Last week the news was dominated by Hurricane Dorian. Our thoughts go out to all those affected by the storm, both in the Bahamas and in the Southeastern U.S.

There was already urgency built into last week due to the 3-day Labor Day weekend, and the approaching hurricane increased that urgency. In fact, the spot market hit a monthly high on Wednesday, and in the top 100 van lanes 73 saw higher rates, with just 17 having lower rates and 10 remaining neutral. If we were in a freight recession (which is debatable), there is growing evidence that we are pulling away with strongly positive trends to end the month of August.

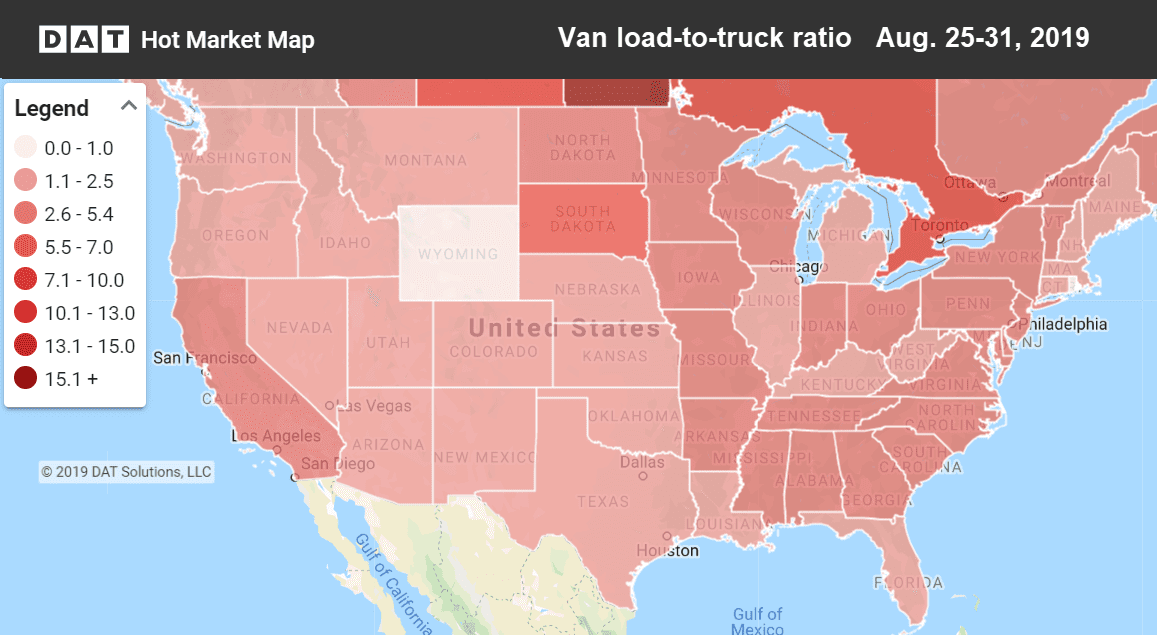

Last week trucks were hardest to find in the East and Southeast. Hot Market Maps show the number of available trucks vs. available loads and are available in the DAT Power load board and DAT RateView.

Month ends on a positive note

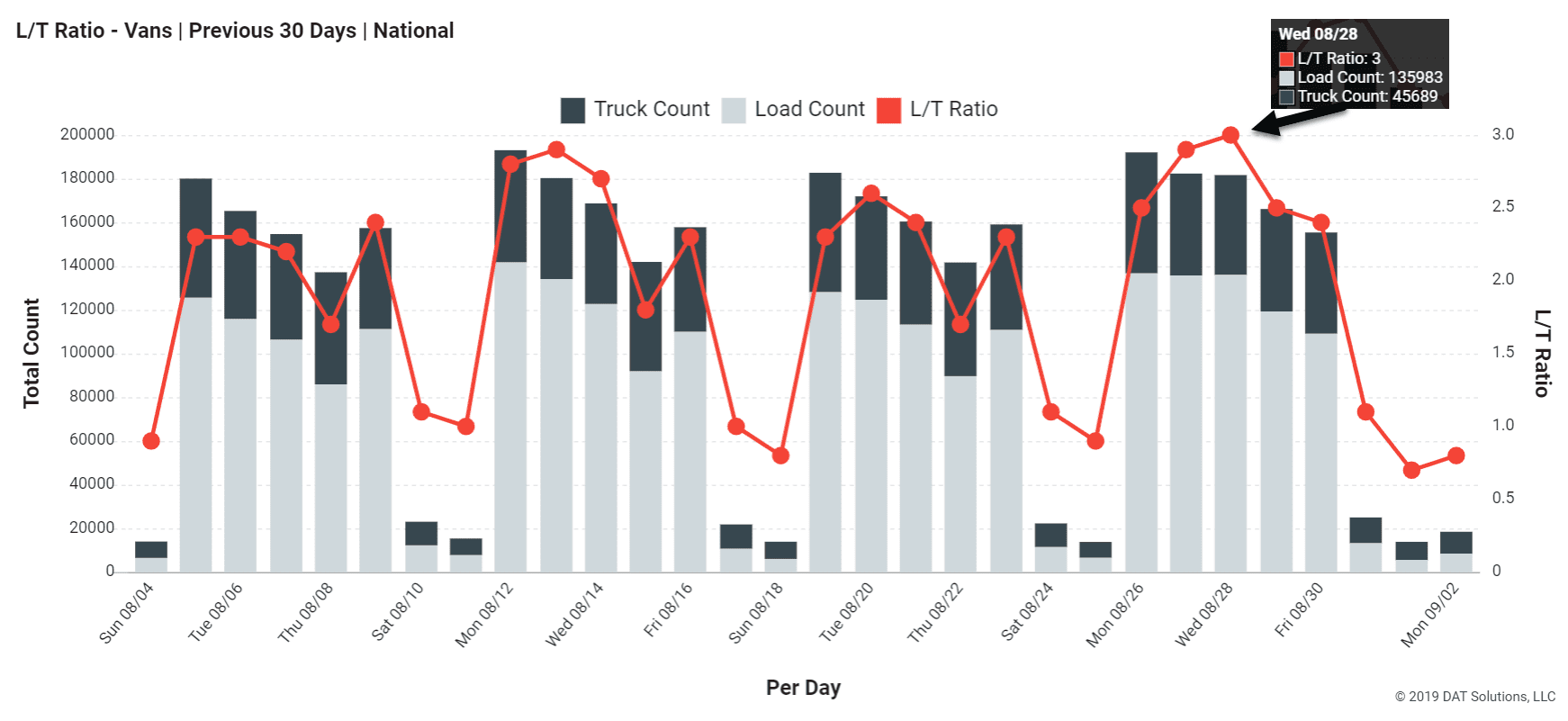

National average van rates ended August at $1.81 per mile, which is below the June and July averages, but higher than April and May. On a positive note, fuel has dropped 10-18¢ in the past few months, which decreases the operating cost for carriers. Another positive is that load-to-truck ratios — an indicator of supply and demand — were notably stronger later in the month. Last Wednesday the ratio hit 3.0, and based on years of observation, rates tend to rise when the load-to-truck ratio exceeds 2.5.

Van load-to-truck ratios have steadily increased throughout August, and hit a peak of 3.0 last Wednesday. (Graph from DAT RateView.)

Rising

Every major market east of the Mississippi River rose last week! Leading the way was Atlanta, followed by Philadelphia, Columbus, OH, and Memphis (where freight volumes jumped 15%). Hurricane-related rate changes occurred mostly late in the week so they had minimal impact overall, However, the lane from Atlanta to Lakeland had the biggest rate jump, as seen below.

- Atlanta to Lakeland, FL, shot up 19¢ to $2.83/mi.

- Seattle to Eugene, OR, increased 16¢ to $2.59/mi.

- Buffalo to Chicago added 13¢ $1.70/mi.

- Memphis to Dallas gained 12¢ to $2.32/mi.

Falling

Freight volumes were neutral in Chicago, Dallas, and Stockton last week. And despite rising volumes coming out ot Houston, rates stayed flat there. Rate declines were minimal last week.

- Denver to Stockton slipped 7¢ to $1.13/mi.

- Memphis to Indianapolis dipped 6¢ to $2.13/mi.

- Dallas to Chicago was down 5¢ to $1.20/mi.