laredo, the largest commercial truck-crossing zone. Linehaul rates increased for the fourth week to $1.84/mile, up $0.01/mile last week. 435-mile loads north to Dallas were paying $2.48/mile the previous week, up $0.17/mile compared to the February average and the highest since last September. Loads 1,500 miles west to Ontario at $1.62/mile was the highest since June and $0.12/mile higher than the prior month.

In the largest market in the Southeast, volumes dropped 9% in Atlanta last week, with capacity easing following a $0.04/mile decrease in linehaul rates to a market average of $1.67/mile. Long-haul loads to Elizabeth, NJ, were flat at around $1.65/mile last week, while regional loads to Orlando at $2.74/mile were $0.07/mile higher than the previous month’s average.

Load-to-Truck Ratio (LTR)

Following the prior week’s end-of-month shipping surge, load posts retreated last week, decreasing by 22%, w/w recording the lowest weekly volume this year. Even though volumes are more than half what they were a year ago, they are within 2% of the average for Week 10 in pre-pandemic years. Spot market capacity loosened following a 9% w/w increase in carrier equipment posts, around 8% higher than the previous year. The net result was a lower dry van load-to-truck ratio (LTR) from 2.83 to 2.03.

Linehaul Spot Rates

At $1.72/mile, dry van linehaul rates lost the most ground last week, decreasing by just over $0.03/mile. Spot rates have been tracking closest with 2019 levels for the previous six weeks, ending last week at $0.12/mile higher. Based on the volume of loads moved, the average rate for the top 50 dry van lanes was $0.21/mile higher, which averaged $1.93/mile last week. On DATs Top 100 dry van lanes, linehaul rates decreased on 70% of lanes, increasing on only 11% with the balance remaining neutral.